Monzo is my main account with my wages paid in and I have a plus account .

If you don’t mind me asking, how complex are your needs that current accounts at 3 different banks can only cover “most” of your needs?

Of course.

It’s not a need thing at all, any bank account at all, including Monzo, would service all my needs if I could only have one.

It’s about maximising the benefit from each and every transaction.

Most monthly bills attract cashback if settled using Santander 123 Lite, so I do that.

Day to day spending on credit cards gets me rewards, typically 0.75-1% valued in cashback.

Paying those credit cards off generates several £5 reward payments via Halifax.

Club Lloyds and Natwest/RBS accounts attract further rewards for basically just moving money in and out.

Altogether this amounts to almost £50 of reward payments each month between my fiancée and I, not to mention the enhanced interest rates on regular savers etc. If we just used a Monzo account each we would have £0 of rewards.

Could you expand in this? I’ve never thought of paying off credit card as something that could generate rewards. Is it as simple as paying off a single credit card once per month with Halifax debit card, or is there more to it than that?

It is using the £500 debit card spend on the Reward Account.

I just move £500 to savings account via debit card once a month to trigger same rewards on my two accounts. Easy £10pm

This is maybe something I’ve missed till now, but anyway.

Monzo has been bugging me to apply for an overdraft for a week or so. A couple of emails, notification and banner thingy in the app.

Sod it, thought I’d give it a go. But my application fails when I don’t connect my spending account via open banking.

It seems like they’re using spending transaction data to make the decision and it’s just a hard no without it.

I suppose that’s what I’d expect for a mortgage, but seems a bit much for some piddling overdraft.

I wonder if somewhere buried in the terms you’re giving permission for your data to be aggregated too for product improvement…

We may use your balance and transaction data from other accounts together with other details we hold about you to:

- improve our decision making

- develop our business strategy, using aggregated data about how customers use Monzo and engage with the Open Banking service. This helps us make sure we make the right products and decisions to make sure Monzo is successful; and

- to store backup copies in case we face a legal claim about the information.

Take from that what you will.

Data scraping, basically

“Improve our decision making” is doing some legwork there, but I think that’s probably right to assume they’d be using it for that kind of decisionmaking. I had mine hooked up and it took seconds without a thought. Definitely not going to cancel it to validate the theory though! ![]()

This is interesting…

Excellent - hope it works out for them.

That new font is ugly

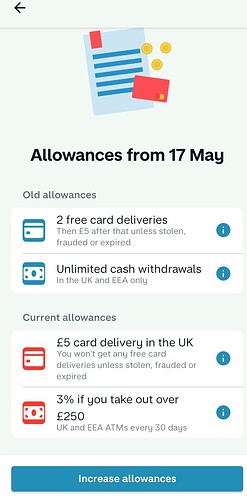

I take it you’re no longer meeting the requirements for the old allowance then ![]()

Must have missed these. Not paying attention!

But yeah, I don’t meet the requirements here:

https://monzo.com/help/account-and-profile/our-new-fees-and-allowances

It does feel like being brow-beaten to use them/upgrade, which just puts me off.

I don’t really get the sort of users who this would affect, other than people who don’t use the account but frequently order new cards?

If you’re withdrawing more than £250 you’ll also be paying in regularly (and thus meeting the requirements), surely?

Alternatively if you’re someone like me who just uses it transfer money to/from and the debit card once in a blue moon when Curve is being a pain, cash withdrawal limits and card reissue limits have no impact?

I’ve now got enough cards so if I needed to withdraw €1000 for nothing, I could spread it across them.

You also need a direct debit to meet Monzo’s requirements.

They’ll make allowances on that requisite if you genuinely don’t have any and don’t get automatically caught by the existing protections they have to cover most folks who will be in that situation.

Just message and tell them someone else in your household manages your bills, or that you pay them via card and which merchant, and they’ll waive the requisite for you.

Don’t know if there’s any way around the pay in requirement though.