I’m tempted to open a NatWest account on top of my RBS one to benefit from the extra interest, especially now that it’s easier to get there

You might as well - you are allowed both and I have had both since the start.

Sadly there isn’t an Ulster Bank version, or everybody could have had three!

But that’s an extra current account, and an extra hard search… does the SO need to come from the NatWest account, or can I set one up from my RBS account?

Yes it does, and it is an extra hard search.

RBS and NatWest do a hard search every time you apply for a current account, even as an existing customer.

Oh, what fun. But it’s £30 for no effort… Hm. I’ll think about it

Unless they change their variable rate over the year, but, in principle, I agree.

I have increased my payments to the £150 as well, until I reach the £1,000 tier level.

The newly introduced additional tier between £1k and £5k at 0.25% is hardly appealing though.

With base rates rising from 0.50% to 0.75% who will be the first provider to make the bold move and increase savings rates.

Bet the lenders won’t delay for long!

The big banks don’t need the money though - hence, they won’t be in a rush to raise rates.

I knew it!

Glad I’m mortgage free.

Santander responding to Chase but I still find Chase offering much better as it has no monthly caps

I would agree - the hoops and caveats around Santander’s offering make it quite restrictive.

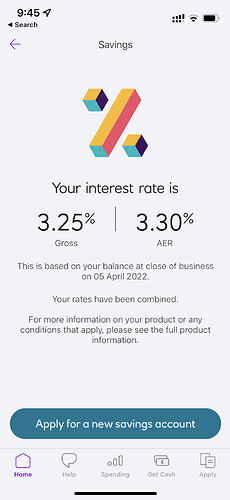

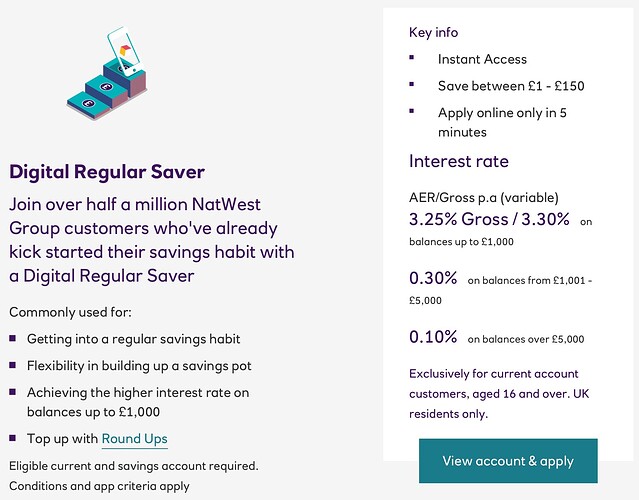

I’ve just opened a regular saver with Nat West that gives 3.3% on the first £1000 (at up to £150 per month). I’m funding that via a standing order from my Chase savings account until the grand is in there.

That will take you roughly 7 months. Will the rate carry on after one year so that you get a full year of £1k in?

The headline 3.3% rate is based on a balance up to £1,000. This account doesn’t “mature” at the end of a given period. The interest rate is tiered based on your balance. The restriction is that you cannot increase your balance by more than £150 per month.

Indeed, so you can leave money in there as long as you want but if/when you take it out you can only increase the balance by the £150 limit per month again.

I quite like Santander’s regular saver. It has the flexibility of allowing you to withdraw at any time without entirely closing the account. In contrast some regular savers require closure of the entire account even if you only want to access a small amount - in particular regular savers from HSBC group banks (when they run them).

Nationwide’s Regular Saver also offers the same interest rate and maximum monthly pay-in as Santander, along with limited options to withdraw from the account 3x during the term if you need to in an emergency without having to close it.

This is open to a wider number of people as you just need to have a Nationwide current account to qualify - whereas with Santander you technically have to be a 123 World customer (although the system seems to have allowed to some people to open an account without being one).

HSBC and First Direct are still offering their regular savers, by the way, just at the paltry interest rate of 1%.

Worth noting you can hold a Digital Saver with both Natwest and RBS.

Revolut has increased rates for vaults, but seems only to be for new vaults…

That’s one thing that’s a credit to Atom and Tandem.

When they raise their savings rates, they raise them for new and existing customers at the same time. There is none of this classic messing around of “opening a new issue” of a savings account to benefit from a higher rate.

Marcus is also better than most, with their bonus system making it easy to renew the bonus, but it would be even better if that could be automatic.