My app is now showing

Trading 212 has increased the interest rate on GBP balances to 5.15% AER

Nicely spotted. Every little helps ![]()

Has now increased it’s rate to 5.17%

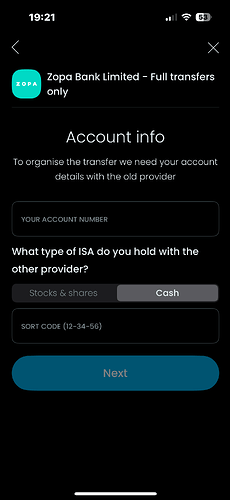

How did you request the transfer?

The help pages seem to say I need to use the “portfolio transfer” option, which lists a load of providers - but not Zopa. I couldn’t figure out how to get passed this.

Make sure you change the tab from Stocks and Shares to Cash.

Should then appear.

I’ve transferred Santander in since too, so risking Trading212 with all my ISA savings ![]()

And why not, indeed - their interest rate continues to rise. Obviously a loss-leader, but hey ho ![]()

(Interestingly, my other ISA is with Zopa. Two good providers. ![]() )

)

Beg to differ. Zopa customer service is shocking!

Would not trust Zopa with my money again tbh.

Oh. I’ve not needed customer service so I’ve been lucky. That’s a shame.

It is the same with most establishments tbh.

Until you need customer service, you don’t necessarily know how good or bad they are

For the life of my I couldn’t find Zopa in the list on the website, but when I downloaded the app it all seemed quite easy. Thanks for the pointers.

I, too, have had no issue with Zopa. I have read elsewhere that their customer service is abysmal but their app and their rates have always been fairly decent.

I doubt T212’s customer service will be any good in the long run but hey ho.

Just received an email from T212 reminding me that the app is mainly there for trading and not carrying a cash balance. Anyone else had this? I do actually have shares active on their books, just invested another $10.

![]()

Keep your benefits active

Hi Richard,

Hi Richard,

We noticed you haven’t traded for a while, yet you are still earning interest on your cash. We wanted to remind you that your Trading 212 account is primarily an investment account. It’s designed for investing, rather than for holding cash as in a traditional savings account.

For more details, please check our Help Center article.

If you have questions or need assistance, please contact us.

An odd statement given they currently operate a market-leading cash ISA.

(Truth is though, that said ISA is probably only as attractive as it is, because they want you to get into trading).

…which I don’t have

It is an odd statement, indeed. They have a debit card which I presume is for spending available cash. ![]()

…which I have, as well as a virtual card, and a single use card. And have used them sparingly.

Interestingly, the euro denominated account has a German (DE) IBAN

I think all brokers issue such statements from time to time. I have certainly had them from others even though no action is ever taken.

I started a transfer out of my Chip Cash ISA to Vanguard. Six weeks later and nothing had happened, so I cancelled the transfer, created a Trading 212 account and started a transfer from Chip last night. This morning I’ve received an email from Chip saying that the transfer is underway.

I really don’t know what’s wrong with Vanguard but I note that their Trustpilot page has a lot of complaints about the speed of transfers.

A good decision indeed. That daily crediting of interest is nice, too.