I don’t think the link should be posted openly as last time there was an influx of applications it raised some eyebrows. I’ll dig it out and can DM you

More weird than fancy tbh! It’s the default RBS card from when they transitioned to Visa from Maestro/Solo with the lettering changed.

I’ll be keeping my Child’s account as my day-to-day debit card. Not that I use a debit card at all very many days!

What sort code did you use?

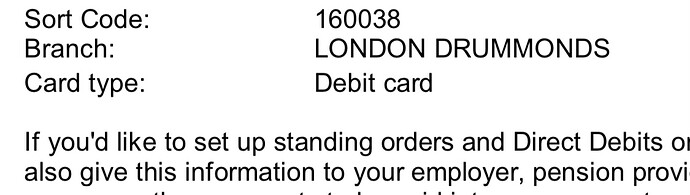

16-00-38. Search SW1 and it appears as '“LONDON DRUMMONDS”, searching for the sort code itself didn’t work for me.

My first Drummonds branded statement arrived and it’s very “bleh”. It’s the standard RBS one with the RBS logo, but they inserted a very, very old Drummonds logo + eagle/bird in some whitespace towards the middle

Much prefer Child & Co branding

Just to add to this: there is actually one “normal” RBS branch in England that is staying! It is in Berwick-upon-Tweed. However, due to being so far north that it’s practically in Scotland, I assume it’s being treated as an honorary Scottish branch. It does have an English sort code (16-12-85) and the same town also has a Bank of Scotland branch - also something not normally seen outside Scotland!

The last Scottish NatWest closure is on the 26th of January, so by this time next week the regional branding divide will be complete. RBS only in Scotland; Ulster Bank only in Northern Ireland; Isle of Man Bank only on the Isle of Man; NatWest (International) only in the Channel Islands and NatWest only in England and Wales - with the sole exceptions, in England, of RBS in Berwick-upon-Tweed, (RBS) Holt’s in Farnborough and (RBS) Drummonds in London. Of course, at Holts and Drummonds the RBS brand is very much de-emphasised so they almost don’t count as RBS branches.

They’ve done what you’ve said in reverse - killed off the speciality NatWest brand in Scotland unless you count Gogarburn itself.

Royal Bank of Scotland predates National Westminster by over 250 years.

Question please (long time lurker), did anyone end up with separate profiles/identities (customer numbers) after opening the two accounts through the form, and would it be worth contacting customer support to merge the two?

I’m a bit torn as it’s obviously inconvenient to manage two separate customer profiles (eg needing two phones for app access) but on the flipside in theory this could mean being able to open another digital saver and/or reward account. I couldn’t find any mention of this being against the T’s & C’s (obviously setting up multiple profiles was their doing not mine - the details are exactly the same on both).

I wouldn’t be at all surprised if the two-profile thing was a clanger dropped at their end. It’s hard to see how RBS would knowingly permit it.

Sounds like a CS call may be the next step. There’s a risk of course……

As part of the application for a Reward account you have to confirm you don’t hold more than the maximum. Same for digital regular saver.

I wouldn’t recommend lying as part of an application.

What you could do is use the CASS service on the new account and see if the new profile qualifies for a bonus payment. Again, that’d be their error, not yours - you’re simply doing a Current Account Switch, not applying for a bonus ![]()

Interesting tidbit fell out of the discussion on MSE (I don’t recommend reading the entire thread, the context is that was in response to one of these people who pop up on there and repeatedly reassert things as fact which are not)

https://forums.moneysavingexpert.com/discussion/comment/79875645/#Comment_79875645

friends of mine have a son who is a newly qualified barrister and he has opened an account with Child & Co as a new customer, arranged through his Inn of Court which has banked with Child & Co for centuries. Child & Co has a long history of providing legal services for Inns of Court, chambers, law firms and individual lawyers and is still actively doing so.

Some assurance then that Child’s is very much an active but slightly underground brand, as it always was (despite a physical branch).

Took me a while, but finally made it through all 36 pages (dipping in and out over the course of the day).

