Why have you stopped at 2 Halifax accounts ![]()

Not sure tbh.

Plan was for 3, one a year.

Opened one 2021, then 2022, then , possibly because I opened around 4 elsewhere, I passed in 2023 and didn’t bother in 2024.

I think Chase, at some point, will start offering credit facilities including overdrafts as well as credit cards and perhaps mortgages, because these will be sources of profit for them.

Personally I wouldn’t need or use any overdraft. I used to deliberately make fairly regular use of the FD free £250 overdraft but have not done this now for many years. So long as I stay organised I will move money around at the end of a month to cover any direct debits for the next month. Having opened many current accounts for switching incentives over the last year or so things are quite complicated with direct debits in many places, so it’s possible I might mess up, but unlikely. One day I will close some accounts and maybe some credit cards too, in order to simplify things. That will have an effect on my credit files so I might wait until after my next remortgage just in case.

And boom, a survey from Chase about overdrafts in the week commencing November 11

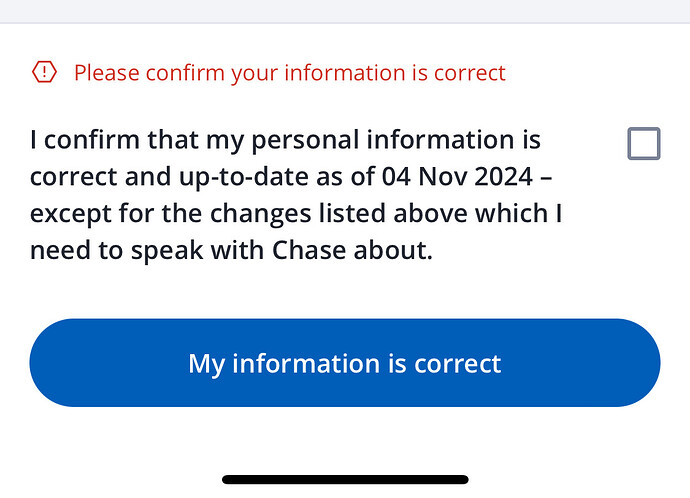

For people who’ve done the confirm your details questions already, does this mean I need to call them?

I didn’t change any information, I just provided new information that they never asked for previously.

So I’m a bit confused by the line “changes listed above which I need to speak with Chase about” as I’m really not sure what that would be referring to and if they are asking me to call them through this tick box?

If you didn’t make any changes to your name/address/employment details, there’s no need to contact them.

I would probably just tick the box and click the blue button

I wonder how many Chase customers found the additional KYC checks so intrusive, that they closed their accounts in a fit of pique ![]()

At least with Chase if you really don’t like their account or get so upset that you close your account, they won’t let you back in again. Still doesn’t stop some people from whingeing and complaining about a choice that they made though.

I don’t recall being asked any additional questions.

I’d have no difficulty answering though, so long as it was quick & easy.

I had to fill in a load of additional stuff back end of August, salary, pension and other things. It didn’t bother me personally one iota.

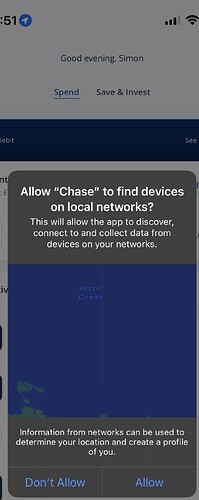

When you access Chase from your home network, it undoubtedly collects IP address data to determine your location. Probably to do with fraud prevention ![]() Then again, I recently used my Chase debit card in the Caribbean and there were absolutely no flags. I can’t remember if I had to press allow for Chase to discover my networks or not.

Then again, I recently used my Chase debit card in the Caribbean and there were absolutely no flags. I can’t remember if I had to press allow for Chase to discover my networks or not.

Upshot is, if you’re not happy providing access, contact Chase via in App messaging and ask why they need the information. If you don’t like their response or their reasoning, then it’s entirely up to you if you wish to continue your relationship with them.

From a personal perspective, I don’t actually care. I submit all sorts of information about myself frequently in order to do the things I need to do, especially from a financial perspective. Plus I’m undoubtedly caught on CCTV 50 times a day non consensually, so I just run with it ![]()

Unless your ISP has given you public IP addresses (and I can only think of one of the smaller ISPs that do) this would be of no use in determining your location. The IP addresses will be collected from logs on their own network devices.

Why the app needs the access that it’s requesting, I’ve no idea. Possibly to do with one of the APIs that it’s using.

Not really up on how this sort of thing works but I am always amused when I am told a device I have just logged on with is near London. I’m in the South West - so not very near at all really. R-

Geolocation, which is not particularly accurate (although it can pretty accurately determine which country you are in).

Any customer of my ISP (Andrews & Arnold) will be familiar with “Hot women waiting for you in Arnold” ads on some websites ![]()

Perhaps of interest, looks like Chase’s credit card, when it comes, is likely not to be a rewards-type card.

They will probably see you have a PS, XBOX, smart TV, thermostat, Octopus mini, etc… then later see packaged accounts covering your appliances. ![]()

Had the email from Chase today about the reduction in the interest rate to 3.45% gross. It took them long enough to announce it. Tandem were very quick with their announcement.

Tbf, they don’t really need to announce it. (Unless their T&C explicitly says so, of course)

Every customer was sent an email about the new terms and conditions and how and when any change of BoE rate would take affect to their own savings accounts.

I had the email too though ![]()

Had already updated my own records last Thursday.

I believe they have to inform customers under FCA rules.