Some of the reasons staff may prefer cash is issues such as Pizza Express waiting staff outraged as share of tips is cut | Pizza Express | The Guardian

Oh wow, that’s pretty impressive!

I’m hoping it won’t be too long before chip and pin only readers are gone - but who knows!

It’s supposed to have already happened!

Mastercard and Visa issued a mandate that they had to have been replaced by contactless-capable by 31 December 2019 and 1 January 2020 respectively.

You can therefore report non-complaint merchants to Mastercard/Visa now if you want.

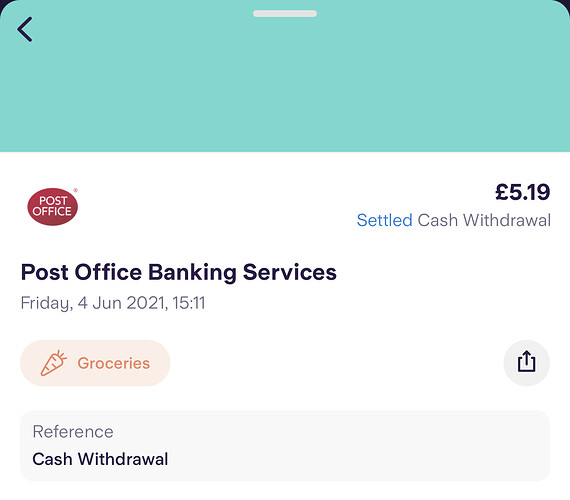

That’s interesting to know. The place I had to use Chip & Pin was a combined general store/Post Office. The transaction shows in my account as a cash withdrawal at Post Office Banking Services - with no location info to indicate where the merchant is located.

It’s the classic “post office putting through a purchase as a cash withdrawal” scam which has been discussed extensively over on the Monzo community (since it obviously causes huge problems for Monzo users who cannot pay, given that they don’t support Post Office withdrawals).

Oh that’s useful to know, thanks!

National Savings and Investments (NS&I) said it had responded to customer feedback by changing plans to axe prizes paid by cheque.

Finally I can get my cheques sent to me, despite not seeing an option to enable this anywhere ?

Why would you welcome your prizes by cheque?

It was meant to be sarcastic but cashing a cheque sounds kinda satisfying tbh

What’s a cheque???

Technically, it’s a warrant not a cheque, but yes, you can.

Although in this case, you’d simply be banking a cheque.

It’s now been announced that the “bank hub” access to cash trials were deemed a success, so will stay open until at least mid-2023, with 5 further sites opening.

Natalie Cheeney herself was on Radio 4 talking about it earlier today (at about 32 minutes in):

Personally, I don’t feel the BBC treated the subject with sufficient journalistic rigour. Ceneey essentially “said her piece”, such as it was, without much questioning and somebody was introduced as “reliant” on cash (yet they clearly had a bank account, so were not truly reliant on cash, but simply preferred it: “I know where I stand; I know how much is coming in, I know how much is going out”).

I also think that the stated reasons for cash “reliance” were not that logical:

-

To budget “cash can’t go overdrawn”

Well, neither can basic bank accounts (and successful budgeting shouldn’t result in that anyway). -

Self isolating with COVID “give cash to get your shopping, not your card”

I certainly wouldn’t want dirty cash passed to me straight from the hand of a confirmed positive covid case! Also, this missed the point that the easiest thing to do would be for the “shopper” to simply pay themselves and the isolator to pay them back, preferably via mobile app, internet banking or (if not tech-savvy) possibly telephone banking. At a push, a cheque. Maybe, if they were really savvy, something like a Starling Connected Card. Cash is the least useful, in my opinion. -

Domestic abuse cases

I’m not an expert at all, so don’t want to be quick to criticise in this sensitive area, but if you can have “secret cash”, why not a “secret bank account”? It is possible to, discreetly during a time you can get away from the abuser, apply for an account online or in branch and ask the bank to put a branch collection marker on your account so all documents for you get sent to a branch and not your home address. This would make it possible to hide the existence of an account. In fact, with Metro Bank you could open the account all in one go and walk out with a working debit card. -

Generic “won’t somebody think of the elderly” argument.

As we’ ve discussed before, this will resolve itself within about 10 years, as anybody aged under about 75 now was not that old when debit cards first appeared, so should be able to use them.

What I found most fascinating was the thought of how much time operating in cash actually wastes, compared, say, to my regular banking habits. This cash-reliant individual described attending this hub to pay cash in, get it out again and pay bills. Imagine having to leave your house all the time for that, during a pandemic!

More here:

The appointment takes a solid 45 minutes.

If I were going to financially abuse my partner, I’d be monitoring all her bank information on Experian, Equifax and TransUnion

Secret prepaid card then?

From dozens, or CashPlus, or somebody like that?

Also, I realise that Metro would be time-consuming, but the appeal would be that you could pick a time/day and do it all at once, then make the account paperless so you would never get post?

It would be much more difficult to hide something if you needed to complete multiple steps all in secret.

In fact, thinking about this, dozens is a good idea.

I think they now have the option for no physical card (so nothing posted) and their app allows you to instantly add the card to Apple Wallet.

It is a proper debit card, but doesn’t report to CRAs. I suppose there is a problem of how you pay in money undetected, when all your other accounts are monitored. With cash, presumably that’s taking out £100 and saying that various shopping cost £80 when it only cost £40, then squirrelling the extra £40 away and building up a secret stash over time.

That’s more difficult to do digitally, I do accept that.

But then all of this comes back to cash’s inherent untraceability, which in that context is a good thing but is very often a bad thing - and a key part of the pro-cashless argument is that anonymous cash, by proxy, aids and abets crime and fuels tax evasion.

Edit: Revolut is also another solid choice, which acts similarly.

I agreed with this a year and a half ago, after C19 no business meaningfully takes enough cash to evade tax short of just chancing no HMRC audit

Then less need for cash to still exist!

Everybody always used to say “what about cash-only small businesses”.

I agree with you that COVID has seen the end of those, pretty much.

A local Asian market has started accepting card at any cost. I spent 79p on a Thailand company seasoning packet and paid by card.

Business is not a reason any longer.