It’s somewhat old news; what’s annoying though is that there is still no word about the freebies and prize draws they promised. Maybe on 1 April?

I have a mortgage with them so will still get £3 a month, but as Barclays is my oldest account I still wouldn’t switch it anywhere

Yeah old news. Ditched my 4 march after last £7 “reward” (£3 really)

Yep same. I might actually be eligible for the Premier account and associated Avios but given it’s a £12/month fee for what would be £12/month worth of Nectar-converted-from-Avios, there seems little point in that either.

Sorry, but just to clear some misconceptions with the Barclays premier thing, and then it can all go back to being about RBS.

As of October 2022, the premier current account became available to all. Assuming you’re happy to pay a £20 monthly fee post grace period. Card collectors go nuts. There’s nothing on the form you need to lie about. It’s a one page thing. If after 12 months you don’t meet the criteria they’ll start charging you the fee.

You’re not doing anything wrong by applying for one, and you don’t need to lie about your income to get it. It is on the form, but should already be pre populated with your existing income anyway. So it’s easy to miss and applying is mostly just tapping a few buttons.

There was a big thing about it on head for points not that long ago so folks could maximise on the avios welcome offer.

Oooh, I didn’t know about this! Do you have the source?

I’ll try to find the head for points thing and message you!

Thanks!

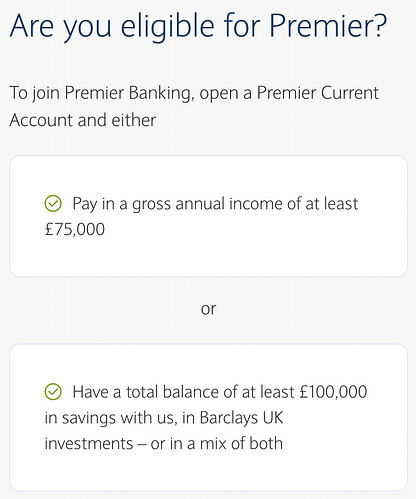

Barclays website is pretty clear:

Are you eligible?

To join Premier Banking, open a Premier Current Account and either

Pay in a gross annual income of at least £75,000

or

Have a total balance of at least £100,000 in savings with us, in Barclays UK investments – or in a mix of both

If your payments or balances drop below what you need to stay with Premier, we’ll let you know.

No it didn’t.

This is a misconception.

All that changed in October 2022 was that a published requirement for maintaining the account was added, with the kicker of a monthly fee if those requirements are not met. Previously you would have simply received a letter saying your account had been reviewed and you were now no longer Premier.

The eligibility requirement remains, and is enforced to the best of my knowledge at application stage. Rumours abound that this will go, but for now it is clear as crystal:

Rob from HfP confirmed this himself on this thread: How did you get a Premier account on less than £75k? — Head for Points

Rob has connections within Barclays, he knows what he’s talking about.

You might be accepted for an upgrade, but that doesn’t mean there is no eligibility requirements or that they’re optional. People are waived through on Premier tier products for all sorts of reasons. If there were no eligibility requirements, they would not state eligibility requirements.

That said, if you truthfully state your salary and get accepted for an upgrade, as other people have, the worst that could happen is you get downgraded. There is nothing dishonest about applying for a product you are in theory not eligible for, so long as you don’t misstate your credentials.

The branch seems like it is still open (at least for another couple of months)

I thought that the cheque book contained a reference to Goslings history.

Oh, I stand corrected. Love this bit of copypasta spiel.

Why our Goslings, 19 Fleet Street branch is closing

Back when we opened this branch…

Uh, you didn’t ![]()

The question then becomes if opening a Barclays account, can you choose the branch (without physically going there…)

Asking for a friend ![]()

I don’t recall being asked to choose a branch when I opened an account online. In fact, it’s only really Natwest Group who do (or did) that - usually you’re either allocated to a central/head office sort code or in the case of LBG and TSB a sort code for your nearest branch geographically.

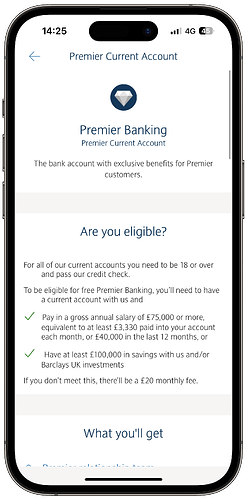

No - but if it’s because you want to try Premier - there’s a 12 month grace period for you to “prove” you meet the requirements.

EDIT: For clarity, when you apply for Premier it takes the information you originally provided and uses that to validate you. After 12 months if they re-validate you and no changes in circumstance, then a £20 per month charge applies.

Oh for sure!

For clarity - you can choose to upgrade to premier, it doesn’t even ask you for any more details that what you put in the initial time if I remember correctly.

Raises an interesting question. Wouldn’t the mere fact of applying for premier, knowing the criteria and knowing that one doesn’t meet them mean that one has lied / fraudulently applied?

Not really, things can change. Your salary might go up, you might win the lottery. You might even choose to stay premier and pay the £20 a month.

HSBC do the same, you get a six month grace period for any changes in personal circumstances/re-verification that you still meet the criteria, and at which point you get offered Advance if you don’t

Conscious this a Barclays question and we’re in the RBS thread (Feel free to move it!) but for some reason Barclays allow you to remain at premier but charge you for the privilege (with the expectation I think that no-one would actually pay £20 for it).