None of which comes close to demonstrating added utility value over fiat.

Freedom from having your bank account liquidated at will by HMG or a snarky employee in the AML department

The ability to not have your money devalued by 2.5% on average per year, by your government, without your consent.

The ability to do instant micro-payments in a system that is truly universal, where you don’t need to worry about maestro this, maestro that, wepay, linepay all these different country specific payment systems

The ability to remit money for a fraction of the cost: which is actually a key reason why El Salvadorian president moved towards making BTC legal tender. There’s no garbage exchange rates on a decentralised exchange that works on demand and there’s only room for a little spread in the competitive environment of centralised crypto exchange

Also like to mention: doesn’t it sound stupid to you if I say, well “a banana and an orange don’t add utility over fiat currencies” because they’re entirely different things? Blockchains that these cryptocurrencies are built on all have different aspects so you to blanket them all like you have done, shows you don’t understand the technology at even a base level.

For example: XRP is designed specifically for cross-border currency settlement, BTC Cash designed to be a payments system, XMR (Monero) to be for privacy, DASH, ZCASH to be used as a cash replacement.

Edit: it’s possible I misread and you meant that dotting ATMs around doesn’t show added value? It’s not really meant to, it’s meant to make crypto more common for the daily man. We’re not afraid of our daily surroundings.

Prevention of money laundering is a good thing, imo

Just have your money fluctuate wildly instead

But unfortunately is a system that doesn’t exist and relies on fiat anyway

Back office is where there’s huge potential. I don’t see why you need to make it legal tender to reap the benefits

We’re talking atms and consumer payments, aren’t we? That’s where I don’t see the point.

I must say, you have gained remarkable insight into my state of knowledge from just one short post! ![]()

Did you know that public ledgers are insanely hard to launder money across? Because, they’re public

I’ve already explained how we overcome this. Every new floating currency has these issues. Integrating it into merchants with real-time liquidation will stabilise liquidity and price.

Every time we adopt a new currency there is a phase where the two co-exists and one relies on the other. Did you not notice the dual EUR/Native Currency pricing?

Even Scotland accepts they’ll have to receive GBP in exchange for Scottish Pounds if they ever get “Independence”. It’s basic economics.

Legal tender helped drive adoption + gave the government the ability to use funds to develop a crypto wallet (it’s called Chivo Wallet).

ATMs, consumer payments, general crypto usage yada yada. as mentioned i may have misunderstood what you meant

That’s not a problem they solved then though, is it? There are thousands of services where one can use a card to purchase crypto, many of which predate Bitcoin ATMs. The problem they solved was turning hard cash in to crypto.

That’s a big leap for average joe consumer (and average joe consumer focussed retailer) to take tho - that’s my point. What do they gain?

I don’t entirely disagree with you, but again: Crypto ATMs help normalise relations with cryptocurrencies. If they’re everywhere around us and businesses start accepting them, the pressing problems will solve themselves.

A currency that doesn’t inflate (depending on the chain)? Do you enjoy losing 2.5% of your income averaged, every year?

It’s all about making things nice and easy for consumers to get into. We only need to get Johnny down the pub to use it once.

We can give a small amount of crypto (maybe 10 pounds worth) for free, they’ll use it once. They see it’s easy, they have maybe 8 quid or 2 quid left in the basket and they’ll buy some more. Whether that’s to use it as long-term savings or to use for day-to-day payments. Either is fine.

I will take a ~2.5% average loss (which is tracked and I can have my salary benchmarked against) over having 0 certainty of what my earnings are worth from one moment to the next. Appreciation of crypto coin value over a period of decades is not certain at all, and they are highly volatile

Unless you pick just one of those 82 crypto currencies you’ve eulogised upthread to become the master currency (which one is paid in and one can spend on whatever they need day to day) ultimately you are asking consumers to give up what they understand about their money completely and start again, accepting they need to hold currency in a number of different currencies for different use cases and have no certainty that what they understood to be £3.49 worth of whatevercoin will satisfy Boots’ demand for payment of a meal deal to in fact be enough despite Boots not changing their price.

