It’s not worth the paper it isn’t written on, but here’s the results:

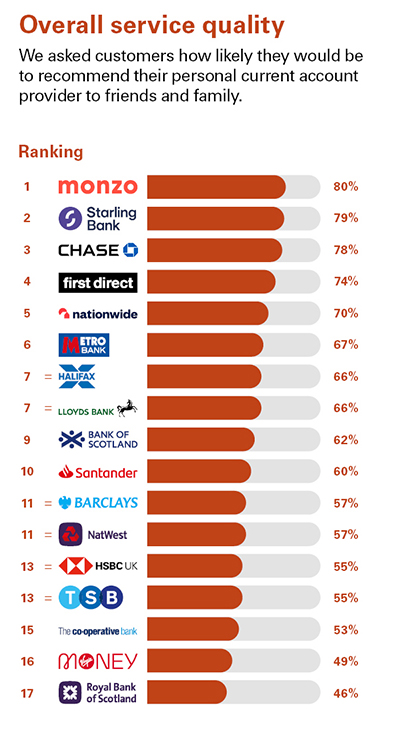

Note that Natwest is somehow 11% better than RBS despite being substantively exactly the same. Worthless.

Other places would by now have launched into the forensics behind the voting (n=92 etc).

As someone at the frontier of UK banking, I’m always surprised Midland Bank doesn’t even get a look in ![]()

All my accounts are 1-2-3-4. R-

I have accounts with 15 of the 17 listed ![]()

![]()

Hmmm. I opened a Monzo account and it felt like I was banking in Toyland. I hated it. Chase is possibly the world’s largest financial contributor to global warming, First Direct is nowhere near the fourth best bank - their offering is mediocre at best and even their phone banking gets you through to a person relatively quickly, but that person usually isn’t able to help with the issue. Nationwide is OK, Metro does nothing different, and offers nothing extra, apart from having a few palatial branches. I’d say the Lloyds Banking group is solid, the NatWest group is very much better than the survey would suggest. Virgin Money deserves to languish at the bottom of the list, but the Co-operative Bank should be much higher up the list - not a year ago for sure, but these days it is much improved. TSB seems to have too many service outages. Before anyone asks, I have had accounts with all the banks listed and tried to operate each as my main bank while I was with them.

I realise the ranking is based on popularity, but given how little most people know about finance and banking, it is to be taken with a large pinch of salt. When people abuse the t&cs of their bank, and the bank exercises its right to sanction them, they complain about how awful their bank is. The trouble is, it’s the blind leading the blind. Those who know very little contribute to this ranking and others take it as gospel.

What’s changed? It seems exactly as antiquated and limited as it’s always been, to me.

To me, the difference between the Co-operative Bank today and one year or so ago is marked - where it counts to me. Faster payments are now pretty instant in most cases, the slowest has been less than 5 minutes - a year ago they could easily take an hour or so. Pending transactions are available in app and online banking. The whole experience is very similar to other banks, previously is was sub par. The bank is heading for mutual ownership (or whatever you choose to call it) with its acquisition by the Coventry BS. It has an excellent ethical policy. I now use it for my main account, where my pensions and earnings go and from where my direct debits are taken. I am very happy with how it is all working. A year ago I wasn’t.

So slightly faster payments (but still not as good as all the other brands on the list above, who all do instant) and pending debit card payments?

On the flipside, they’re the only bank that applies a non-optional 3 week wait on CASS switches when you join and demands that you call them to tell them what you want your 3D secure password to be before any online transactions can take place.

On top of the above, they have a thin branch network, a current account offer bereft of features and a habit of holding up payments for fraud checks without informing the payer. To make matters on all the above worse their customer service is also very patchy, and when you need them (and it is when, not if) you may well be on hold for 30 mins plus.

Glad it’s working out for you but so far as I see it the only reason to jump through the hoops is to nab the cash and grab the nice regular saver. I hope Coventry pump some investment in to them because it’s urgently needed.

In the meantime I can see why Co-op Bank’s own customers rate them so poorly.

And I acknowledged this, to reiterate, glad it’s working out for you - but from what I see online and hear from people IRL (including some family who’ve held current accounts since before they issued debit cards!) is that it’s a world of pain and they’re moving day-to-day banking away from them for that reason.

