For our crypto aficionados……

It’s becoming pretty difficult. Algbra told me they allow payments to crypto exchanges.

I’m sure crypto payments are a safe bet ![]()

It’s not worth keeping a high value holding on an exchange as if the exchange goes down your holdings are not protected.

You can keep tokens in hot/cold storage instead.

Imo it’s good to own a bit of crypto (not random altcoins or native platform tokens) as a small part of your investments, purely for diversification/to open yourself up to a bit of risk should things go the way that r/bitcoin etc folk think.

But, back to Chase…![]()

Indeed, back to Chase, undoubtedly they have very experienced people who consider crypto to be too much of a risk.

A commercial risk for them! It cuts out the leg work of helping those affected by scams where an exchange is used to facilitate it, but impacts those using exchanges legitimately. Those using exchanges legitimately presumably make Chase little revenue whereas the fraud leg work costs them. By that logic though they ought to ban e gift cards etc which are just as common in online scams.

Personally, I think it’s protecting themselves whilst wording it as protecting customers. I could get scammed and withdraw the cash and hand it over - but they wouldn’t have to be involved in recouping that money.

I shall dip out here, as I haven’t had a Chase account since 2021 ![]()

I agree. I think it’s the lazy, easy solution to the problem they claim to be trying to solve.

But at least they’re not being coy with their stance unlike most banks.

This doesn’t affect me, but I’m not particularly fond of the trend with banks trying dictate what I can and can’t do with my own money, but that’s a mantra that’s largely trickling down from the regulator.

I’m personally 100 percent with Chase on this announcement. In very polite words, what they’re saying is, if you want to deal in crypto, bugger off and bank elsewhere because we don’t want to deal with your problems when your investment goes tits up.

And, at the end of the day, who you choose to bank with, is an individual choice. And let’s not forget, if the bank thinks you’re dodgy, they’ll probably bin you off their books anyway ![]()

As anyone can tell, I don’t do crypto and I’m highly unlikely to ever get involved in it. If mainstream banks choose not to involve themselves in crypto in order to protect themselves from customers who think they know what they’re doing but then make disastrously wrong decisions or end up handing money over to people or organisations pretending to be amazing investment prodigies, the banks shouldn’t have to bear the consequences.

As am I.

Respectfully it’s nothing to do with this, it’s to do with people sending money to exchanges to then send to a fraudster (whether this is to facilitate a push payment scam or a fake investment is by the by). It has nothing to do with people having any recourse on the value of their genuine investments going down. If this was the case people would have claims against AJ Bell etc if they invested in a business that filed for bankruptcy. They can warn you that the value can fluctuate significantly, but an outright ban is about fraud/scams.

And when every bank is doing it, where do you go then?

Crypto won’t be the end of it either. E-money and P2P platforms will be next. In some cases banks already block your ability to use those, particularly if you have their basic account.

And then we have investment platforms starting to meddle in and dictate what you can and can’t invest in, which actually does a lot of harm when you’re already invested, because everyone starts selling the disallowed stocks.

In this particular case it doesn’t affect me, and I like that they have a clear stance and have communicated it with customers. But the precedent of banks starting to do this stuff concerns me greatly. If you’re objective truly is just to protect customers, then this is the laziest way to go about it, because it impacts those with a genuine need.

I’m pretty sure Monzo is the only British bank who openly allow personal use of crypto at this point.

This is a far more pragmatic (whilst still being clear) approach imo

I hope at the very least, like Freetrade did with complex stocks, the outright ban is just temporary to comply with regulations until they have worked up a more practical solution.

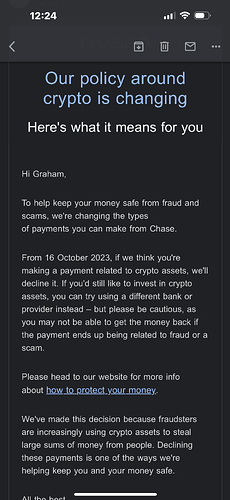

Chase were one of the few crypto friendly ones until this email.

They don’t have to, lol

There’s probably more work in restricting it than not

Banks shouldn’t have free reign in how they do business as an essential service - political opinions and legal enterprise should be a requirement for them to serve (or to process payments for)

Same w/ visa/mc/card processors

They don’t have to, just as they’ve never had to cover costs for investments you’ve made on the London stock exchange lol. You’re fighting ghosts here

Which is fixed by better education and a refusal to cover losses

Remembering recently a minister critiquing ESG because it’s making people sell defence stock holdings, having investment platforms arbitrarily choose what we can invest in will only further fuck the gem of our nation, the financial services industry

Don’t like how they’ve outright barred Binance - it’s not for them to decide credit risks etc of private enterprises

Complex stocks?

A place to discuss banks policies with regards to Cryptocurrencies - following on from the discussions in the Chase chat!

I’m not sure what’s gone on with the merging, just getting caught up on all the discourse, but one of my posts that has been moved here was directly related and in response to the Chase email that they sent out and should probably have stayed in the chase thread, since that’s what I was discussing.

Also, the Chase thread is locked… and I’d very much rather get back to discussing Chase than crypto. It’s an interesting discussion to watch, but not really one for me to take part in I’m afraid.

Stocks that are considered to be complex instruments (not sure if it’s by the regulator or by Freetrade), but for a while you couldn’t buy, only sell. Now you have to take a test to be able to buy. It directly resulted in folks dumping £TRIG which I have tens of thousands invested in. I lost 14% of the value of my holdings.

Just to be clear, I was talking about investing in stocks. Not funds. Funds are different, and how those are run, and how client money is invested is 100% down to the fund manager. So I’ve no problem with ESG funds and such. I like them and invest in a couple myself.

But now we’re talking about investing, not crypto. ![]()

Early mod days error!

Although I understand why banks do this, I’m not a fan of any bank meddling into my affairs and being the arbiter of my money. Having multi factor authentication should be sufficient if I consent to make a crypto transfer. Heck, I’d even be fine with triple factor authentication for these one-off transfers like most crypto exchanges employ.

Most banks seem to be okay with accepting crypto withdrawals, but those that allow deposits or transfers to acquire crypto assets are in the minority. Revolut has fortunately served me well in this regard.

It very quickly becomes their money if something goes wrong though, that’s the issue…