Illuminating thread. Seeing some of the petty quarrelling between folks makes me wonder if I perhaps made a mistake in sharing the link in the first place. That was a rather pointless back and forth that probably wouldn’t have happened if the form wasn’t out there.

As @anon47616136 would say, this is why we can’t have nice things.

They made a fair assumption, even if inaccurate, which the rebuttal linked to doesn’t actually prove.

I don’t think it’s particularly fair of you to refer to someone from another forum by an ad hominem generally, but especially when they’re not a user here who can defend themselves against it. It isn’t nice. Leave that stuff on MSE please.

As for the rest of your post, It’s very interesting information. Thanks for sharing it. Hadn’t occurred to me that existing clients would still be able to refer individuals to open accounts there.

I think it’s a bit of a forgotten concept, but it does still exist! The HSBC no fixed address campaign works on a similar principle. The charity refers and vouches for you. And it’s also how I got my first bank account in the UK. A family member had to come to the branch with me as an existing photo ID verified customer, and refer me, so that I could open a bank account without having my own british ID yet.

It’s a bit old fashioned and will likely eventually disappear for good, but I do miss some of those old fashioned processes compared to the more bureaucratic ones we have now. It felt friendlier.

I’m dubious as to whether Child&Co is actually open to real new clients. There doesn’t seem to exist any sort of public facing interface to sanction it, which would make it more elusive than Coutts, which surprises me.

I think the intent (as far as I can tell from what is public knowledge) is just to continue to serve existing clients, which is what they’re doing by sanctioning an account for the individual referenced by that MSE user.

I was offering context with the intent of offering a shortcut so nobody felt like they had to read most of it (which veers towards rot and misinformation quite a lot of the time).

I’ll editorialise my own contributions with my name by them as I see fit, ta.

Not so sure. But in any case it’s interesting to note that the user’s new account is reportedly just a standard Select account - nothing complicated or bespoke about it. What benefit would there be to any party of going through a referral process to open just a standard RBS account with an old brand on, if that brand is known to be about to sunset? Clearly both the applicant saw merit in having one and the bank sees some merit in operating this referral service…

It’s all a bit mysterious - like so many things about Child & Co.

But hey, we all know how it’ll end up eventually and long may it remain as an oddity in the meantime.

Fair enough, but ad hominems are against the rules here and can sour the experience for the rest of us who have to read it. As I say, it isn’t nice to read, as free as you are to write it. Just some friendly feedback. The choice to take it on board or ignore it is certainly yours.

I imagine this will have just always been the case. I know the brand is used by big accounting firms, and although I don’t see it frequently in the U.K., it’s by no means unheard of, and quite common in the US, for your employer to refer you to their bank branch for a current account. I think it used to be more common here, back when banking with the same bank as your employer made life easier for everyone (as it largely still does in the US). I think that experience just demonstrates that the practice still exists.

I imagine this is partly why the non-private sort code exists in the first place.

I’m only speculating though. Your guess is as good as mine. Don’t have many friends in the accounting field to check with, and certainly not in London where the big firms on their client list reside.

Indeed! It’s part the intrigue though. I don’t think many of us would be half as interested in it if that wasn’t the case.

I mean we’re on a fintech forum, and one of the largest and most active threads is for a traditional bank, and mostly because of this particular brand.

It’s defo a bit of a confusing thread with contradictory things being thrown in but from what I can tell Child is still accessible via the form and Drummonds has recently become more consistently accessible. I applied for the latter, actually don’t mind the look of the card!

Day 0 I got an email confirming I’d applied - when can I expect further correspondence - the next working day?

5 working days I think it was. Someone who’s done it more recently might have a more accurate answer but I think that’s roughly what it was for, or at least what I was quoted.

Some folks have had vastly different experiences with relation to communication. So it’s probably just gonna be a case of wait and they’ll contact you when they contact you, if at all. It’s certainly possible your next communication will be the debit card through the door.

Ok mate - let’s see!

I received an email 2 working days later asking me for proof of ID and an electronic signature. I then received a further email 2 days later saying my account was open and I’d soon receive my debit card.