I dunno who you think would be paying this £10 - but again I think you are grossly underestimating how unmotivated consumers will be to pick up the change. Banks pay £150-200 typically at the moment to encourage consumers to move their existing bank account (with all the same core functionality), and still it is considered to be tough going to get most consumers motivated.

Real term wages have been slugging behind for decades. When my grandmother was raising her children one person could maintain a household and have money leftover for leisure. Few can do that today.

They’re worth whatever someone will pay for them, same with your sterling. It’s a floated currency.

It is likely as most chains have a max supply, increased demand will strain the supply and it will go up. Some chains even decrease the supply by taking some of the fees paid and sending them to a burn address, where they can never be accessed again.

Generally id recommend pricing in something like DAI or a multi collateralised coin

They hold different assets and use smart contracts to sell assets according to supply/demand to add stability to the coin itself

Theres one that does this with a basket of real world currencies even iirc, using the pound, dollar, yen and maybe the Swiss franc as a bucket

But just to mention: if someone is willing to accept a trade it doesn’t need to be a set denomination in this "nominated currency*. For instance, I could well prefer to accept a few grams of gold instead of a few shillings.

They do this already? You’re looking at the blockchain from a very odd viewpoint.

Bitcoin, Bitcoin Gold. Consider them value stores. They are equivalent to gold or stocks and shares. You hold them to appreciate in value and build net worth.

DAI, Multi Collateralised DAI, SAI etc are stablecoins pegged to either real world currencies, a basket of them, or a random assortment of assets that are sold off programmatically to ensure a stable price. This is your equivalent to a savings account.

Bitcoin Cash, Dash, ZCash. These are your equivalents to physical notes. (except a lot harder to launder)

Do you get what I mean? You’re comparing gold to cash and calling them both currencies. It’s not like having 20 Foreign Currency accounts. You have a single 12 word key phrase and this will derive private keys for all of your blockchains and you can store all your asset classes within their respective wallets.

False equivalency. People don’t want to change, but they’re nowhere near as adverse to giving it a punt for a free tenner, especially as theres no implications of it besides an app you download and then delete if you don’t like it.

Changing from the banking relationship most in the UK have had since they were 16? The thing you have a mortgage with? That your auto loan is with? That you have 2-3 credit cards with? Fat chance. Its such a different thing I’m not sure how you thought of it.

You’re talking about convincing someone to end a relationship with their long-time partner and to move. I’m talking about introducing them to a friend of mine and letting them see how it goes. There’s no obligation, but I am sure some will stick around.

Yes, but I understand that Boots will take £3.49 of them and give me a meal deal in exchange. I tacitly understand that will not change day to day (it has only risen in price twice since I was a lad).

Really struggling to follow your point.

My point quoted was that people understand the (notional) notes in the wallet to have a value, and they understand that the value of those notes depreciates with time unless they properly save or invest them.

They might understand that a big shop might typically cost then £x at one supermarket but only £y at another, and understand that is a genuine saving. They will also understand their take-home pay to be £z and can thus equivalate how much of their salary is spent on groceries. This is all £, not £ equivalent in a spread of coins - even if its held in the form of an investment account or whatnot.

You are variously advocating for a fully crypto world in which one’s monetary assets will definitely* appreciate in time but the (massive) trade-off being that they have no real way of tracking how far their money ins getting them one moment to the next; or a world in which people use crypto coins linked to existing currencies - in which case why would they bother? What is the upside?

*not definite at all

I think it’s more the case that people regard the process of changing your account as a faff with no long term benefits, which I accept is different from the major faff with huge disadvantages which you’re talking about.

This 2-3 credit cards comment is interesting tho - the stereotype regarding holding multiple credit cards is that one is balancing a debt over multiple cards, typically with multiple lenders. Those type of consumers are typically very aware that their banking relationship is not necessarily 1-dimensional.

My only response is ![]() I’m afraid.

I’m afraid.

It could be priced in a stablecoin like Multi-Collaterialised DAI.

A large amount don’t understand the extent that their money erodes and about the compound eroding of it. Lots of people have inadequate pensions and end up having to continue working. Lots of people think savings are adequate.

In an all-crypto world assets would definitely increase in the short-medium term in a very quick way. The sooner the United Kingdom adopts it, the sooner we’d ride the wave of every country after us joining the pool.

