Hi everyone,

I remember the discussion a while back about trying to obtain a non-GB IBAN to get around those pesky companies that still (illegally) discriminate against British IBANs. @Seb, I recall you having an Irish Euro account, but that sadly wasn’t open to new applicants anymore. And then of course there was Fineco, which offered an Italian IBAN but also an app that looked like it was from 2012 and a sign up process that - at least in my experience - made me contemplate ending it all on more than one occasion ![]()

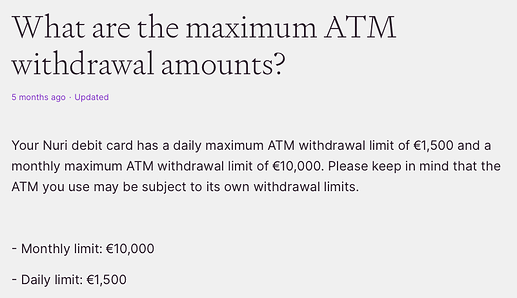

I recently came across a German firm called Nuri. They’re a Berlin-based fintech offering free German Euro bank accounts (with a DE IBAN, EU €100,000 deposit protection and a contactless Euro Visa debit card with no FX fees) which can be managed from their mobile app or web interface. It’s available to people in the EEA, Switzerland and the UK, and the actual bank account itself seems to be housed with a white-label BaaS provider called Solarisbank. Nuri are seemingly going for the ‘crypto-hybrid’ bank niche, so the app also has the ability to buy BTC and ETH, although I personally wouldn’t use them for crypto investing - I see it like Fineco’s stock trading capabilities tbh: completely secondary and redundant to my personal indented use case.

I’ve signed up for an account and my (rather artsy looking) card is on its way, so I’ll see how it goes. So far I’m definitely appreciating the modern interface compared to Fineco, and the sign up flow was a piece of cake comparatively (although I gather the Fineco onboarding experience seemed to vary slightly from person to person and depending on whether you applied through the app, mobile website or desktop site), but there are a couple of downsides I’ve encountered already:

- No Apple or Google Pay support: this is a real shame since I use Apple Pay for basically every in person transaction, although if you only really want a Euro account for transferring money and not spending it by card then I guess it’s no biggie. Curve should work but it would charge the card in GBP, so you’d be able to spend your Euros as Pounds through Apple/Google Pay, but not as Euros. Hopefully this is added sometime in the future; I’ve come to expect it from financial institutions nowadays.

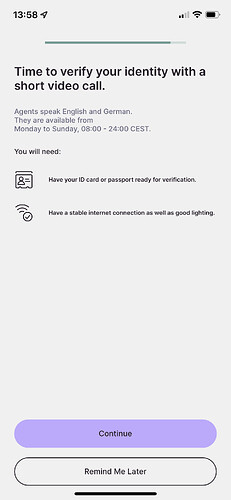

- For some bizarre reason, ID verification upon sign up is done through a short video call as opposed to through the usual passport photo + selfie combo: this I know will be a deal breaker for some, and I must admit I found it rather awkward and frustrating compared to the usual methods. It only took a couple of minutes, but still a downgrade compared to what the likes of Onfido offer banks imo.

They’re currently running a €30 sign up bonus (only through a referral), so if anyone fancies that drop me a PM and I’ll happily share my referral link since they apparently don’t like them posted out in the open online (full disclosure: I’d also receive €30, and you must make one crypto trade to qualify, although you can immediately sell it back to fiat again if you wish). There’s also an additional €50 bonus at the moment (for the new sign up, not the referrer), which you have to meet ‘regular use’ criteria for 3 months to get (1x SEPA ≥ €50 per month + 1x use of debit card, see here and here). The €50 one is a bit of a faff if you read the T&Cs, but the combined 80 Euros is a pretty healthy joining bonus I suppose if you can be bothered to jump through the hoops.

Anyway, I’ve now got Italian and German IBANs, so I’m feeling rather continental indeed! Although as international as these foreign accounts make me feel, I always find myself using my Starling Euro account (as long as the GB IBAN is accepted) because I value having it under the same roof as my Pound Sterling account and I know I can rely on their UK support should something go wrong. If an EU domiciled account is something that you’re after though, then I’d seriously consider it and weigh it up against Fineco’s offering since there aren’t many EU banks left that still serve the British market. Hey ho, another interesting card for my collection at the very least!

I agree, it’s a very interesting design, I just hope it isn’t one of those ones where the renders looks great and then the physical card arrives and it looks cheap and tacky in-person. Time will tell!

I agree, it’s a very interesting design, I just hope it isn’t one of those ones where the renders looks great and then the physical card arrives and it looks cheap and tacky in-person. Time will tell! (I’ll drop you the sign up link just in case that ends up being the case

(I’ll drop you the sign up link just in case that ends up being the case  )

)