This will use up your ISA allowance. The flexibility of a flexible ISA only applies to that ISA. If you withdraw £1000 from a flexible ISA with bank A and deposit it into the ISA of bank B, that uses up £1000 of your ISA allowance (unless you do a partial transfer of £1000 from bank A to bank B).

My understanding ![]()

Yes, once you deposit to another ISA then you have used that amount of your allowance.

That’s fine, though - I’m only temporarily using the flexible cash ISA to store my ISA allowance and earn some interest on it.

That’s true, but you can still “put back” what you have withdrawn from a flexible ISA into any other ISA, provided that you accept that you’ll then have irreversibly used that amount of your allowance.

(This assumes that you are dealing with the current year’s allowance and not previous years.)

Just found this example at

Withdrawals replaced in any current year ISA example

Mr Andrews subscribes £10,000 to his flexible cash ISA on 6 April 2017.

On 12 May he withdraws £2,000. His ‘net’ current year subscriptions at

this point are £8,000 and he can use the balance of his annual

subscription limit of £12,000 (£20,000 less £8,000) as he chooses

between his cash ISA and any stocks and shares, innovative finance or

Lifetime ISA he subscribes to in 2017-18.

According to this you can re deposit funds in the same tax year and not use up a new part of your allowance?

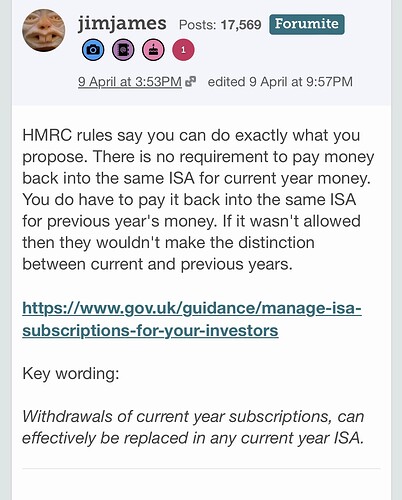

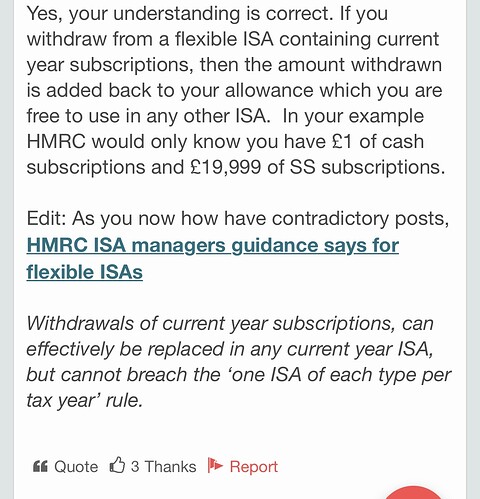

“Withdrawals of current year subscriptions, can effectively be replaced in any current year ISA.”

I only found this out today - but I think it would work out fine for Mikes method?

In essence you just couldn’t repeat the process, am I right?

Ultimately though, once you’ve subscribed once you’ve used that part - it’s just how many times you can take it in and out…

Says further down

Where a flexible ISA has current year subscriptions only, any withdrawals over and above the amount subscribed (for example, income or capital growth) can only be replaced in that ISA.

Replacement of flexible ISA previous year funds must be made to the account from which the withdrawal was made, and in the same tax year.

They are inconsistent in what they’re saying.

This relates to like a stocks & shares ISA where you subscribed 20k but it’s now worth 23k isn’t it? It’s saying you could replace 20k elsewhere but not the 3k on top?

Or of course cash ISA interest

Or am I mistaken?

That first paragraph would be more likely to apply to shares ISAs, though there were cash products in the past with similar characteristics.

The second seems to say that the flexibility is only applicable to the flexible ISA.

I suspect that this is yet another case of the chancellor getting up and saying something not fully thought out. Biggest bo bo there in recent times was the flexible pensions which hadn’t thought about all the unfunded public sector schemes and had to quietly close that potentially bankrupting aspect in the first year. Turns out that NI proportionately took that up at around ten times the rate in the rest of the UK ![]()

I’ve done some more digging.

This is the key distinction. If you paid 20k in a few tax years ago and withdrew part of this, it would need to go back into the same account (and when it says about the same tax year, it means you have to replenish it the year you withdrew it).

If it’s this years tax contributions were talking about, this is when they can go back into another ISA.

I do agree though, it’s confusing.

That can’t be right either. Surely that would make all ISAs flexible and in that case, why does the text make a distinction between flexible and non flexible ISAs?

It’s all on the prerequisite of them being flexible in the first place. For one which isn’t flexible it wouldn’t matter when you put it in, or back in, it would take up part of your allowance.

If they are you can take out previous years contributions but only put them back into the account from which the subscription was made.

But if it’s a current years subscription they can then go into another ISA - if this one isn’t flexible then that’s where the flexibility ends.

Someone on MSE confirmed it quite succinctly earlier but I can’t find the post ![]()

Another one, this probably explains it better! (Second line about one type of ISA has since been removed)

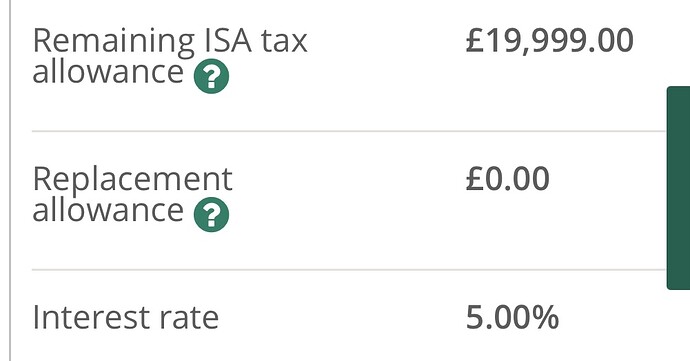

I suppose the “replacement allowance” would go up, if I did a withdrawal.

Yes - spot on!

No, because if you pay back into a non-flexible ISA then that amount is then irreversibly deducted from your remaining allowance.

The flexibility only has to be in the ‘donor’ account with what @anon22494410 and I want to do this tax year.

Yes, that makes sense and doesn’t affect what I’m planning to do regarding drip-feeding my S&S ISA from my flexible cash ISA.

At the end of the tax year my cash ISA will only contain any interest earned.

The bit I read about withdrawals being added back to your allowance is where the penny dropped for me - as I was wondering how on earth they linked the withdrawal to the next deposit.

I’m glad I posted on here & I am glad I picked a flexible ISA!

If we’re getting confused by this, can you imagine how confused the average punter will be? I can see a whole lot of people getting pulled up by HMRC for violating rules this year.