Finally have it available

I’m still waiting. Quite frustrating that they hold off rolling it out despite all the advertising on social media.

Yes it is I did say on Twitter why announce it if it isn’t available to all customers

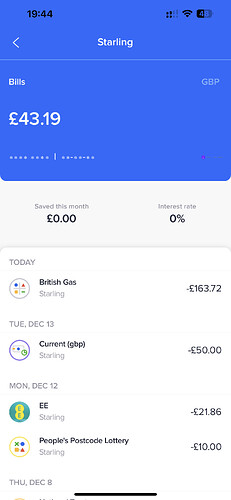

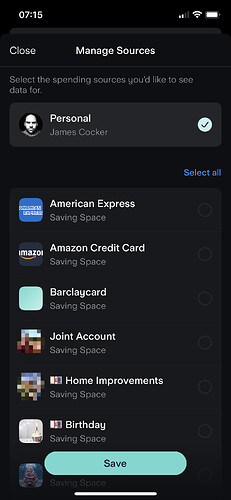

Not on joint accounts from what I can see

It’s just personal accounts for now. Hopefully they’ll roll it out to joint accounts and business accounts in the best future though.

Unfortunately, linking virtual cards to spaces makes this another useless feature for me (along with the ability to link a DD to a Space), as Starling doesn’t include space transactions in Spending or expose them via the API - you just get the Space balance. I still can’t get my head around why they’ve taken that approach.

Could it be a limitation of the API? It’s the same with Monzo - pots don’t expose transactions via Open Banking.

Just seen this on LinkedIn

Britain’s Best Current Account.

3.25% interest on your savings.Introducing our new 1-Year Fixed Saver!

Now available in the online bank and rolling out in your app from today > app.starlingbank.com

Very poor offering from Starling there

A cautious first step, methinks. ![]()

It doesn’t even pass the “convenience of keeping it all together” argument because you don’t touch it for a year once you’ve transferred the cash!

It’s how the API has been designed, not a necessary limitation per se. The fact that there’s the same problem in the app makes me think it’s poor design

It wouldn’t when I tried it! It showed Space balance but no transactions.

I had a bit of a disappointing interaction with Starling on Twitter earlier about the new fixed term saver. When I asked if there were any plans to offer a wider range of savings products, I got this response:

Hi Dan, thank you so much for the feedback, we do appreciate it. However, after extensive customer research we found that this rate at this term in this way suited the majority of our customers needs for a savings account.

“Extensive customer research”? “Majority of our customers”? Doesn’t sound right to me.

Here’s the conversation:

https://twitter.com/danmullen/status/1603411023645462528?s=20&t=0XpecL5noxszFN5wIx3Quw

Just seen this elsewhere…

Requirements are you gotta have a minimum of £2,000 and you can’t add or withdraw from it once it’s opened and deposited.

Is that right? £2k minimum? ![]() Not seen that mentioned anywhere, but maybe I’m just missing it.

Not seen that mentioned anywhere, but maybe I’m just missing it.

Personally, would have thought easy access with a low, or no minimum, would have been better, especially at the moment? But then… I’ve not done extensive research, so I wouldn’t know

And if I actually opened my eyes, I’d notice that yes, there is indeed a £2,000 minimum…

Lock from £2,000 up to £1,000,000 into a 1-Year Fixed Saver, and we’ll reward you with a guaranteed return of 3.25%. A Fixed Saver is similar to a regular Saving Space, but you won’t be able to access your money for one year.

I’d have expected something rather less strangulated from Starling, particularly as they’ve had so much time in which to define the product.

@Dan’s challenge around the focus group approached is pertinent. Some friends over wine & nibbles, perhaps? ![]()

Seriously though, it’s underwhelming.

Starling just a has a more wealthy clientele. £2000 is nothing to us ![]()