- Immediate faster payments (like all their competitors listed above)

- Immediately alerting customer their payment is held up if it is (like all their competitors listed above)

- Open banking (like all their competitors listed above)

- Linked savings accounts which open immeditely (like all their competitors listed above, except First Direct)

- Ability for new customers to set up 3D secure stuff themselves, and not be dependent on a password (like all their competitors listed above)

- In app card controls

- Current account balance interest

- Perks for doing certain stuff each month (not neccessarily financial, could be something like Club Lloyds)

-

Most faster payment are immediate. Having to wait for a couple of minutes for some is a non-issue for most people.

-

Open Banking is now available and both the Co-operative and True Layer confirm this: Open Banking Connections | The Co-operative Bank

3D Secure is a VISA issue and some other banks are re-visiting their Mastercard relationship so it might become more common. Doesn’t the Lloyds Bank Group need 3D Secure passwords for online shopping? I’ve found I am asked for the password in about 1/10 purchases online. The main players, like Amazon, only ask for it if I’m entering into a subscription.

Who do you bank with that offers all you requirements? In my experience every bank is a package of good and bad features and as customers we weigh it up and make a decision.

Do you find using the Co-operative Bank as your main account a problem?

Source for that (bit in bold)? It’s a nuisance and one of the most commonly quoted issues I see. Again, perhaps it works OK for you, happy days if so - but we musn’t make assumptions that our own experiences equate to the experiences of “most people”.

They’re not immediate, they run on a batch script - if it appears to be immediate then you got lucky with timing. Seemingly this is also when fraud checks are run so annoyingly the customer has no idea when they submit their payment if it has been accepted/queued or not.

It seems from what you’re saying they’ve increased the frequency of their batch service running these payments - that said it took 11 mins from my Dad pressing send on a payment to Monzo notification popping up last time I tested it (around Easter), so perhaps you’ve just got lucky?

Good news! Now just the legacy issue of being last to enable this, meaning that many apps still don’t support it.

3D Secure is not a “VISA issue”. It’s a protocol common to all payment types used. “Verified by Visa” is Visa’s version of it, and it’s the Co-op Bank’s implementation which is terrible and anacronistic.

No, they send a nudge to your app and/or a one time code, much like every single other 3D secure implementation (Amex sometimes additionally ask for digits from card PIN, being the oddballs they are).

Regardless of whether you’re prompted for a password, the transaction will be passing through a 3D secure “layer” (even Amazon now). Co-op Bank will not let you get past these checks until the cardholder has called them and read out a password over the phone - that’s the biggest issue.

I’m not saying they must have all the above, but so long as you exclude current account interest (which I wouldn’t benefit from anyway), the answer is:

- Natwest

- Royal Bank of Scotland

- Santander

- Halifax

- Lloyds Bank

- Barclays

In fact, the only high street current account I have which doesn’t fulfill all the above is Nationwide, which is also a massive laggard - and even they only miss out on ‘in app card controls’ (and scrape through on ‘perks for doing stuff’ based on Fairer Share). I’d use Nationwide over Co-op any day of the week if I had to choose tho.

Yes. They became issues a decade ago when I switched away from the accounts I held for years (with Smile) and the same issues which led me away are still there today.

It is very odd that you and I have a very different perception of the Co-operative Bank. A year ago I would have completely agreed with you, but having had accounts with all the banks listed, and most recently the Royal Bank of Scotland, I just don’t feel as you do. I do feel the Co-operative Bank’s ethical stance easily trumps that of all the other banks in the list - and that is a big plus for me.

BTW, I just did a test faster payment to my account with RBS - and the funds appeared instantly. This is the norm for me.

@Graham sorry to be a bother, could you move some of these posts over to a co-op bank thread? (Maybe this one or a new one: Co-op Bank customers threaten to quit as app goes down again and again )

Not really. Other people love Monzo, yet beneath a nice UI I don’t personally find much to love there - looks like we agree on that one. We’re all entitled to our own opinions on these things.

It should be noted that 53% of surveyed Co-op customers would be happy to recommend the bank; that’s still a slender majority. I’m not saying they are utterly useless for everyone, quite obviously that isn’t the case.

They’re just not very good by comparison on any reasonable metric (other than the vague concept of ‘ethics’).

Perhaps it’s improved, good news again, if so!

These popularity tables never fail to stimulate discussion though I for one have found them to be a bit of a spectator sport (more so historically in other forums).

I’m going to suggest that the Co-op related exchange has probably run its course and might be parked up for the greater good. ![]()

(DM’s sent as appropriate)