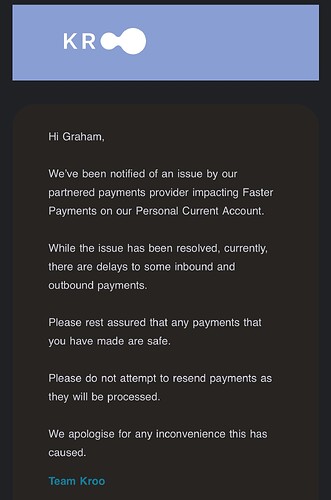

Just got this……

Imagine if you’d just lumped a large savings deposit in to benefit from the forthcoming 3% ![]()

I tried Kroo over the weekend, I have to say it left me a little bit “meh”. Now, I know it’s early days for them but considering the standard of banking apps elsewhere I was quite surprised how limited it was in terms of features.

Limited details on transactions, no logo’s, no map’s, you can only budget by month and you can’t change categories of purchases (or at least I can’t seem to).

I’ll keep the card for posterity but that’s as far as I’m prepared to go for now

Pretty much.

They’ve featured in the British Bank Awards the last two years, but you’d expect that for a newcomer. The approach seems to be about added extras - mental health support, tree planting to reflect uptake and a lot of friendly content around financial management and community.

Trouble is, that still leaves a featureless app, way behind the competition.

Their current account interest offering, starting shortly, is attractive, but others are in that ball-park.

Good luck to them, but they need to decide what they’re aiming for.

I think this nails it. Clearly they tried to be a “social management app” e.g 5-a-sides, clubs etc and found this was a solution for a problem that didn’t really exist and pivoted towards being a bank instead.

But, as you say, its so far behind the completion I struggle to see how they’ll remain competitive, my bet is buy out by another firm, even if it’s just for the banking licence.

That would explain the name! Had always wondered why they’d play on the word ‘crew’ (which has negative connotations, as well as positive).

Yes - when they first started out I think their aim was to focus in on the bill-splitting with a current account “on the side”

Clearly, they worked out that this was in no way a service people actually needed, and had no way to make money from it so pivoted to the current account side of things. Which is a problem for them as this was at one point the “add-on” vs the main product proposition.

Good luck to them but I’d say once investor money goes, so will they.

Surely given they only offer overdrafts this interest rate is just a marketing loss leader rather than a sustainable rate of interest.

The Bank of England will pay them 3.5%, surely?

True but it’s a small margin - banks generally will make their living off lending it out for a bigger differential. There will be costs associated with managing the deposits.

They will keep my petty cash, move it to Nationwide fir 5% on groceries or 1% at Chase .

Do you mean put a balance in that current account and use it for groceries?

Holding the balance with Kroo, transfer to my Nationwide when going to shop at grocery stores for the Nationwide 5% cashback.

Ah yes, I see now.

It’s nice that they’re extending it to FlexBasic too. The people who actually need it may get a decent bit of this help

Just a nudge - let’s return to all things Kroo please?

Would I be better off opening a Kroo account than Algbra, or are they pretty much the same?

Kroo is a current account - Algbra isn’t. Kroo has FSCS protection and algbra doesnt.

Algbra has virtual cards, Kroo doesn’t. Algbra has cash back. Kroo gives you interest on your balance.

I can’t think of any other difference. Depends what works best for you.

Both have a sign up offer but I cba with either - not sure why!