Don’t worry: if the bank doesn’t I’d be happy to oblige

Out of curiosity would you share the ballpark figure? I was thinking about making one but couldn’t see myself spending over £30 for it ![]()

Cheque ![]()

That is perfectly normal. The counterfoil in your cheque book is designed for you to note who you made the cheque out too

No it’ll never be linked to the payee’s bank account. That’s your job as the issuer.

You don’t make out a cheque to a bank account though, you make it out to a person or company and they insert the bank account

My initial offer was £30 then we met in the middle.

One of my many americanisms! ![]() mom being another that everyone likes to call out too. I find myself switching back and forth between British and American with certain words like this for no clear reason! I’ve probably called them a cheque somewhere in this thread too!

mom being another that everyone likes to call out too. I find myself switching back and forth between British and American with certain words like this for no clear reason! I’ve probably called them a cheque somewhere in this thread too! ![]()

Edit: yep!

Thank you both!

I should have put an offer in  oh well, someone will post one up at some point

oh well, someone will post one up at some point

Exactly, the number shown is the cheque number which is printed both on the cheque itself and the counterfoil, for you to link back to.

If you filled in the counterfoil at the same time as writing the cheque, you can go back later and reference it.

Paying-in slips work the same way (you are supposed to reference the paying in book for the exact details, your account statement just shows the slip number).

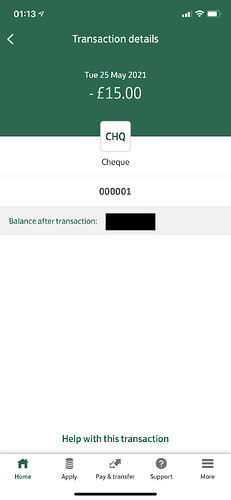

It makes statements difficult to read as they literally only show a single line of number and amount, as @anon62610374’s app shows here.

@anon47616136 I don’t know why you think banks would get suspicious of you writing yourself a cheque. Once upon a time, it was a relatively common way of transferring between accounts. It would be fine; they probably wouldn’t even realise both cheques were to/from yourself!

RBS notifications, at the moment, are only for card payments.

Presumably they will expand it out to full transaction notifications eventually!

Very nice, and with the marygold logo too!

I don’t know, I guess having never lived in an era of cheques it feels odd that you’d transfer money to yourself in such a way, especially if you know your own bank details! Cheques feel more the sort of thing you’d pay businesses with or people whose bank details you don’t know

For the record, I’ve not (really) lived through the era of cheques either!

I just know about it from the point of view of being interested in banking, I suppose.

It’s a few years since I used a paying in slip, but I don’t remember the slip number appearing on my statement. I’m sure it usually said “cash received” or something similar, plus the branch name.

It might vary from bank to bank.

I’m talking about my specific experience of using a Child & Co account to deposit at NatWest branches.

The statement would have the code for cash deposit on the left side and then the paying-in slip number. It would be similar on the RBS app, and there would be no reference to the depositing branch.

It might work differently if you make a deposit without actually using a paying in slip, or even if you make a deposit at an RBS branch (which I’ve never personally done, so can’t say what happens).

Lloyds is supposed to have push notifications for everything, or so I thought… it seems they forgot to add them in for cheque payments, since I was very disappointed to get no notification at all when I paid a cheque recently to a shop. I only found out they had cashed it (many weeks after I gave it to them) when I actually opened the app and checked the transaction history. Here’s what it looks like in-app for anyone interested in comparing to RBS:

As an off topic aside, I thought it’d be really cool if bank accounts that still offered cheque books had a pots/spaces feature whereby you transfer the money you write a cheque out for into that pot so that it is protected from spending in the main balance, like how banking apps now show the available balance instead of true balance so you can take into account recent pending card transactions that haven’t been collected yet. This would be especially relevant to cheques because once you’ve written it out and signed off the amount, the recipient could take anywhere between a day or many many months to claim it, meaning you just have to remember to keep that amount safe in your account, which would get really messy if you started to write out multiple cheques at once! I wonder if Lloyds (or any of my other banks) would let me open a second current account just for this purpose - I could even name it ‘Cheque Account’ or ‘Written Cheques’ or something like that. I’d probably never use it, but I like things to be organised! ![]()

Edit: yep, Lloyds have confirmed via Twitter that they don’t have notifications for cheques ![]()

https://twitter.com/lloydsbank/status/1412212804719984644?s=21

Does anyone know a bank that does?

This I like the sound of! If cheques ever experience a vinyl moment and fintechs jump on the trend, maybe it’ll happen!

I’m surprised businesses still accept check tbh. Maybe some of the cash only businesses here will accept them. Saves me the bi-weekly trip to a cash point just for the Saturday night pizzas!

I haven’t tested it, but Barclays may do (as their notifications are for everything, as far I can tell, whereas Lloyds only offer “smart alerts” which don’t cover everything).

Lloyds do allow you to open a second current account if you want, but you are only allowed one Club Lloyds account in your sole name (so if you are a Club Lloyds customer and want a second account it has to be a Classic account).

@anon62610374 By the way, you just did it again! I feel compelled to point out any use of “checks” instead of “cheques”!

Wouldn’t it be great if they just forgot and then never did cash it? ![]()

Also the word check triggers me in the context of chequebooks

Ah, I’d assumed ’Smart Alerts’ was just Lloyds’ marketing talk for notifications in general!

Yes, I think I’ve seen them offering me a second current account in the app (in one of those promotional boxes you get on the main screen). Do you know whether they hard credit check you for opening a second current account? Or if you already have one with them is it pre-approved? …and I assume a second current account would mean a second (unnecessary) debit card ![]()

I’ll be honest, I got my hopes up that they’d just forgotten it or lost the cheque!

A perfect example of the importance of spelling cheque the correct way! ![]()