This is how my iPhone defines “legacy” and I think it’s pretty apt in the context of our older well-established banks:

They haven’t been superseded by anything, though.

Neobanks have not really done anything but move processing to cloud services (which probably cost more at scale as you’re charged on usage rather than hardware you own) and make an API with newer techniques, then slapped a front on it

The actual core banking systems have not changed at all, so I think you’re definitely right in nothing in banking is legacy in truth

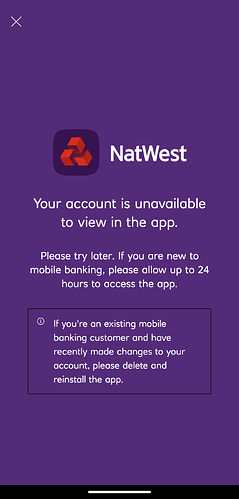

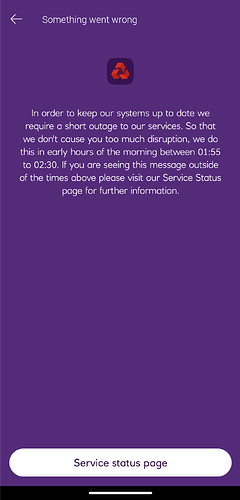

Well… an interesting experience with NatWest this afternoon with their antiquated systems rearing their head again. I went to download a PDF statement from online banking (which, btw, looks so incredibly dated - I think even the functionally identical RBS interface looks markedly better due to the blue colour scheme instead of that oppressive dark purple), which I almost never do. Upon downloading it I skim the details and notice that it has NATWEST ADAPT (their children’s account) printed on it under my name. Now it’s been a fair while (years) since I moved over to a Select account, and even though it took months at the time (which itself felt very old fashioned, while HSBC updated my account type to adult at midnight), I have been fully migrated - or so I thought - to the adult ‘Select’ account type for quite some time.

I checked to see if it was a one off, but sure enough all of my statements had ADAPT on them! So I started a live chat, which frustratingly meant having to bulldoze my way through Cora’s persistent questioning (she does seem to have a bad case of amnesia - asking me what was wrong about 4 times  ). When I got through (which tbf only took about 5 seconds once the AI opened the gate) the friendly gentleman wanted to order me official paper statements for some reason. So for the 5th time I had to explain my issue again, and then he came back after a minute or so and said that he’d altered the text in some field from ‘Adapt’ to ‘Select’ and all my statements should be updated not immediately, not this evening, but the next working day.

). When I got through (which tbf only took about 5 seconds once the AI opened the gate) the friendly gentleman wanted to order me official paper statements for some reason. So for the 5th time I had to explain my issue again, and then he came back after a minute or so and said that he’d altered the text in some field from ‘Adapt’ to ‘Select’ and all my statements should be updated not immediately, not this evening, but the next working day.

While the NatWest app is starting to feel pretty damn modern, sadly its legacy-ness can, and does, ooze through just enough to be reminded that behind the scenes, what you’re dealing with is far from a modern fintech.

Yeah statements for whatever reason haven’t been touched, all the more obvious by the fact that they’re nowhere to be found in the app.

I have been a Natwest Customer for over 30 years. Have not had any major issues with them in terms of service provided. I mainly use it to pay a few direct debits each month now. I do not use the app but check my account with online banking.

Do you still need a card reader to setup new payee?

![]()

![]()

No, you can set up facial recognition and use that instead.

I opened a NatWest account for their new switch offer.

No real interactions with customer service yet.

Has cheque imaging and access to NatWest/RBS/Tesco cashlines via their app; Access to NatWest/RBS branches & the Post Office is better than Monzo & Starling too.

Seems okay but not the biggest fan of the Fisher Price inspired debit card but then it will be getting shredded once the £150 gets credited and my next victim (bank) is available.

Today I made the first use of my Natwest card reader. It was a great experience.

I removed both batteries and put them into my car key fobs. No more low battery warning. ![]()

Nat-west is not letting me set up a standing order to a Payee I have paid before in the app. I get a notification that I should have paid that person via online banking first before I can set up the standing order.

What is this all for? I have paid this Payee (me) several times in the app, why do I have to then first use online banking?

Sounds like a poorly thought-out restriction.

How long ago? IIRC there must’ve been a payment within a certain period to have unlimited (well, less limited) app payment access.

I noticed that last night then posted here. Switched to Natwest late April and have been making in app transfers to my account about once a week. So last night I wanted to automate the process and was met by that notice.

Oh, yeah. You can transfer small amounts within the app. You can’t sent larger amounts (£1000 rings a bell, that might be across all ‘non-verified’ payees though) or set up standing orders until you pay them through online banking (which forces a second factor check).

If you don’t make a payment of any sort in a long while (might be a year or 18 months) the payee becomes non-verified again, I think.

This payee is verified and has a green check mark. The amounts transferred are less than £500. I did their face verification stuff that lifted the £1000 limit in the app, it was also required to even have the option of standing orders become active.

Sorry, verified is probably the wrong term to use - ‘safe list’ might be better (which is totally separate from the account verification system - which is what those ticks mean).

How long does it actually take to be able to access an account you’ve opened? I’ve been spoilt by fintechs clearly ![]()

Also I find their switching offer strange. You have to switch during the application. If you decide you want to do it after you open the account you don’t get it. With first direct you open the account and then you switch. Makes more sense to me ![]()

It took me about 7 working days, you will get several emails about the account. Then your login ID code will be hidden in some email. You will then have to wait for the account number and sort code in the post (got mine from the card). That’s from here that you maybe be able to log in to the app with visible details.