I’d heard someone say Revolut were one of the quicker ones, so let’s see

I’ve used opening banking since I opened my account

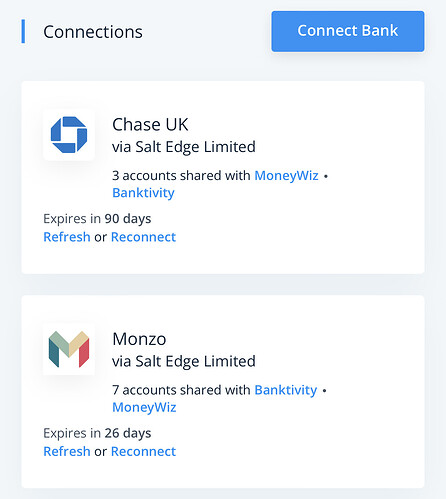

How are you using Open Banking with Chase? ![]()

How do you use it? Chase does not show up in the list of banks available to be linked via open banking through all my bank apps even Emma the budgeting app

Use it thought MoneyWiz and they use saltedge for their integration only caveat with it is have to logon each time through the chase app

What’s moneywiz?

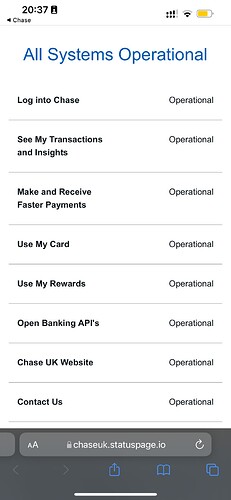

Chase UK do not have a modern “open banking” implementation, it’s an MCI bridge (a screen-scrape) rather than using standard API calls. I’ve been trying to find a reference to this but it’s eluding me at the moment - will update when I find it.

It’s a financial app for iOS

So the use the same stone age thing like Metro bank?

Anyone else submitted feedback to Chase from the email they’ve been sending out? I have done so and basically pointed out that the only way they’ll survive this game, is to take the best of Starling and Monzo (though really I haven’t got a clue what Monzo are like anyway  ) and then they’ll have a really polished product.

) and then they’ll have a really polished product.

If Chase really have built their App banking platform from scratch, it comes across as somewhat underwhelming, especially when you compare it against Starling. To be fair, I just don’t get it, you’d think that Chase would have sat themselves down having already got one of their own team to open a Starling or Monzo account to see how they actually work in the real world and then basically copy all of the great bits from both and then smash it out. Or is that too simple and idea?

I said that until they have - at a minimum - DD’s & Overdrafts then I could not recommend them to anyone.

I quite like Chase, and use it as my daily spending card, whilst using Nationwide for DDs, SOs etc.

But it’s a bit of a novelty and I think needs to show progress quite soon, or at least put out a roadmap so we know where it’s going.

Please don’t take this the wrong way, but I’d actually commend Chase if they didn’t offer overdrafts, or if they do, make the rates pretty tough. That might sound a bit awful, but I don’t get this whole thing with overdrafts personally because for some people, it’s a horrible trap many just cannot get out of. Often, the only way a bank can deal with a customer that can’t manage their overdraft, is to dump them as a customer. That all being said, I’d actually love to know the percentage of banking customers that rely on an overdraft month to month.

Chase as it stands, have so much work to do. I too am using them at the moment as my daily spending account because quite simply, the cashback offer is too good to ignore. Just hit £7, that’s more money back than I’ll ever earn from Starling in interest over a year. Mind you, for proper cashback, TopCashback is still the one to beat, done very well out of that so far this year.

Chase pretty much has these 12 months to prove they’re worthy players in the UK.

If they start to liven up the app with new features, I’ll accept a diminution of the cashback sweetener. But those features will need to pass the forum test.

Can’t seen them pulling any but the most disaffected Monzo or Starling users, though they should claim a fair few scalps from the legacy banks.

An interesting year ahead. I’m hopeful….

Similar. Monzo for DDs and SOs, Chase for spending.

This ![]()

Anyone finding Chase debit payments take an inordinate amount of time to settle? It could be that I’m using Curve…

It is Curve. Depends on when Curve decides to collect the money.

Can’t say I have noticed, but then I don’t keep checking each of my transactions to see when they change from pending.

As far as I am concerned, the money is deducted from the available balance and I just carry on as normal

It’s a fair wall of cashback that’ll be coming in - interested as Curve have coughed out their 1% but Chase haven’t yet