10.38% AER

That’s… shockingly good.

Holding firm for a decent switch incentive still…

Chip have reduced their variable cash ISA to 4.84% AER overnight. There was no email warning or notification but I’m pretty sure that it’s in the T&Cs that it automatically tracks the BoE rate (rather than them making a decision after each BoE change).

Tandem easy access is also dropping but I did get an email about that.

Secured yesterday.

Now to work out how to find it each month ![]()

![]()

Interest rates falling in some of my other accounts, so strategy rethink required prior to Sep 1 funding date.

If you hold a Cahoot Sunny Day Saver (Issue 1), you may wish to check your e-documents.

Spoiler: The rate is reducing on 18 November 2024

Issue 2 is currently available at 5.00% AER, * variable rate interest for 1 year on balances between £1 and £3,000.

- No interest paid on balances over £3,000.

Cahoot seems to have a problem with our address - any attempt I make gets instant rejected; same for my wife.

Just setting up an ISA transfer to Moneybox. It transpires they have a relatively unshabby easy access saver as well.

Atom are bettering that at the moment but I’ll keep an eye on it.

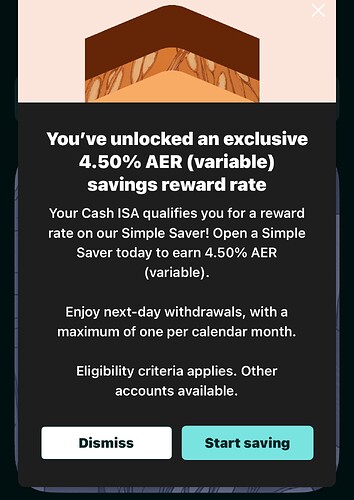

Yeah, I have that. It is basically a 1% bonus for having an ISA.

Standard rate 3.5%

Major restriction though is the one withdrawal pcm, so my balance in it is £0

LightYear cash ISA is also 4.5% - and its a flexible ISA

I’ve moved everything over to LightYear - Cash ISA & S&S ISA - so far has been a very good experience. Though the S&S ISA doesn’t currently have all the ETFs & Shares I would like - but it is growing.

PS - if anyone wants an intro code that gets the £20 on joining just let me know !

Moneybox Cash ISA decreasing from 4.00% base to 3.75% AER wef 03/03/2025

Any bonus you may have still to be added on to these until expiry.

Will make mine 4.66% AER

Gatehouse Bank Easy Access account

Annual EPR: 4.75% to 4.35% wef 19/03/2025

Monthly EPR reduces to 4.27%

Coventry BS Sunny Saver RS

Down from 6.25% var to 6% var wef 03/03/25

Sorry, Yazz, the only way is DOWN atm!

I’m in the process of switching my cash ISA to Moneybox. With the bonus, I’ll be getting 4.77% in March.

Bulk of mine is with Trading212, however, small amount with Moneybox, but I will be moving that to a NLA Virgin Flexi Cash ISA in May, if the rate on that NLA stays competitive. Currently , 4.56% AER

Lots to move out of tax-bearing interest savings accounts come April 6th. Not quite the maximum ISA allowance though. Spending a lot at the moment, living life. Money is no good just sat in cash accounts. It’s there to improve your life, so I am doing just that ![]()

THUD!!!

Trading212

Due to the Bank of England’s recent interest rate cut, as of 01.03.2025 Trading 212’s GBP interest rate changes as follows:

- Trading 212 Cash ISA: 4.5% variable

- Trading 212 Stocks ISA: 4.6% variable

- Trading 212 Invest: 4.6% variable

- Trading 212 CFD: 4.6% variable

Still competitive as everyone has lowered the rates.

I am not eligible for the new customer bonus at Moneybox (or Chip or Plum or pretty much anywhere that isn’t brand new) and will be sticking with T212.

I’m straddling T212 & Moneybox with my cash ISAs. Think I’ll leave both accounts sitting for a while.

Yh, same, Graham.

I will review everything come 6 April. For now, just leave be.

Tembo Cash ISA looking good now at 4.55%.

Doesn’t help with tax-free savings, but for taxable saving regular savers have really never looked so good. I finally put it all in a spreadsheet to help my wife understand where all our money is, I was pleasantly surprised to find our money across all these regular savers is earning a blended 6.41%. Obviously that’ll come down over time as a good amount of these are variable rate accounts but there’s still a dozen or so fixed rate accounts at 5.5% or more.

So all that remains is for you to list those healthy providers for each of us to see (purely out of interest, naturally).