Chase wouldn’t be able to launch a ‘Sapphire’ type card in the UK without pumping massive amounts of cash on an ongoing basis due to the EU level interchange fees in the UK.

I was actually going to ditch the savings logged in and found a bonus rate still applies until early 2025. Still not top paying but Chase is just so hassle free to use.

Maybe not Sapphire, but perhaps Freedom?

Amex seems to manage fine with their fancier cards in the UK, so I’m sure Chase could venture into that arena.

Amex cards are not subject to the interchange fee cap, unless they are co-branded. They also carry chunky annual fees.

I’m not sure that they are exempt as of January 2018. My card is free and with rewards too, so I don’t see why Chase couldn’t do something similar in the UK.

Admitedly cobranded.

Amex own brand cards are exempt - Platinum, Gold, Cashback, Rewards, Basic etc.

Amex co-branded cards are in scope - BA, Nectar, Marriott, Harrods, Vitality etc.

https://www.headforpoints.com/2018/02/08/american-express-european-court-of-justice-interchange-fees/

I suspect this is the reason they passed up on the opportunity to launch a UK Hilton card to match their international ones, and have recently been marketing the hell out of their own brand offers.

Chase would be in scope regardless, unless they launched their own card scheme (not going to happen!).

You never know. Didn’t Capital One buy Discover recently? Pretty unlikely, I’ll grant you, though if they bought the Discover licence for the UK presumably the cap wouldn’t apply to such cards.

Mind you, Discover acceptance in the UK is probably a touch worse than Amex. That said, now that I have a Discover card I’ve noticed a fair number of places that accept it.

But not happening anytime soon I think.

Using the Discover brand would still bring them in scope. It’s defined as number of ‘parties’ in a transaction, as well as the cardholder and merchant.

With any average credit card, there are at least 3, - the merchant acquiring bank, the issuer, and the card network.

With Amex, there are technically only 2 - the merchant acquiring bank and Amex.

3 or more parties brings a card in scope for the interchange fee cap.

The court ruled that a co-brand partner counts as a party involved in the transaction, which drags co-brand Amexs in to scope.

If Discover were to launch their own brand credit cards over here, without a co-brand, they’d be out of scope. Similarly if Mastercard or Visa was to change their business model and launch their own cards, they’d also be out of scope.

Some people already got approved, from comments on this post.

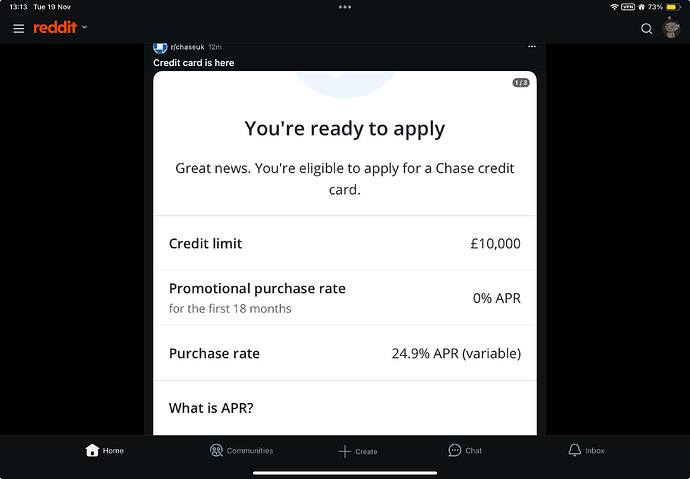

Looks like there’s a 6 months 0% rate on purchases.

https://www.reddit.com/r/chaseuk/s/CB1bpZbW16

Edit. It seems everyone gets a different promotional offer .

Seems pretty unexceptional.

Yes - up to 18 month’s 0% interest on purchases and no cashback. Very mediocre.

All this time waiting for it and looks like I’ll not be applying for this iteration of it! It’s not even World Elite so no advantage over something like Barclays or Virgin cashback, unless you want 0% for a bit and then Nationwide have that with the free overseas use anyway.

The only way they’ll launch something decent is if they find a partner like Avios/IAG with the Barclaycard Avios cards or Virgin Airlines with the Virgin Atlantic cards.

Didn’t stop them on the debit card…

They already partner with Avios as there’s been Avios on offer from Nutmeg in the past.

Starting credit limit is higher than I expected. I’d assumed a more conservative approach at launch.

For those who’ve chosen the credit card or who are thinking of so doing, I can report that you can currently only set your Chase current account to make repayments. You can’t choose a different bank.

Don’t you get bank details that would let you do a bill payment from another bank?

It seems not. You can make a one-off payment but again, that’s only enabled from a Chase account.