Been with Starling since before the banks stopped saying bye, probably

I just did the same, and feel exactly how you do ![]()

My switch completes on Wednesday (09/08/2023), but I actually do like the TSB app even though it doesn’t have as much functionality (yet?). The sign-up process (I did it via the app), was actually pleasant.

Thinking of staying with TSB for the foreseeable future to keep my credit score profile stable.

Hi, and a very warm welcome ![]()

Besides the cash incentive for dropping Starling, I had an ulterior motive for joing TSB again. So far, all as expected. I genuinely like the App better than Starling’s odd as that may be to some.

Not that branch banking is in any way important to me personally, but if by some rare chance I do need to visit a TSB, my nearest one is 20 miles away.

Anyway, I definitely don’t miss Starling as I hadn’t bothered with the account as I said previously, for over 12 months, and keeping it there as a dormant account was in my view, pointless.

4 posts were merged into an existing topic: General TSB Thread

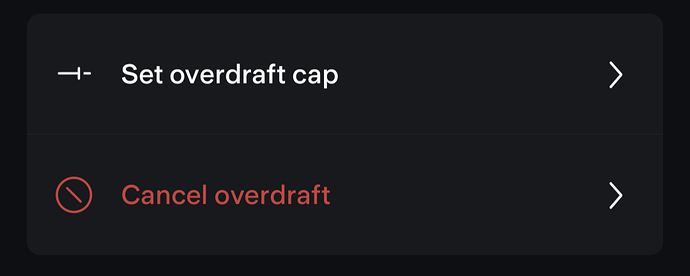

The overdraft section of Starling has been revamped. You can now set an overdraft cap which I think is just a rewording of how it was before or cancel your overdraft.

No - your overdraft limit stays the same but you can now set a lower cap within your limit if you like. You should have received in-app customer services messages explaining it all.

I can’t see it mentioned anywhere. I just noticed it myself ![]()

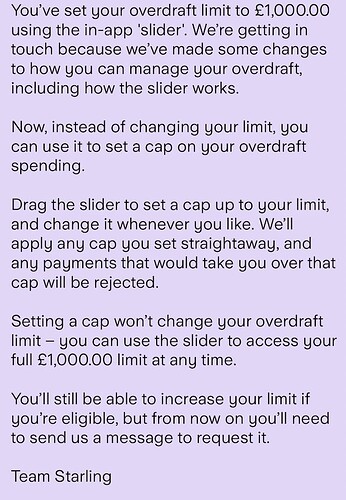

That’s odd - I’ve had this message twice over the past couple of weeks in my in-app chat, along with a push notification each time:

Have you actually used the slider before because I never have so maybe that’s why I didn’t get it ![]()

I can’t remember the last time I got any sort of message or email from Starling. Sometimes I see in app notifications but that’s it.

Ah yes - once. I originally set it to £1000 because they kept pestering me that I was eligible for £2500 and I didn’t want or need that much. When I stopped using Starling for many months I reset it to zero.

Last year I started using Starling as my main bank again (for a short while in the end) so used the slider to set it back to £1000. I thought they might do another hard search because I thought that I’d cancelled it completely by setting the slider to zero but they didn’t.

Yes, so it’s probably because I’ve used the slider (albeit once) in the last 12 months.

They should definitely send that message to everyone with an overdraft as it’s a good feature and I imagine others would use it if they knew about it.

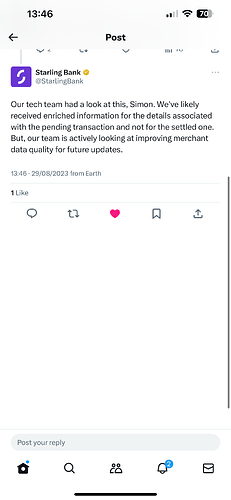

I haven’t had the message yet. Tell you what though, I contacted them recently about changing my overdraft limit. They approved it, and I’ve since noticed that the ridiculous 35% interest rate has dropped to 15%. I remember discussing it when they announced the new 15%/25%/35% bands. I contacted them back then as I was surprised to be given such a high rate as my credit rating was about as good as it’ll ever be. Didn’t really get a straight answer, but I suspect it was some sort of error.

I always have enough in Spaces to cover any overdraft usage anyway, so I don’t get charged, but I’m still pleased they’ve dropped my rate to a sensible amount.

Supposedly they review the rate but mine has never changed since I’ve been with them. It would be interesting to know if anyone’s has ever been changed ![]()

Not ridiculous at all, in fact pretty reasonable as these things go - almost all competitors are at 39-40%.

Your “credit rating” is irrelevant to Starling. They’ll have an idea of the sort of customers they want to give each band (and no overdraft) to. This is a flexible concept which can change, as can what they know of you/your credit record.

It’s pretty ridiculous since they can borrow the money for less than 25% of that cost. Granted I know some debt will turn bad but >75% profit margin is a bit HMMM

At least Starling’s pretends to be reasonable by having a rate that’s only like 10% above that amount(ish)

Find a player charging less. It’s also a smidge of an oversimplification to just look at the headline cost of interbank borrowing and compare that directly on the price of facility designed to be used for single-digit days when needed.

It’s an oligopoly.

‘Consumer champion’ Nationwide came out with the 39.9% APR on their overdrafts and the main banks coalesced around that awful rate.

Starling and Virgin Money can provide overdrafts at circa 20% plus credit card providers can do that ballpark whilst funding an interest free period, S75 costs and even points/cashback.

Yeah but they know it doesn’t get used like that which is why they used to have millions of daily charges and is the entire reason why the regulator changed to a flat % rate. Because people were getting fucked on it.

… right, so it’s a good thing that the fees are both transparent and clearly punitive then, right?

Far worse would be to charge them at an ‘affordable low’ rate in the teens and thereby encourage people to use them.