Starling offering is pretty solid. Better acceptance than Monzo and the app isn’t as complicated and overwhelming.

You have to ask yourself if you’d be comfortable to do without the money for a month or more. Say, just before you were about to lift it to pay for your holiday or car. Are you comfortable not being able to pay your mortgage or rent for a month or two too?

It’s meant to be paid within 7 days

I won’t go full Monzo with too many accounts being closed it’s to risky for me

Don’t have a mortgage. Will manually switch things over and still keep Metrobank open.

Yes, but if you look at what happened with dotcomunity a few years ago, the regulators stepped in and everything froze. Depositors with money in ISAs could not access funds for several months. As I understand, FSCS could not act as they were not able to do anything until the company actually went into administration. When that did happen then everything went quickly and people received compensation within about 7 days, I believe (I was not a depositor, I am going by what I have read recently).

Now, Metro Bank has been placed on the FCA financial crime watchlist since last summer (Metro Bank added to FCA's financial crime watchlist). The risk seems tiny, but there is a small possibility, I think, that potential further regulatory action could again force a freeze until a resolution. It is possible, by analogy with dotcomunity, that I may not be able to access my funds for some months. I think this is highly unlikely, but not impossible. I’m comfortable with this as I can do without the funds for a long time if needed. Have enough savings and investments elsewhere.

But why take the risk when you can move now and eliminate it?

Perhaps best to move back to Chase now and save a job of a thread split folks ![]()

Think we all have different risk appetite’s in these areas

Is it too early to restart speculation about the arrival date of the Chase credit card(s) ![]()

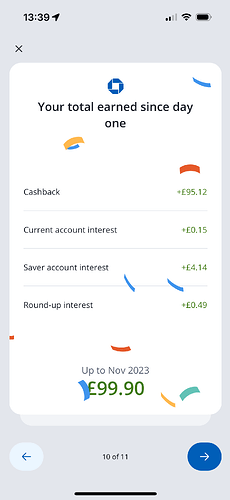

Anyone seen the Chase spotlight on 2023 yet? It’s a bit like Monzo’s year in Monzo, or Apple Music Replay.

Focuses more on your rewards and savings with Chase though.

No as not showing on my chase app.

Just seen mine. The numbers have shocked me. I can’t believe I spent that much at Amazon yet I have greatly cut my spend there. ![]()

Nothing in my app yet ![]()

Has anyone had any issues with Direct Debits with Chase? Do you see what’s coming out in advance? Thinking of moving my DD over to Chase.

You see DDs that are set up and you get a notification one day in advance. I only had one issue where an org set up a DD and then the day of collection cancelled it. They blamed the bank, Chase blamed them, and it happened twice.

It was a small thing though and bills have been fine

No issues with my Direct Debits with Chase, and I have been running them through my Chase Savings account, since the month we could open the savings accounts and attach the DDs!

No issues here with chase and direct debits.

why are you reposting my serious issue ?? ??!?!?!?1

For me, the Reddit image has little of merit and probably doesn’t warrant being here. I couldn’t on first scroll, find your original post. It certainly doesn’t add anything to the Chase thread.