Same for LBG machines, I have deposited a good number of times

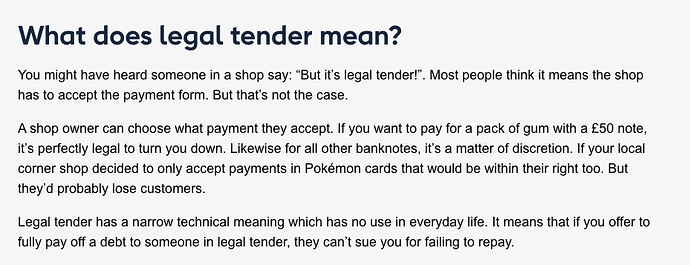

English notes aren’t legal in Scotland either only Royal mint coins.

Appears that debit, cheques and contactless aren’t legal tender anywhere either.

Outstanding, so if someone wants to settle a debt in Scotland their only guaranteed method is quite literally showing up with a basket of coins

And yep, no digital form of money is legal tender yet. Hoping the CBDC Pound Sterling fixes that

I’m not so sure about a basket of coins either. Isn’t there some limit on how much you can pay in coins?

I vote we go back to using sovereigns.

iirc only 1/2/5/10/20/50p have a legal tender cap on them. £1+ coins can be used to settle debts of any amount

But without wishing to prolong the discussion unnecessarily, turning up with a bucket-load of coins doesn’t guarantee acceptance. A merchant could legitimately turn them down as payment based on simple practicality.

And why would anyone seek to do it? ![]()

If a merchant refuses to settle a debt already created when legal tender is provided, they have no recourse in court to seek the payment in a more practical means

Naturally, the answer is to take payment before offering your services and then you can refuse them for anything bar protected characteristics

Sheer spite

And when told to feck off, what’d they do? Demand a receipt? Call the police?

Take a video and say “so you are refusing to let me pay this debt in legal tender?” and then play it in court

There is no recourse for anyone refusing legal tender to make a claim in court to settle debt

You don’t even need to go there, only to prove in writing that you made the offer, actually.

As I said, no one would realistically do that unless it was to be spiteful

Heard the other of someone rolling up with a bucket load of coins to settle some court debt. So, not unknown.

Cash payments rise for first time in 10 years

I never get why people take out cash in hard times… like, what tangible benefit does it have over checking your account after each purchase?

bank/company fees because your DD bounced because you took the cash out? But at least you got to eat? It has to be something like that

Knowing exactly what you’ve got left to spend? I know when I was with First Direct, card payments weren’t always reflected immediately in my balance. If you’re on a budget, cash withdrawals do, so you know what you have in your account is what you’ve got.

Looking at the graph in the article, though, all payment methods appear to have increased in number. And the biggest increase is in debit card payments. Which suggests that the proportion of payments made by cash may have decreased.

Anyone know how they measure the number of cash payments?

I don’t understand the connection in your question. Help me, here. ![]()

Did you read the embed for your own posted link? It was a comment on that BBC implied it’s because of a cost of living hike and why I don’t get how that’s linked to increased cash usage. It seems silly

It has tangible benefit for those who don’t bank electronically and well, @mirodo says it quite simply.

And whilst you query that behaviour in “hard times”, it’s exactly the anxiety and uncertainty that accompanies those times which results in the perceived need to get on top of their finances.

If having a bunch of cash in the hand creates a sense of control - then that’s the way to do it

This is why I started using Monzo back in 2017. Prior to that I only used cash for day-to-day spending because I didn’t like waiting days for transactions and balance to be reflected in app.

Some people find envelope budgeting to be a very effective way of controlling their spending. Very few banks have tools for virtual envelope budgeting.

Also some people just don’t like having their bank app on their phone.