I know, that’s why I put “manufactured spend” in quotes. Technically, it’s not manufactured spend as normally understood. It is, however, still manufactured in the sense that it’s artificial/unusual behaviour.

True, in fact it’s possible to argue that overtly spelling out the policy in terms that are too black and white just leaves it open to abuse anyway because then people will be looking for ways around it and/or arguing about the precise nature of the terms and whether they apply to their particular transaction or not!

Or they could just limit it to a maximum of £x.xx saved in a 24 hr period.

I don’t think Fair Use Policies are the norm in banking, but happy to be corrected on that.

But then what is unusual? This is my entire point.

When I go to Costco I regularly end up splitting the transaction in to several bills to separate stuff for parents, stuff for inlaws and stuff for us. Those are reported as 3 subsequent transactions on the same card. Is that unusual or out of line though?

How about the use case of a family who spread the cost of Christmas by topping a small amount up each day to their Amazon account (this is a behaviour Amazon themselves encourage) - the amount they choose is £1.25 so they’ll have £400 in there by Black Friday. Is that unusual or out of line?

I think the people who were warned by Chase were over doing and were not spending anywhere else on their card. I still buy my Amazon top ups and Iceland card top up for those £x.01 transactions with no issues. Of course I use the card for other daily spend.

Has anyone had any DD come out of Chase yet? Interesting to know how it works with the notification, hope it’s like starling, when they let you know the day before.

Just set one up and it’s showing in the scheduled payments list. I’ll report back……

Whilst on the subject of cashback, can someone in the know confirm that Chase excludes credit card repayments from attracting the 1%?

100% definitely will not work unless your credit card issuer are using the wrong MCC.

Costs nothing to try, but I wouldn’t recommend broadcasting it if you find one that works.

Chase provide the MCCs they exclude if you ask!

Here’s what they gave me:

Here are the list of MCCs that are excluded from cashback:

MCC 4829MCC 5511MCC 5521MCC 5551MCC 5561MCC 5571MCC 5592MCC 5932MCC 5933MCC 5971MCC 5972MCC 6010MCC 6011MCC 6012MCC 6050MCC 6051MCC 6211MCC 6300MCC 6513MCC 6532MCC 6533MCC 6536MCC 6537MCC 6538MCC 6540MCC 7012MCC 7800MCC 7801MCC 7802MCC 7995MCC 8050MCC 8062MCC 8220MCC 9223MCC 9311MCC 9399MCC 9405MCC 9406MCC 8999

Credit card payments are not eligible as far as I know. Payments I made for my Lloyds and Nectar credit cards didn’t earn me any cashback

Thought not - thanks @Amazon_Parcel.

Edit: I was looking for a reason to use my credit card ![]()

I still have a reason for my credit cards. Chase on several occasions declined to pay cashback for payments I make at BP stations for my Petrol. They always said payments at garage and the like are not eligible.

I also pay council tax and rent from credit cards to get a few points whereas Chase would give me zero for this.

I’m amazed that people will try almost extreme lengths to extract the urine out of an offer which is supposedly time limited anyway. I thought I was tight, but I’d never kick the arse out of it. I think the £30 I’ve so far had in cashback is exceptional and I’ll miss it at the end of my 1st year with them.

That’s with regards to the Cashback offer though. My point is they could massively limit one’s ability to cream the 5%-on-round-up-savings by excluding those same MCCs from participating in it.

I don’t suppose you have the list of what Curve does with input MCC to the output MCC they send to banks? I know they collapse a few into larger ones.

Wondering if I could pay my rent through Curve with it ![]() 26 pounds cashback n all that

26 pounds cashback n all that

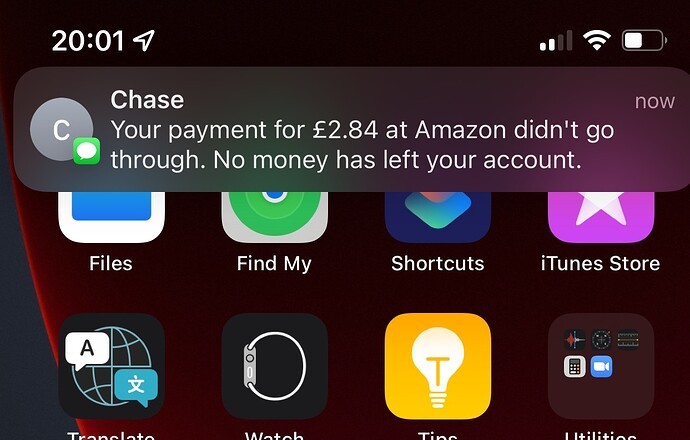

I’ve always thought it strange they send these via text and not push notifications

I imagine it’s because there’s no feed item for a transaction that fails. Since there’s no actual transaction gone though. So a text makes more sense. An in app solution for this would be nice tho.

Even if it was like a separate notification icon or something I’d prefer everything to remain in app.