That’s exactly what the Government want you to do ![]()

Makes my fixed term savers look poor and irrelevant in the process though.

Four, so far, are now lower than EA rates.

![]()

![]()

I’ve always steered clear of fixed rates - not through any grand design. I’ll not likely change that stance. Just grab what’s going while the volatility’s there.

Same plan with cash ISAs.

Same here, I’ve rarely touched fixed rate savings almost always opting for variable rate EA. Last time I had a fixed rate saver was 2009/10 with Santander when I made £1k interest over 12 months.

I have a fixed rate at 5% for 6 months which will mature just before Xmas. I won’t go longer than 6 months, though.

Schroders are predicting two .5% rises then two .25% rises, getting us to 6.5% by the end of the year.

On a personal level it’s great news but it is going to mightily suck for people coming off 2/3 year fixes from that post-covid glut of mortgage sales.

We have credit cards with fat limits mate, no interest for 27 months. ![]()

And there are plenty out there who are maxed out and only making the minimum payment ![]()

Just in, interest rates now at 5.25%

In earlier news, someone here indicated which providers are normally first out of the traps after a rate rise.

![]()

Other providers are similarly responding.

(My cash ISA has now moved (in-house). Let’s see how the market plays out……

Monzo Savings account up to 4.00%

Among the retail banks, Monzo are the fastest. Since they launched, they’ve increased the rate within an hour of the BoE announcement every time.

Today they upped it from 3.7% to 4% at 1pm.

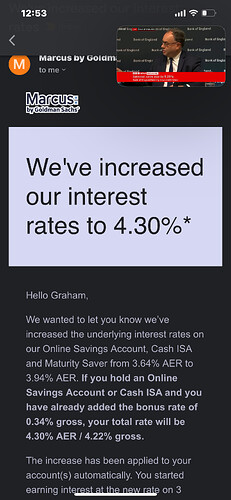

Marcus were shortly after that, but that’s an anomaly. They’re usually very slow, if they bother to move at all.

Chase are fairly quick to announce, but slow to implement. On the flip side being as a result of the terms of all these banks, they’ll be the slowest to put the rates back down when they start to fall too.

@gt94sss2 seems to have their finger on the pulse when it comes to the smaller savings providers most folks haven’t heard of.

Chase also going from 3.8% AER (3.74% gross) variable to 4.1% AER (4.02% gross) variable, effective from 14 August 2023

Zopa raised EA to 4.28%, up to 4.52% for 95 day notice.

Why would you put any money in a 95 day notice at that rate when you can get more than that for easy access elsewhere? ![]()

Pointless ![]()

Weren’t you the one involved in boiler room scams that made the BBC? Might be getting that wrong though I’ll admit, massive asterisk

On a personal level, I wouldn’t want to lock any of my cash away for a year, especially the rate at which the BoE are raising rates.

Could be a great investment over a few years if this proves to be a temporary phenomenon. Worth the risk with a proportion of the cash you don’t need imo

Make it stop!