We’ve been at our address for almost 3 months now. I’ve just checked my MSE Credit Club account and Experian who MSE use, are still showing our former address as our main address on our credit file. This is despite the fact that we are registered on the Electoral Roll at our new address and our TransUnion credit file shows the correct information. So I’m wondering, just how often do Experian update their records? I haven’t even bothered to check Equifax. Upshot is, as far as I’m concerned, the only credit reporting agency I feel I can actually trust with up to date information, is TransUnion.

It’s funny you bring that up, because my friend moved a few months ago, updated address on the electoral roll, and his banks, who report to Experian, and there’s still no sign of his new address.

On the flip side, when I moved to Scotland, mine had updated the month after. I just blamed it on his council being slow, because when I moved around in England, some areas were very slow at updating the electoral roll records. I’ll suggest he check TransUnion now then, seeing as that works for you, so thanks for that!

Electoral Roll updates can take months, they tell you this online when you submit it too. It’s annoying it comes up a warning on your credit files but it is literally jst a waiting game

All of my banks know where I am and I have no payment issues. I’m paying Council Tax, TV licencing know where I am, I’ve had soft searches for buildings and contents insurance etc, so why don’t Experian know where I am yet?..odd!

Thing is, I’m showing on the latest Electoral Roll. It took my new local Council 3 weeks from moving in, to issuing poll cards to the new address allowing me to vote in the last local Elections in May.

When I queried a slow electoral roll update with the council I was told they update it every 3 months but once it updates, the CRAs need to request the new list from them as it’s not automatic. That’s why it can take even longer for it to appear on credit files

No explanation then, however I’ve given up trying t understand how these CRA’s and affiliated companies work, my Clearscore account hasn’t updated my file now in 9 months, I tried to talk to them about it and got nowhere but literally every single thing is wrong on it, wrong address, wrong credit cards, wrong electoral roll address, and wrong bank accounts in certain places. It feels like they think I died or something so don’t need to track me anymore.

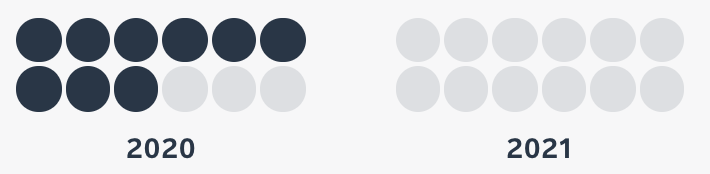

Photographic proof from parts of the credit file … weird

Ok, so Clearscore are not in themselves, a credit reference agency. They use Equifax.

And so my point, check your Equifax file and see if it’s equally as pants as what Clearscore are reporting.

Could they be confusing you with someone else with the same name/DOB (unlikely but still?). That would explain why if everything is wrong

I know that’s why i said CRA’s and their affiliates. I should check with but i really really dislike them, I had a run in with them a few years ago and they were awful to deal with and I hate them.

I don’t know, when i say wrong, I mean its wrong from August last year onwards as the reports havent updated once and no new information has been added not removed, If you look up until August last year it is correct

I re-signed up to Equifax today, their file is complete, up to date and correct, issues must just be with Clearscore, Equifax’s meaningless number is much much higher than Clearscore’s ever was

What’s happened is that Equifax has recently updated their scoring system. I noticed this today when I tried to login to my Equifax account and was told that I wasn’t recognised. I registered again and was taken to “My Equifax”, which is a completely new and redesigned site.

Their old scoring system was out of 700 but the new one is out of 1000 (they just had to go one better than Experian). Interestingly, my ‘old’ score was 530 out of 700 and the new My Equifax score is 1000 out of 1000. Nothing has changed between old and new reports. Just goes to show how meaningless it is

Odd that ClearScore doesn’t appear to have picked up this change…

Well I’ve come to the conclusion that credit reference agencies are just crap, no matter which one they are.

Not a single one of the credit reference agencies I’ve checked, can manage to get decent up to date info on my files, indeed some are just weeks behind.

TransUnion, who I thought were one of the better ones, absolutely claim I’m not on the Electoral Roll when Equifax has me listed correctly as being on the ER. Some of my credit card accounts are weeks behind. You’d think that credit reference agencies should be obligated to ensure the information they collect on you, is actually relevant and up to date.

Surely it is up to the companies to submit in a timely manner, not batch transfer.

I am not privvy to the workings, but I’m pretty sure it’s the providers who send the info, as opposed to CRAs requesting it.

I think TransUnion are still the best of the bunch, though. Last time I applied for credit I got a notification from the Credit Karma app within minutes.

This topic was automatically closed after 179 days. New replies are no longer allowed.