I can not really tell

This is exactly the reason why I never answer my phone and it’s on silence unknown callers 100 percent of the time. Forcing everyone to my voicemail or them choosing to hang up because they use the dumb excuse they don’t like leaving messages, or they’re too lazy or they’re scammers or they’re just absolute tools, is fine by me ![]()

I always ring back then they should identify the original query (if there was one)

I had nothing going on with them, I haven’t noticed anything with my card, no declines, no unauthorised charges , nothing. Being asked for my card number on first instance was the turn off.

A few months back they restricted my card and charges were being declined because they thought they were fraudulent. During that tine they did jot get in contact with me through any means until I contacted them myself and I had to go through the checks then they lifted the restriction.

This time, a totally different story.

I’ve always found that if Nationwide want to speak with me, they’ll send me a secure message.

I still don’t understand the concept of phoning back 0800 numbers or indeed any number if the number isn’t known to you. Just ignore it. If they want to speak with you, they’ll find a way.

I meant phone the official line - with the Coop Bank I had no choice as they froze my account lol

My employers have such numbers they use sometimes, so I pick up and listen in to see who is on the other end. If I end up with a bot, I block immediately.

Provided that you check that the number is genuine (by looking at their website, for example) there is no harm in ringing it, even if the caller has spoofed it. For outgoing calls you’ll always be connected to the real owner, not the person who spoofed it.

That’s good to know.

Unless it’s a landline, some of the more enterprising scammers stay connected & pretend that it’s a new outgoing call.

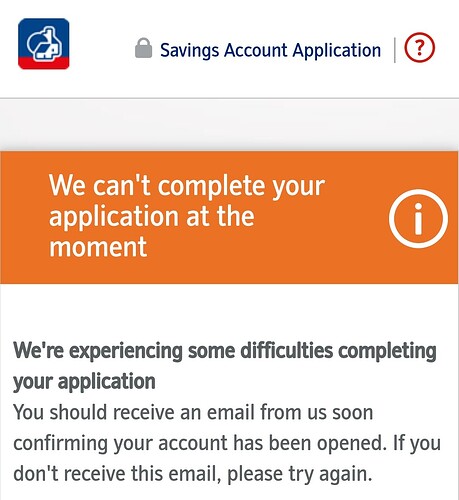

If only I could get the application to actually go through!

Really hope Natwest/RBS step their game up with the Digital Regular Saver soon. I’ve always preferred prioritising these ones as they have no fixed end date (and have had a great rate on the first £1k/£5k for a few years now), but they are at risk of falling behind as things stand.

I applied for the current account - got to the switch bit and forgot my tsb card wasn’t in my wallet. Had to stop there, I now have a pending application. I’ve been told that because I didn’t click the full apply button, I can apply again without issue.

I’ve had trouble with the Nationwide application form before, once I lost internet connection before accepting T&C and it left it in the ether - account details set up but no way of opening it - even signing the papers in branch couldn’t correct it.

I’m assuming this is high demand. I may leave trying again tonight even though I’ll have my card in hand…

I’ve been a frequent flyer with Nationwide (they never forget your customer number ![]() ). I think I’ll open an account and get rid of an RBS account that’s sat doing very little.

). I think I’ll open an account and get rid of an RBS account that’s sat doing very little.

Good to get the heads-up on the £200 switch. ![]()

Do you need to have active DD before you switch or can you set them up once the account is open?

I’m assuming the former. They’d have to be in place before the Switch completed.

Yes before you switch. I’m frantically thinking which 2 low-value, low-commitment DD’s I can set up that would be debited quite quickly. Most probably need 10 day lead-in I would imagine and they might have pulled the offer by then. I’m already switching main account to Lloyds to claim their incentive!

I reckon as long as there are live DDs on the account, that’d suffice.

Paypal is the easiest for me. It can be set up to multiple bank accounts.