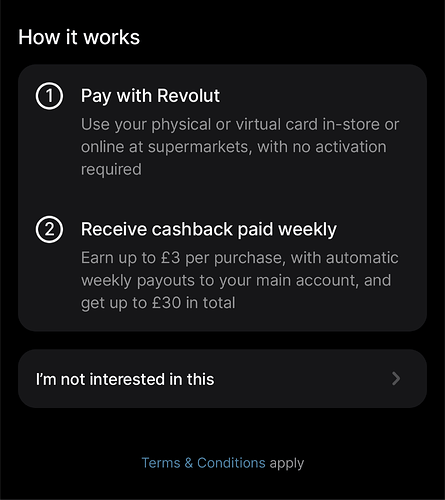

I don’t open the Revolut app that often. I had to make a USD payment today and remembered that I had some in Revolut. I came across this cashback offer so thought I share it here which might interest some.

No such offer in my Revolut app ![]()

In any event, there is no way I would put £1,500 in my Revolut account.

No way indeed ![]()

I had my salary going in there for a year and my partner still does - no issues whatsoever!

even momentarily? I keep my Revolut balance down because I don’t think it’s sensible leaving money without FSCS protection, but if there was a decent enough offer I wouldn’t hesitate to add and then immediately remove £1500. Would probably have to be better than 3% at supermarkets that said!

No. I fear that the return transaction would be blocked, as I have never transferred money out of Revolut before, only debit card transactions.

Cba with the hassle. Not for 3% cashback anyway.

Building up usage certainly helps - but I’ve had more issues with payments being held up with Barclays, Coop etc. Especially as a new user!

That said, whatever makes you comfortable. I’m a full advocate of that!

I went purchasing a used car for about £5000, I was going to bank transfer the money to the seller on the spot. LLoyds blocked it, I called and waited for 45mins without any luck. I remembered I had Revolut, sent the money there, from Revolut I was able to transfer to the seller without any problem whatsoever.

I do understand why it was blocked, and I’m all for protecting my money but I went through all the security checks and passcodes before hitting send… I drove ~3 hours to buy the car, there was no way I’d make that journey again. This was on a Friday and Lloyds called me back on Monday about the transaction… This wasn’t the first time but the most memorable one.

Tbh the morale of the story is that if I can’t access some of my money if needed instantly then there is a problem in the system (again I agree with high-level security).

I keep ~8k on my Revolut, it’s in the Vault, so it is FSCS protected. It also has a ~4% interest (paid daily), I get like a pound each day. It’s kinda my emergency fund.

I never had an issue sending money… transferring money for a Villa in Bali to a Balinese account? transferring a month’s rent to a Spain account? transferring money to a Swiss business account? all went through instantly and close to a zero fee. I would not even try that with a traditional bank account as sending money within the UK got me blocked.

All that said, I would NOT recommend keeping most of your money there for sure. However, for money that you might need quickly, it is a great solution.

I’ll be honest your experience is similar to mine.

I made a 5 figure purchase for a car on a Revolut card once and had no issues whatsoever (credit card wasn’t an option fwiw). I’ve had much smaller amounts blocked with other banks (RBS, Barclays, Coop).

I have had payments with Revolut blocked at a card terminal & been able to unfreeze things with two taps on the app. The flow to remediating these things is just as important, with others I have had to call back in after not picking up an unsolicited call.

The only downside to the vaults is that you may wait longer for your funds back in the event of default than direct savings, but this is the same for Raisin, Flagstone or any others of this ilk.

Yeah, I found Revolut support quite good, although I have a Metal subscription, not sure if that changes anything.