I’d have to concur. My email provider is ProtonMail. I’ve never had any issues with Chase emails going to spam.

From my headers, Apple’s iCloud mail, there’s.

Sorry, I don’t understand that. Are you saying that the iCloud Mail servers have incorrectly responded to Chase’s DMARC record?

Probably this and they pushed it into junk mail

This prompted me to check my iCloud junk mail folder.

I found a recent genuine email from Nationwide and one from Santander in there.

The Nationwide one was a regular “Your statement is test to view” one, and the Santander one was confirming that my new card was ready for Apple Pay.

This could be due to them using mailing lists and not configuring the headers correctly. I know that Santander do that because my own mail server flags their emails as possibly having forged headers.

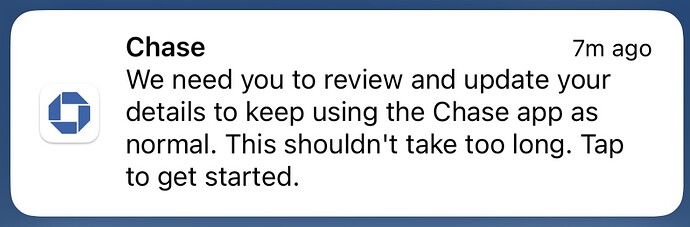

Anyone know what this is about?

Asking a lot of personal questions like my income, employer etc that they shouldn’t need to know, unless maybe profiling whether suitable for credit ?

Know Your Customer checks

Many financial institutions ask for this information even when not getting credit, they say it is part of regulation and compliance probably with stuff like AML laws, etc

And don’t we routinely get asked all this when applying for the account in the first place?

I had this at the end of August. To be fair, I just got on with it and answered the questions. Chase is my main personal bank account and so if by answering the questions it helps keep my account secure, I don’t personally see any issue with the level of perceived intrusiveness.

Yup, it’s normal.

Similar concern was raised by some on MSE forum, where the curt response from some was, well don’t fill it in and bank elsewhere ![]()

Compassionate bunch, some over there ![]()

In fairness, if you don’t want to fill KYC out then closing your own account is likely a better outcome than it being closed for you…

Very much doubt it’s that.

Under the Money Laundering Regulations it’s incumbent upon banks (among other businesses) to keep up-to-date information on their customers. Some banks (e.g. Chase) are more proactive than others, in my experience.

I’ve had similar from Starling (and possibly Monzo) but I don’t remember any High Street banks that I’ve been with being as proactive.

Problem I have is that the questions aren’t consistent so my ‘income’ is different by a factor of two or nearly three depending on the wording. So it can be just personal income, household income, and other income with wildly different totals.

Going by the Lloyds thread on Monzo, thanks to me popping money in for the free Disney and whatnot, it would look like I’ve maybe £15k/month going in which doesn’t tie up with any of the above figures.

I had to do the same with LBG and Santander recently .

I guess it is personal income if they aren’t being specific.

I also saw some that ask for household or additional income you have access to on top of your personal one

Even ‘personal income’ isn’t so simple as some places ask specifically for salary, whereas others aren’t so specific and might want you to include investment income, rental income, etc.

Not really a problem until the day comes when they crosscheck the answers and block your account because of inconsistencies caused by the lack of consistency in their questions.

I get what you mean. I also have no fixed income as my pay varies week on week. So I always try to put an annualised average from last three months. I have not had issues yet.

Also there are those who ask for annual income before tax, and other after tax and deductions. Some ask for specific take home pay monthly.

I last had a fixed pay in 2021, so from then onwards.

One time I just put a figure from my p60.