Again, we can use non-fiat linked stablecoins.

There’s actually quite a lot of upside even if we used a GBP-backed stablecoin

- Consumer backed, guaranteed lending through smart contracts

- Easier and quicker access to funding for businesses

- Instantly cleared payments; with visa/mc you don’t have the liquid cash straight away

- No “my account got locked and I had to call up RBS at 3AM to be told I need to call back at 8AM since the department isn’t working and now my X bill is late and they’re going to charge me extra for the privilege”

- Cheaper transaction costs which will pass down to customers

- The ability to pay with your mobile without a requirement for NFC (for few, I admit)

- The ability to pay back money with friends without SC/AN. Just scan a QR code and it’s done.

- Vastly higher interest rates for consumers that lend, right now I can access about 7.5% on a GBP-backed cryptocurrency.

I’m sure I’ll think of more ![]()

Have you ever downloaded a cryptocurrency wallet? Calling it a major faff tells me it’s likely that you haven’t. The fact that you haven’t seen that the disadvantages are small as well, shows me that everything is going through one ear and out the other.

It’s 12 words to store securely. It’s probably a lot harder to remember a first direct login ! You’re not stupid, right? You have used more than 12 words in your paragraph to me. So it can’t be a “major faff” to remember 12 words to you.

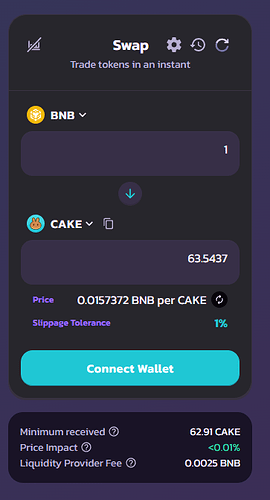

Exchanging cryptocurrencies for cryptoassets can be done by a very simple process, also. I’ll even include a screenshot of a UI.

I find it interesting that as of February 2021, there were apparently almost 10 million Brits who allegedly had Bitcoin. I personally don’t know anyone who has any Bitcoin, but then many folk are quite reluctant to divulge their personal wealth, which is of course their right. Bitcoin is not something I’m personally interested in.

And equally reluctant to admit to how much they made then lost ![]() , having felt they had no control over any of it, nor any clue as to what was happening

, having felt they had no control over any of it, nor any clue as to what was happening ![]()

Such tosh lol

Few people understand how stock markets work. Also, if you have any control over traditional investments you’d be guilty of insider trading anyways !

I’ve no idea what you’re saying here, but as usual, you’ve little patience for the contrasting views of others.

Never mind.

If it wasn’t clear:

- “having felt they had no control over any of it” you don’t have any control over it in traditonal assets. IF you did, you’d be guilty of insider trading if you started buying/selling to benefit you.

- “nor any clue as to what was happening” no one on planet earth understands how the market works, you can’t time the market, you can’t predict the market

As for my “little patience for the contrasting views of others” it depends if the contrasting opinion takes everything into account - if you’ve thought it through we can discuss it, if you haven’t, don’t post if you’re not prepared to be critiqued for it.

You can certainly try! Doesn’t mean you’ll predict it right. My friends and I have a fairly good track record. Sometimes we get it right (recently: Lucid Motors, Activision) and sometimes we get it very wrong (recently: doubling down on SMT in November).

I “have” Bitcoin and other crypto in a variety of venues - Revolut, Ziglu and Paypal. I think the 10m probably includes that. When I bought the Revolut “Bitcoin”, I paid £30 for it, and it dived in value to £18, before reaching its heights of around £200 and falling to around £130 now.

I’d hardly call mine wealth but I’ve got £600 Bitcoin and £400 Ethereum. At least I did this time last year! It’s down to around £700 in total now but it’s just a little dabble that I’m happy to leave for a few years.

I sold all my ethereum last October. For no other reason than my friend told me to, and she’s always right (when it comes to crypto)! Ethereum is the only one I’ve dabbled with since crypto became a thing and bitcoin was new and cool.

There’s been lots of research into trying to predict the market, there’s no correlation on actual success though.

Monkey beats man on stock market picks | Financial Times (ft.com)