They changed to taking all fees when payment received from buyer not sure if that’s everyone moved across but I have been. I had to give my bank details to receive funds from eBay,

PayPal fees, though, are for selling not buying, so I’ll not be able to test it out until I sell something… Doh!

You can also add money to your PayPal balance via DD, but it takes a few days.

I think you end up on the same page from frequent or the Move between accounts option.

The crux for me is that you have to tap to change the from and to accounts, but there’s plenty of space to display them on one screen. I want to see two account lists and tap quickly on the two I need, all on one screen…

I think it’s been touched on before, but I do marvel at the speed of refunds in cancelled transactions.

I cancelled an Amazon order last evening. The Amazon message was predictably that if any funds had been taken, they’d be returned in 5-7 days.

Almost immediately there was a message from Chase that no funds had been taken so we’ve refunded your account.

I wonder why this isn’t common practice with other banks….

Anyway….nice.

I get similar response time on refunds to my Sainsburys bank Nectar credit card.

Strange I cancelled an Amazon order yesterday that I had used my Chase card and had to wait till today for refund to come through like Monzo does normally for me.

That to me sounds more like they actually took the money, and then refunded it. Because that’s the only time money is returned that fast with Monzo for me.

Whenever Amazon just void the pending transaction because I’m quick enough to cancel before it gets to the ready to dispatch stage, Monzo take over a week, whereas Chase is instant. Monzo blame Amazon of course, and Amazon will naturally blame Monzo. But Chase is so consistent, and Amazon is not the only merchant this happens with. It’s consistent with a variety of them, so definitely feels like a factor on the bank’s side of things to me! Chase get this spot on. The money is returned very very quickly, so I’m no longer left thinking so this is why I always did my spending on a credit card prior to the fintech revolution!

No had not dispatched and only cancelled a little while later. Was using chase for the 3% cash back was not issue just found it strange after you said you got a refund same day.

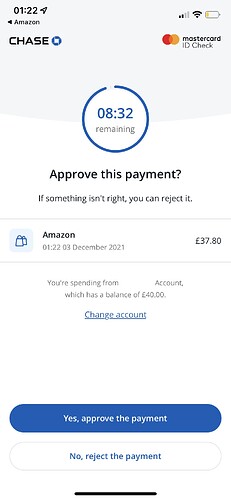

Is this new? First time I’ve had it happen with Chase. Nice interface though. Didn’t screenshot how it looked on Amazon, but it was visually similar to the Chase app UI.

I like how there’s a prompt here to change account too.

I think it’s about two weeks now since I started seeing it

I’ve had that from the start just not usually with Amazon mainly with Tesco

I’ve seen it, but can’t recall what triggers it.

I don’t know if this has been asked before or if someone raised it earlier.

Do we still earn cash back when we spend with our Chase card while abroad? Like at supermarkets, retail shops, bars, etc?

I have a planned trip soon and will be using my Chase card while there.

Any experiences?

Yes, you will earn cash back for spending abroad. Used the Card in Middle East and got 1% same as in the UK.

This is good to hear

Yep! Most of my cash back I’ve earned so far was from money I spent in Europe!

It’s also where I first discovered how quickly Chase refund voided transactions with the iffy reliability of Uber!

I love that they’re not just another London-centric player. I also think it’s a pretty smart play. The market outside of London, anecdotally feels very much untapped by Monzo and Starling, so very much free for Chase to snap up.

The benefit of having wads of cash to burn in order to acquire customers. The lack of which, I suspect, is why Starling and Monzo are so London-centric. A large condensed population relative to area size.

Monzo’s app in particular feels like the foundation was designed for the stereotypical lifestyle of London-living, salaried, young adult. And it hasn’t really evolved beyond that at all, so the game changing components and features for those folk, just aren’t anything to marvel at for other demographics, and you could say the same about Starling to some degree.

I think Chase is a breath of fresh air for those folks where the complexities and benefits of other neobanks just weren’t designed for them. The basics are that spot on in my view, or will be once direct debits are confirmed.

I work with low income individuals in the Midlands - I’ve noticed a real increase in people using Monzo and some with Starling (and to an extent Revolut but not so much as a main account) of late - far more than in 2020 - have chase come to the party too late with an incomplete product? I can see them scooping some people for a second account.

Monzo tend to pick up more low income clients than Starling from what I’ve seen. What is odd though - is they don’t seem to utilise many of the accounts features.