Fraud, it’s big news at the moment and seemingly, far too many people are falling for it hook line and sinker.

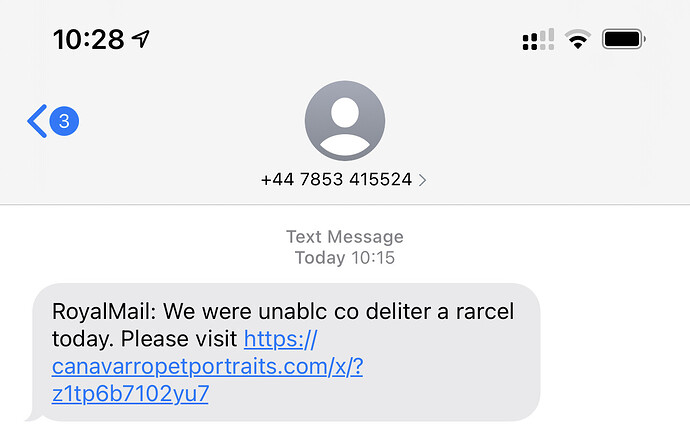

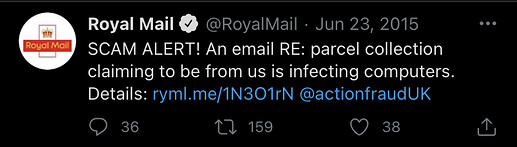

Almost exclusively, most of the fraud or scams that present to me, are by phone. I can literally go weeks without any scam texts and then like a couple of weeks back, I was getting 2 or 3 scam texts a day, mostly parcel delivery and banking scams. So my immediate action, is to just block the number and delete. My Wife and I now always make a joke everytime one of us gets one of these scam parcel delivery texts, both egging each other to click on the link.

Scam phone calls. Very often, the phone will just ring 3 or 5 times and then ring off, no voicemail, no follow up text. There was one exception a couple of weeks back, I actually had a voicemail left, a rather robotic voice threatening me with bailiffs and a Court appearance. It was almost laughable listening to it!

I have Silence unkown callers activated on my iphone, so I just get a notification that there’s a missed call. I then block them, simples, done. I also have an Android phone which unfortunately, doesn’t have the silence unknown callers feature. Some calls Google recognises as known scam numbers and the number doesn’t get through anyway, but mostly, my phone will ring and I just ignore, block and delete.

I guess one of the biggest problems is, lots of people just cannot ignore a telephone call, and this is clearly a big problem for many. Answer it, and all of a sudden, it’s your bank, or someone claiming to be from your bank and then financial pain ensues. I just take the view that none of my banks will attempt to call me by telephone, and even if they did, I wouldn’t answer the phone anyway. They all have my email address or they can leave a voicemail or a text and from there, I will then evaluate and if necessary make immediate contact completely independently from any said message.

Let’s be clear, scammers, fraudsters, whatever name we give them, are little more than pathetic scumbags who leech off the vulnerable and those genuinely caught in an off guard moment. But in any case, anyone who gets a telephone call advising them to deposit their entire bank account somewhere else, should be thinking to themselves ‘Is this normal?’ I don’t care if someone on the other end of a phone tells me to check the telephone number on the back of my bank card matches what’s on their caller display because undoubtedly, it will be spoofed anyway.

So to sum up from my own position, if your number isn’t in my contacts list, you get ignored and blocked.

How do contributors here deal with different types of fraud activity however it presents itself?

from me.

from me.