Still scroll on Android

I was looking in wrong place.

Horizontal scroll on android too.

Or at least now, if wasn’t before.

Strange how can freeze debit card in app, but not credit card.

Yes, I think that’s probably because Nationwide actually outsource their credit card operation to TSYS whereas they handle debit cards themselves?

It’s the same with Barclays. You can’t freeze credit cards in app, only debit cards. You can block cash machine usage, or remote payments, but you can’t block the card altogether.

It would be great if they displayed the reference on Faster Payments

Would be even better if they stopped needing a card reader for a new payee

Yes it would. It would be even better if they displayed the other person’s name for payments sent to and from other Nationwide accounts. All you get at the moment is the sort code and account number.

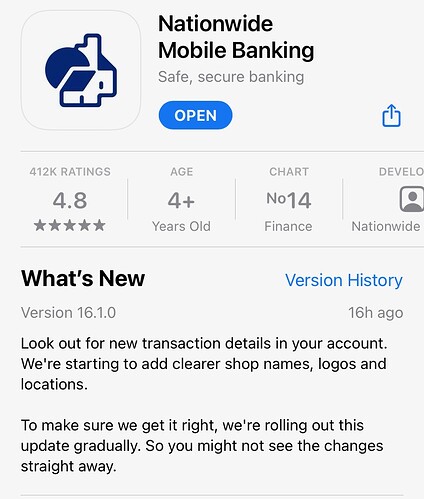

Same text in Google Play Store’s latest update.

Despite a splash screen on app open after installing this update to explain the feature, I haven’t got it yet.

This is going to be like the HSBC push notifications again, isn’t it?!

Yes, it seems to be rolling out gradually. The only thing the app now does is expand to show more details for a given transaction --the account number, the type of transaction etc.

Very gradually! Has anyone got it yet (I’ve got the additional details, but not the “shop names, logos and locations”)?

I have it on android 17.0.1

Shows Asda logo and Google map location of store when tap on transaction.

The screen also shows merchant website address and phone number, plus merchant code and my Google Pay virtual card number, not the true card number.

That is actually an improvement - they used to prefix the account opening branch number and a 6 -so account 12345678 would become 0405/612345678 for internal transfers.

In terms of general service, they used to be great but in post-2008 they take advantage of being the only full service building society left. They now operate like a bank with their one year FlexDirect offer and tacky adverts but come across as fairly bloated and inefficient.

When you ask why they don’t have X facility such as mobile app cheque deposits , their excuse is always that they are a Building Society.

There is also definite shift to referring to customers rather than owning members. They seem to want to operate like a bank with zero shareholders so that they can operate with limited scrutiny.

Despite logo update, you still only get sort code account number for internal transfers and, in my case, a giant zero in the logo box.

Coventry Building Society is just a giant C as a logo, not the Coventry BS logo, and to other external accounts in my name just my Initial appears,not the logo of the bank it to or from, which would be more helpful as I hold numerous accounts with numerous banks and building societies.

I don’t think I’ve seen any bank that displays the transferring bank’s logo on faster payments. Even Monzo just shows initials for the name that appears on the transfer. I think data protection rules mean they can’t show you the account number or sort code so probably won’t display logos either

It can’t be data protection rules which prevent them displaying the logo, because when I set up a new payee from other banks (not Nationwide) the Confirmation of Payee system tells me which bank the sort code belongs to. E.g. it says “just checking those details with Lloyds Bank”

Yes, but incoming transactions no longer display the bank details from which you’ve been paid – Monzo I believe cited data protection for the removal of these. Without incoming bank details, its pretty hard to tell which bank paid you

When you have someone’s bank details and set them up, that’s different. If it still doesn’t show a logo, then that’s on the bank

Not massively relevant but you can still see the inbound details with Dozens