Ditched mine on Thursday. It’s an ancillary account anyway.

That’s interesting, I was under the obvious incorrect assumption then that many ATM’s abroad charged withdrawal fees on foreign debit cards

The ATMs charged their fee (which was added on total amount drawn) but all that was converted by Chase at MasterCard rate

That was the point I was trying to make. Chase in the US however don’t charge Chase U.K. customers ATM withdrawal fees, they just do the conversion at the Mastercard rate which was the info I was actually after. I won’t use cards in ATM’s abroad for the sole reason that I don’t want withdrawal fees and conversion fees.

Natwest and RBS used to offer 2% cashback on the same range of DDs Santander offer cashback on.

They now offer a fixed payment for having 2 or more £2+ DDs a month. Co-op Bank and Danske Bank NI run similar schemes, as did Barclays until recently (well they still do but it’s impossible to actually benefit from it unless you also have a mortgage or loan with them). Barclays also offer a chunk of Avios if you qualify for Barclays Premier. HSBC have been trialling a similar scheme too.

So, yeah is the answer to your question.

From what I have deduced however concerning these incentives, is that for the most part, it’s a bit ‘smoke and mirrors’. The actual bonus amounts don’t appear to really add up to much it seems, it’s just all marketing.

Santander 1-2-3 Lite nets me about £2.50/month

Natwest and RBS net me about £3/month each

Danske Bank NI will net you £5 a month if you can get it

Co-op Bank is £1/month which I agree is paltry and not worth going to any effort for.

No cashback scheme is ever going to yield life-changing sums as it is a small amount of what you spend. Every £ is a £ worth having.

I have to admit, the Chase cashback has been far more profitable than anything I’ve experienced out of any current account over the last 3/4 years. It would be nice if it continues after the initial 12 months, but I’m not holding my breath.

agree, made 20 quid cashback so far.

Merchant fees on a debit card are 0.25% - 0.6 %. So Chase are losing money paying their customers 1% on those transactions. Which suggests this may stop after the introductory 12 months expires.

If it does stop, will anyone here use Chase as their main current account?

I expect the answer to that question is no, unless they bring some other incentive in

Those are the merchant fees - only part of which form the interchange fee which is the amount paid to Mastercard, capped at 0.2%, who in turn cut a small amount back to Chase. The amount that Chase get per transaction is likely less than 0.1% unless they have a sweet deal with Mastercard, but certainly no more than 0.2%.

On a selfish level, I rather hope they do something different because the 1% cashback doesn’t really do much for me - I prefer my current method of using a credit card for 0.75-1% cashback (or equivalent in rewards) then another 1% back from Halifax Reward. Not really any opportunity for gamifying cash in the same way Clubcard points and whatnot can be too.

In a word, no!

And Chase, no doubt, know that. Hence, I await the next incentive package with bated breath.

Or they may do what other large banks do & offer diddly squat

I jest - I don’t think they’re established enough for that yet

Starling have acquired a decent market share without offering any significant benefits other than a very good mobile app experience.

Yes they’ve done relatively well domestically

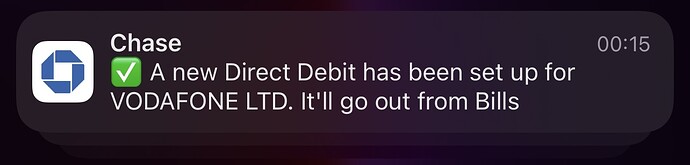

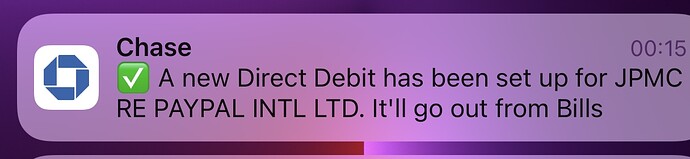

Push notification this morning to confirm that my Direct Debit has been set up, and which of my accounts it’s attached to ![]()

Me too, I received a push notification about the setup of my new direct debits - here’s a look - I really wish they would stop using emojis though - as I feel they’re not necessary

Well at least there’s no ![]() or

or ![]() I guess.

I guess.