I think that I’d lose the will to live waiting for replies to my snail mails…

How does 3.82% sound ![]()

That’ll do for now ![]()

Are you an existing member of Skipton Building Society?

Regular Saver launched today at 7.5% gross/AER, max £250 pcm, maximum £3,000

No withdrawals, other than on closure.

Details:

Saffron Buildning Society Member?

9%, but at £50pm

https://www.saffronbs.co.uk/savings/regular-savings-accounts/members-month-loyalty-saver/

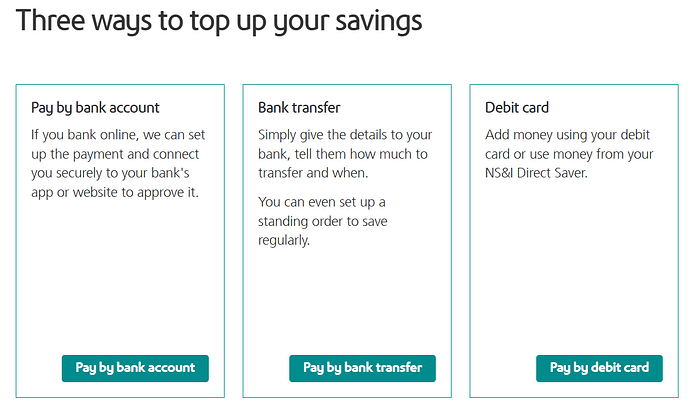

nsandi now support making transfers via open banking if anyone cares ![]()

Thankyou.

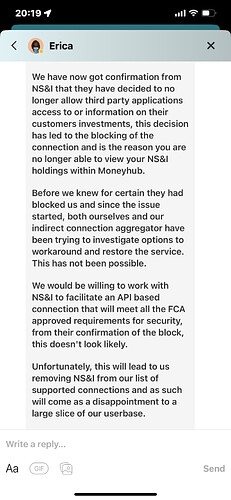

That’s interesting as Moneyhub have explained only this week (to me) that they can’t offer visibility of Premium Bond holdings as NS&I are pulling the plug on 3rd party access.

Not sure if that’s contrary to what you’ve learnt.

Anyway. Here’s an excerpt of their chat with me….

Deposits via open banking integrations with other banks, not open banking access to NS&I.

It’s done via a third party called ‘ecospend’.

It looks like NS&I support at least some facets of Open Banking (to allow customers to make deposits) but have blocked whatever method Moneyhub were using to access account information (which wasn’t the Open Banking API, according to the chat).

Yes, that makes sense. It’s no big deal - it’s a static figure anyway, so I’ve simply added it as an asset.

Chip instant access account now at 4% AER.

Tandem Instant Access now at 4.10% (with top up rate)

Kroo rising to 4.10% wef 1st July

Atom at 3.95%

Zopa 3.92% instant, through to 4.16% for 95 day notice.

Showing in my app, and mentioned on other forums.

Well I’m not sure if anyone still has one, but I opened a Santander savings account a few months back and it’s still only giving 3.2%. I moved everything out of it ages ago, well there’s less than a fiver in it. I’m slightly surprised that Santander doesn’t want to stay competitive. To be honest, I may as well close it.

That’s the one that drops dramatically after 12 months, so I agree. Mine has £3 in it atm

Skipton have increased their rates.

My Tracker 3 will be 4.10% on 3 July, but my money is already in an account at that rate so no incentive to move it.

Not all rates increase by the full 0.50%

Many are 0.15% or 0.30%

https://www.skipton.co.uk/-/media/skipton-co-uk/pdf/savings/changes-to-variable-accounts.ashx

Trouble is, I’m now only interested in ISA rates. ![]()

Yeah, they’re currently not so attractive, are they?

Nope - like pulling teeth.