You use the digital card number. No need to assign the card as spending from the account you’re switching.

Thank you, this is reassuring.

So Chase stopped paying Cashback on car insurance?

I got cashback in 2021 at Tesco insurance, 2022 at AXA, and just now I have paid Tesco insurance, no pending cashback.

They’ve never paid cashback on car insurance premiums (or any insurance premium for that matter)

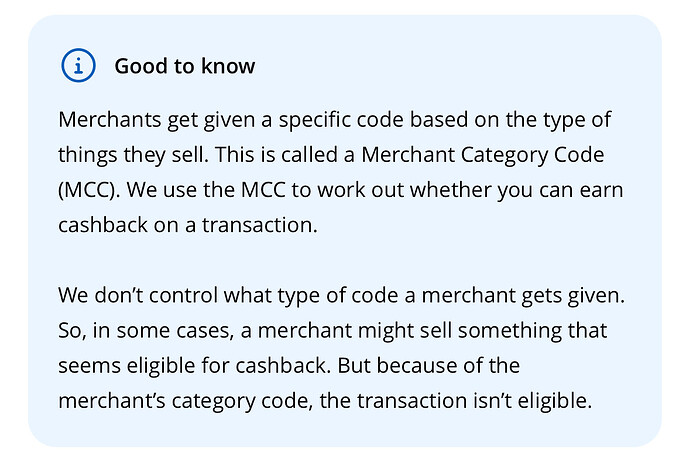

It’s governed by the merchant category code though, so some will slip through on the basis they had a merchant code that isn’t excluded.

You were never supposed to be earning cashback on your insurance premiums, but that will be why you did on some past payments.

I must have been lucky then. I have checked the last payment at Tesco that earned cashback, it showed up as just Tesco, the one for today has Tesco insurance.

Edit: All these transactions have been through Curve, that could partly explain why. And I have seen several complaints on Reddit about Curve and MCC.

Don’t know if you can, but if you could pay the insurance in the shop, you would likely get the MCC for normal shopping. Probably not at the travel money place which might have that MCC in their card machine.

Just thinking that there’s mileage in this for general purpose shops like Tesco and the supermarkets but also Boots and maybe others where they sell some stuff that’s excluded from cashback but other stuff that isn’t.

You can’t pay for it in-store as it set-up to be serviced via remote channels.

Like lottery tickets and gift cards you mean ![]()

You can even pay off PayPoint on the same MCC as groceries at Co-op Group stores…

I used to do this when I was still with EDF. I could pay £49 towards the bill and £1 for groceries at CO-OP and scoop all the cashback

No need to even buy groceries in my experience, but can understand why you did for peace of mind that it was going through the same bill ![]()

So you can get cashback on gift cards. Can you use these to pay insurance etc. which doesn’t directly qualify for cashback?

I don’t know any insurance company accepting giftcards.

I have bought gift cards from Wilko, ASDA and Sainsbury’s stores and earned cash back. Also the Airtime rewards gift cards earn cashback with Chase on top of the 4% for Airtime rewards

Possibly, if you can find a ‘prepaid Visa/Mastercard gift card’ and an insurer which accepts them, but the load fee would likely way offset the possible gain.

Back in t’day there was a product called 3V, which was sold like a gift card but yielded a virtual prepaid card when redeemed, and had no load fee. From what I read people were living their whole lives off these things in order to net the loyalty points/fuel vouchers Tesco/Morrisons gave at the time. I think there was even ways of getting the balance off the card by depositing with bookies then withdrawing…

But ‘no, not really’ is the likely answer to your question.

I’m thinking the likes of Tesco and Sainsbury’s insurance. The current prepaid Visa/MCs charge £3 or so to top-up so not worth it for cashback purposes.

I think you’d probably be wasting your time with that, but this is why having a decent reward credit card or two is handy; they tend to be far less restrictive.

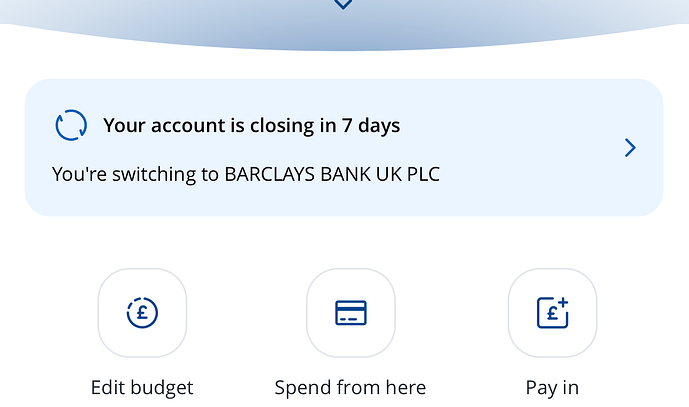

So you’ve CASSd away one Chase account, retaining another?

Yes I did that. It is the new account I am taking (forgiving Santander). I am impressed by the speed at which new DDs were set up.

I set up the DDs two days ago when I got this information.

Yesterday morning they were showing in my account and got notifications about them being set up this morning and initiated the switch.

Seeing as you can have a DD from a Chase savings account, does that mean you can CASS one of their savings accounts?

No you can not CASS a savings account