Just for fun (while sunbathing in garden  ), I visited the MSE Credit Club and tapped on 0% Purchase for X months credit card eligibility. (It had featured in the weekly email).

), I visited the MSE Credit Club and tapped on 0% Purchase for X months credit card eligibility. (It had featured in the weekly email).

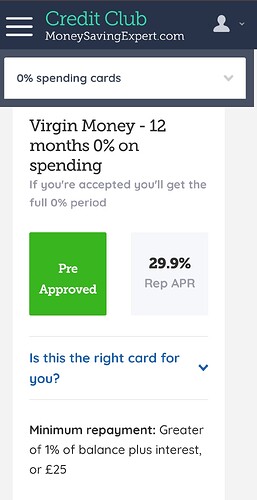

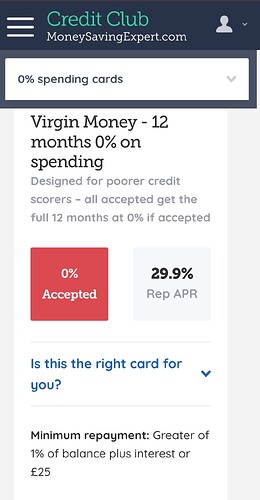

To prove it’s a farce and cannot be relied on (which I never did anyway), these two results, for the same card, yielded contrary decisions:

So, basically, you could say that I have been pre-approved for rejection

That looks more like a bug to me. How did you get those two contradictory decisions? Do they appear on the same page, or did you go into it twice and get different results?

1 Like

I just scrolled down.

There was a 0% accepted at a 27.9% rate two.

One search, three results on same 12mth card

Don’t need any more credit cards anyway.

Already have 7, including a 0% for 24mths that’s still live.

I suspect that’s actually 2 very similar products, with some subtle difference.

Edit - yep they’re different. See the text below the product name. Congrats - Virgin Money don’t categorise you as a ‘poor credit scorer’.

Eligibility checkers aren’t “myths”, they’re just deliberately very fuzzy. That said if it says pre-approved then you are pre-approved for that product; notwithstanding something the checker can’t deal with (i.e. a record Virgin have on their own systems which means they won’t offer you credit).

3 Likes

![]() ), I visited the MSE Credit Club and tapped on 0% Purchase for X months credit card eligibility. (It had featured in the weekly email).

), I visited the MSE Credit Club and tapped on 0% Purchase for X months credit card eligibility. (It had featured in the weekly email).![]()

![]()