Monese’s slithering down the ladder of the competition yet again, having failed to get people to sign up for their dubiously priced offers.

Hi Richard,

Here at Monese, we’ve been working hard to improve our pricing plans and have updated our free plans to offer the best service that’s right for you.

As a result, we’ll be moving you over to our NEW Simple plan on 27 January 2023.

Our NEW Simple plan fees and limits

Card

• Card: free

• Card delivery fee: £4.95 (free when your current card expires)

Instant top-ups with cards

• Local and international: 0.30% fee

ATM withdrawals

• All currencies: no fee for <£100 and 2% fee for >£100

Transfers

• Incoming local transfers (transfers in your base currency coming from an account in your country): free

• Outgoing local transfers (transfers in your base currency sent to an account in your country) including outgoing SEPA transfer (transfers in EUR sent to an EUR account outside your country but inside the Single Euro Payments Area): free within allowance but £0.20 per transfer outside of allowance

• Outgoing international transfers (all other outgoing international transfers other than outgoing SEPA transfers): no transaction fee but subject to currency exchange fee

• Incoming international transfers (all other incoming international transfers other than incoming SEPA transfers*): we’re currently upgrading to an optional subscription-based service and our existing service will no longer be available from 14 February 2023.

- Incoming SEPA transfers are transfers in EUR received from an EUR account outside your country but inside the Single European Payment Area (SEPA)

Additional changes if you’re currently on our Starter plan

• Replacement card fee: free but subject to delivery fee of £4.95

• Outgoing international transfers (this relates to all other outgoing international transfers other than outgoing SEPA transfers): 2% currency exchange fee (£2min) and you’ll no longer be paying additional weekend currency exchange fees

• Online spending in other currencies (excluding £/€/lei/SEK): no fee for <£2000 and 2% fee for >£2000

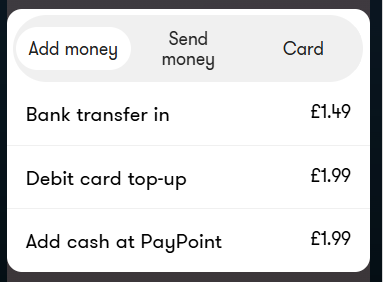

[Fees & Limits]

If you’re happy with these changes, you don’t have to do anything and we’ll automatically move you over to our new Simple plan on 27 January 2023. If not, you can choose to close your account, but we’d be sad to see you go. These changes also apply to any Monese account you have in other currencies.

We’re also updating the relevant section of our Terms and Conditions about incoming international payments, and adding a section to confirm that we can close your account if you haven’t used it for 12 months.

You can see all of the changes we’ve made in our updated [Terms and Conditions]