Some people genuinely don’t understand what suspicious or illegal activity is, even moreso when it comes to banking. Some people don’t even realise that being a money mule is illegal and they do it because perhaps they’re just gullible or uneducated. So yes, you’ll get some people moaning like hell that they’ve been ‘done over’ by their bank and they will take to forums and social media and slag off the bank involved. I’m betting, look deeper, and many of these ‘wronged’ people have a hidden story which of course, they’re not going to tell everyone else because it undermines their complaint.

Good point.

Monzo’s young-skewing demographic is probably more easily taken in than most, too. I wouldn’t normally make a blatantly ageist point, but in this instance it’s backed by data (I believe that when research was done into this, I remember reading that 18-24 was actually the age that scored the worst in identifying scams).

I would put a link to the research, but I forget where it was from!

Were/are you banned?

Or have mental health issues which the person recruiting them blatently exploits. So many reasons if we’re honest.

I was with Santander my whole life. My account was never closed. I’ve now been with starling for more than three years and it hasn’t been closed.

I imagine that’s the same situation the majority are in… 🤷

And I’ve been with multiple banks over a period of 37 years and I’ve never once had my account closed nor threatened with closure.

Monzo closed my account.

Admittedly, I did ask them to do it…

I’ve been using Starling as my main account for about a year and am just as relaxed about them closing my account as I would be with any other bank.

At the end of the day these banks do want people to have accounts so there’s no point from their perspective in closing them all - while it seems likely that Monzo are closing a higher proportion of accounts than is normal due to the large amount of noise about it with them in particular, the chances of it happening with an account that is being operated ‘normally’ is still very small.

If you spend some time in the banking board on MSE it won’t be long until you come across a post about somebody having their account(s) closed with the high street banks. One that comes up fairly often is Lloyds doing a review and closing all products a customer has with them across the entire group.

What do they do about a mortgage in that situation?

No idea!

I imagine it’s a bit more difficult with loans and mortgages than with deposit products. I imagine they’d just have to leave it and then pounce if the terms are broken?

And with mortgages, not offer a remortgage product once the current deal is up so the customer would either have to remortgage elsewhere or pay the SVR?

I think I read one where the customer had a mortgage. The standard letter they got had no mention of the mortgage, so they asked Lloyds and were told they could keep it but probably wouldn’t be able to remortgage with them at the end of the term - like you’ve said.

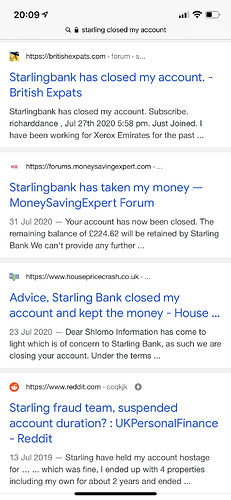

The whole group review also sometimes comes up as a NatWest/RBS thing. “HSBC Safeguard” comes up too. You don’t seem to hear so much about Barclays, but there was something about them at MSE the other day. So all the big four are at it, not just Monzo!

Yes, I think Monzo are defintely suffering a beating with a fat faeces covered stick concerning account closures at the moment. Unfortunately, their PR stance in relation to their responses to account closures is not helping me thinks.

I guess it’s tough when the press jump on a story because someone says they can’t feed their kids or pay their rent, and Monzo can’t reply and say “well if you hadn’t been using MonzoMe as a way to get drug money you’d still have your account”

My phone must have read this thread, it’s offered up this news article.

I’ll take it with a pinch of salt as there’s no way of ever finding out the actual truth. The article just fits nicely with this conversation.

I don’t think joining the facebook group and asking people to contribute constitutes an “investigation” but the whole article is a mess.

Banks close accounts. Bears shit in the woods. Etc etc.

I didn’t look but given its the I, they’ll be holes all over the story

“The problem of account freezing is an ongoing issue for every digital bank apart from Starling”

For that one quote alone it’s probably a good idea that the Monzo forum is currently closed

It’s just been dropped in the middle of the article with no further comment about why, even if just conjecture. Are Starling handling this better by preventing account opening before there’s a problem that requires account freezing, or worse, by not caring about dodgy behaviours and not freezing at all? Something else? It’s just so vague and disjointed, feels like the article has had bits cut from it.

Edit: I don’t care if Starling are better at this than Monzo, I’d like to know why so Monzo could improve things if possible.

Could it be something to do with customer demographic and the way the accounts between the different banks are operated? I can only speak for myself being a Starling customer in my 50’s who may have a different approach to banking overall than perhaps a younger customer base involving themselves in such things as crypto, or perhaps not having a regular source of income or even perhaps less likely to attract a customer that habitually lives abroad but operates an account in the UK.

In any case as has been said before, thousands of people may well complain, but what percentage of those complainees are telling the truth, the whole truth and nothing but the truth regarding their circumstances?

I wonder if this answer can be found here in the 2019 post on Starlings website

At Starling the average age of our customers is 35 for the personal account. Three quarters of active customers live outside Greater London; the average balance on active personal accounts is £932, with an average of £1,140 coming into the account each month.

I don’t have corresponding info for Monzo and I am not suggesting Starling customers are “better quality” (sorry for the clumsy choice of words) but maybe this starts to explain it