I read on Twitter that there’s a scam currently doing the rounds specifically regarding Starling. I’d guess that’s why they’ve added a prominent message. I agree though, it should be dismissible.

Pay Direct Debit from spaces now available

Has been for nearly a fortnight and discussed above and on another thread.

I dont check the app that much because starling is still trash

Elaborate on why?

They should just make it salary rather than a monthly one, tbh

Yeah I noticed another issue with this page that stopped me completing it as well.

I like that they’re setup up pretty resiliently but it seems like they push feature sometimes without checking

Starling are updating their T&Cs today.

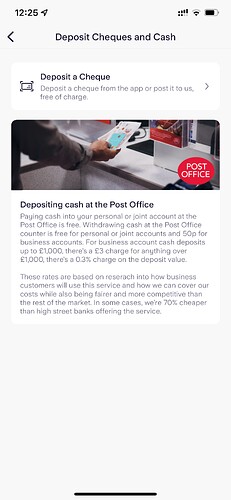

The main change is that personal customers will only be able to deposit up to £1,000 per year at the Post Office for free, and after that there will be a 0.7% fee.

Fees for businesses are also increasing from 0.5% to 0.7% too.

I have this screen in app now and doesn’t mention fees for personal customers just business

also on another note just had a screen popup asking what I earn and where from!

The change isn’t effective yet, so isn’t on that page in the app.

It is detailed in their new T&Cs document.

Looking at Starling’s T&C, I’m surprised they are quite badly laid out over several different documents. It’s quite confusing.

Yes you are correct just looked through the T&Cs and see it now has a section valid from 3rd March 2022

As much as I don’t believe that it’s an issue that they’re charging for cash deposits, I don’t think it’s a good precedent. Might be worth filing some objections?

To be clear, it’s only a charge (for personal customers) if they deposit over £1,000 a year.

So the odd small deposit here and there wouldn’t take you into chargeable territory, and I imagine this charge is designed to make excessive users - who must cost a lot more than average users - pay for at least some of the cost of the service they are using.

The Post Office probably charge Starling a percentage fee + a small per transaction charge to process the deposits, so that would add up for people using it all the time.

The Post Office have also been aggressively renegotiating their service contracts with banks to get more money out of them, so I wouldn’t be surprised if these changes are driven by that rather than Starling being greedy. The Post Office will say, of course, that it helps pay for a better service - but I doubt it does!

So any cash workers are now locked out of Starling, tbh

That’s just the cost of doing business for a bank, who’s entire business is in money

I disagree, frankly.

In the 1960s, a bank’s entire business was virtually in (physical) money. That’s no longer the case.

Being paid in cash is very rare in the modern world, and as such those people would fall into Starling’s assessment of heavy users. That’s perfectly fair.

If you really wanted to pay in cash at the Post Office regularly, you could still do it (unlike with Monzo’s hard limit on PayPoint deposits) but it will cost you.

To avoid that fee, there are plenty of other banks that will accept virtually unlimited cash pay-ins to the Post Office for free. It’s your choice whether to pay Starling’s fees or use another bank and transfer the money over (it’s not like they are egregiously punitive fees either, it seems like pretty much cost pricing being passed on). Or to insist on not being paid in cash (which is pretty unreasonable for an employer in this day and age).

Do you spend your whole life objecting to things you don’t feel are an issue?

It’s actually not very fair that you’d have to pay money to deposit your cash into the bank, since companies charge you for paying by other means than Direct Debit these days. Banks are aware of this.

Also, “heavy users” would to me, mean someone using it as a business or really excessive input of cash into a bank account, not someone paying a mediocre salary in. 1000 a year isn’t even a part-time cash in hand job.

We actually mocked Monzo very heavily when users on their forum suggested using a second account to pay cash over.

Does it not sound stupid to you that a bank doesn’t have a (free) way to deposit cash in without a workaround that involves another bank?

Britain is a country where people scoff at an ATM fee, people do not like and will by large not use anything that charges them to access/deposit money.

I’d also like to mention Starling make 0.25% on bank deposits from today, and did make 0.10% on bank deposits for many months. They also make interchange. They actually make money when we use our money, they also make money to hold our money. They don’t need to “break even” on deposits. Their entire business is taking deposits. Ice cream men don’t charge the people giving them ice cream !

Employers are within their right to only pay in ways they want to pay.