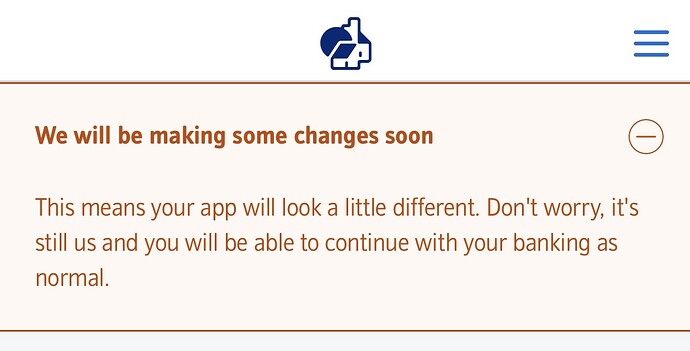

Looks like Nationwide is about to drop a big app update. Could this mean we could see notifications come too ![]()

Hope it will have more functionality. It can not even show credit card statements at the moment.

On another forum, someone asked Nationwide Customer Service what the changes were, and the agent claimed they didn’t know ![]()

![]()

I like the honesty.

To be fair they probably haven’t shared it out comms wise to stop people from speculating or leaking the new changes

That is a genuine possibility, I guess.

I bet their so-say “big update” will actually just be a minor change of font and layout.

I am not holding my breath for any further changes to functionality; I doubt we will see notifications, cheque imaging or dark mode support coming to the app.

I foresee dark mode, in app cheque scanning…oh alright I’m talking crap ![]()

I’ve consulted Septic Peg

Apparently, dark mode will be enabled along with an improved nationwide logo.

References for payments and transfers?

Maybe even the sender and recipient’s names for payments between different Nationwide accounts?

I highly doubt it will be anything like that, those changes would require major upgrades to the backend system and I seriously sceptical of the notion that they would bother - especially since it’s always been how it is now and we don’t really seem to see people complaining.

I get the sense that most Nationwide customers are relatively elderly and technophobe (not that the two necessarily follow, but tech-savvy people do tend to be younger). The same logic is also why there is a mileage in a “Branch Promise” when, frankly, few younger people would care about such a thing.

And that is all I want it to do.

we’re still using nationwide in the home of nationwide :') everyone else is probably in it for the insurance or out of bank hatred

I imagine with the annual fairer shore payment coming along now, they’ll suddenly be happy enough with nationwide and may even move to it

Fingers crossed it’ll remove the need to get the card reader out just to change the date on a standing order by one day.

Genuinely hope this update brings it into the 21st century…or that it loads up a bit quicker than it does now (it’s currently like a PS4 game on my 13 Pro). I’m not holding my breath though. ![]()

They haven’t actually promised it will be annual. Even if they repeat it, there’s no guarantee the terms will be the same next time.

Probably, although your point reminds me that I’ve also never understood why everyone seems to think their insurance is so good either.

Depending on exactly what coverage you need, Virgin Money or Halifax (especially with a £5 Reward Extra acting, in effect, as a discount) offer better value for money.

The idea of people liking Nationwide “because it’s not a bank” is similarly baffling to me - it behaves exactly like a bank, most of the time, and it has terrible banking features, as discussed (so is objectively worse than almost every bank in a straight features based comparison). Why would you want to use an inferior service just because it isn’t technically a bank: for warm and fuzzy brand affection or because you think they might give you £100? Even with the Fairer Share scheme, that’s a meaner payout than most bank switches and they only revealed the qualification criteria after the fact.

Different folks have different needs I guess. My Wife and I have had a joint Nationwide account for over a decade. In the early years, the insurance aspect was pretty cheap and we used to get cash back in the form of interest etc. Then the cost crept up to where it is now at £13 a month. However, for my own situation, at £156 a year, it represents good value in my opinion. Me and the Wife both in our fifties and we do do worldwide travel. We also both run our own vehicles, so there’s the breakdown cover if we need it. Plus we both have iPhone 14’s which we bought outright from Apple, so the mobile phone cover is there too if we ever needed it.

As for the App, well it’s not the best I’ll admit and it really does need dragging into the 2020’s. Unfortunately I don’t think their App is ever going to be that good without significant reimagining or investment. That being said, their grey haired tech savvy 50 something customers like me, will demand better tech service as the much older non techy customers shuffle off ![]()

I suppose it’s OK, as packaged accounts go!

It’s just that I used to see people saying constantly on MSE forums, Monzo Community and so on that Nationwide was the absolute best packaged account when it clearly is just about the same as all the others. A quick look down the list helpfully provided by the MSE website, and you can see that both Virgin and Halifax may work out cheaper for the typical cover of the type you are describing - and Co-op is another handy option for older travellers. Nationwide is more, frankly, just about keeping up with the competition rather than setting the world alight. Not that I’d seriously suggest you bother changing over for the sake of a pound or two per month!

I agree on the app too, but I think the problem really runs deeper and points to serious system limitations. Like the issue with paying other Nationwide customers not showing any details (reference or even name!) is because they process all Faster Payments to other Nationwide customers as internal transfers, to save on Faster Payment processing, and they would really have to change that or seriously alter how their internal transfers process works if they wanted to resolve the issue. Sooner or later they will have to bite the bullet though. Perhaps after the “Branch Promise” runs out?!

I must admit, I also find that lightly amusing as Debbie Crosbie cut TSB branches back ruthlessly when she was at the helm of that bank, but now as the Nationwide CEO she is singing their praises.

We moved from Halifax Ultimate Reward to Nationwide FlexPlus this year, because the AA coverage is much better (includes onward travel, given that we holiday in the UK in a car with probably more years behind than ahead at this point…) and because I had a very disappointing experience with Halifax’s Home Emergency “cover”, where they refused to fix a simple problem with a bathroom basin on the grounds that another sink was available in the kitchen.

Not an advantage for us, but the mobile insurance is also better in many instances as it protects all devices owned by partners and children who live at home, as opposed to Halifax who cover one device per account holder.

Given details like that, along with differing coverage (Co-op’s age limit, Virgin’s different gadget cover) it’s easy to see why people have to pick carefully depending on their situation.

Perhaps I was overly harsh on Nationwide, as they do fill a niche, and the cover is still cheaper than buying it all separately, quite considerably.