I’m looking for some recommendations for a general savings account. Appreciate interest isn’t fantastic anywhere at the moment, but it’s got to be better than just sitting in a current account

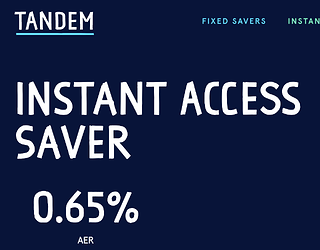

Not a recommendation as I don’t use them, but here is an instant access at 0.65%

Of my choices,

Tesco Bank at 0.50% (inc 0.40% bonus) and multiple linked accounts.

Marcus at 0.50%, incl 0.10% bonus, one linked account, speedy FP transfers

Atom at 0.50%, one linked account, truly instant transfers

When do you need the money? Long term savings? Or do you need instant access?

For long term saving where do don’t mind a little risk you could look at an investment trust like the Scottish American Investment company. They aim for moderate growth and a consistent dividend (currently around 2%)

For just a savings account I suppose it doesn’t make a huge difference. I use Marcus

For just your regular old easy access savings, Marcus and atom are the easy ones to recommend. Atom’s rate is slightly lower (0.35%) for new customers though, but transfers are instant.

Both offer leading rates though, and don’t have any restrictions, limits or drawbacks on withdrawing.

Given the way things are though, my monthly earmarked amount for savings is mostly going into stocks and shares right now though. Namely SMT and PCT on Freetrade for the most part.

Yep, I’d go with Atom now at 0.5%, particularly so now they’ve put so much effort into the app.

Admittedly, there’s little you ever need from a savings app, but this is so much better than it was, with immediate transfers to/from a linked bank account.

Any thoughts on Chip? They seem to be using 1.25% if you bring a friend.

It’s just sat there doing nothing except tempting me at the moment. Instant access is nice, but I don’t mind a bit of a wait

Looks like that rate may be conditional as I’m being offered 0.4% (I had an account two or three years back).

I took a look at Chip last year and it struck me as a bit frictiony (new word) so didn’t go through with it.

Have they? I haven’t used them in months, and just had a look. The UI is slightly less blown up, but it’s still unintuitive and looks like a child’s toy. Not to mention the awful proprietary biometric system

Nothing on their website suggests any conditions @Graham

Clearly states 0.65%

Just fact-checked @N26throwaway quote:

and he is right. New accounts opened since 24-June-21 only attract 0.35%

I literally cannot keep up with Atom’s up down rate changes. Last I saw they had increased it from 0.37% to 0.50% ![]()

Explained here

I use Chip.

You can get 1.25% on up to £2K with their free Lite account.

Alternatively, 1.25% on up to £10K with their AI account. This account costs £1.50 every 28 days. So rate after fee will depend on how much is deposited. If you deposit £10k rate after accounting for fee is approx. 1.05%.

If you don’t want to use the autosave feature you can disable it.

They are quite spammy with their email marketing but you can unsubscribe from marketing emails.

Yes, you need to link a current account with Chip. I was saving the full £10,000 with them until recently when I paid off a car loan. With the £1.50 4-weekly fee that works out at 1.06%.

I waited until the first amount of “interest” was paid and then withdrew everything. The £10,000 was returned to my linked account the same day and the “interest” came in the following day. The interest is actually a marketing bonus, hence the inverted commas.

You’re right, but when I logged in, the offer was 0.4%. ![]()

I’m comparing with what was. Yes, it’s a bit out there, but they’ve speeded it up no end.

I’m no fan-boy. I’m just happy with the current rate.

Oops. In which case, as a new customer I wouldn’t go for Atom then. ![]()

Just shows the significance placed on loyalty customers. What you see is not necessarily what you get ![]()

Perhaps that says something about keeping accounts open, even if they’re left empty?

Taken a further look. It ‘s certainly market leading but there’s reference to an annual fee depending on the plan you choose.

RBS offers 3% for up to £1000 with a max deposit of £50/PCM. I know it’s very restricted, but it’s a good option to save for something you plan to buy or for birthdays etc…

You’re right, these are eye-catching rates (though the restrictions do dampen it rather) but they are risk free and importantly, get folk into the saving habit.

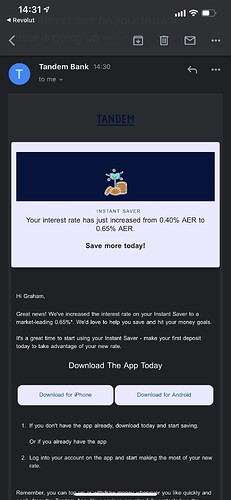

So…… Tandem-wise. Seems I already had an account open I hadn’t used. So as soon as I got playing, it just gave triggered the email with the higher rate.

I’ve now funded it. Expected instant balance update, but an hour later still no show.

(If this becomes a thing or it gets interesting, I can split off to a Tandem thread).