I wasn’t aware you’d started a switch ![]()

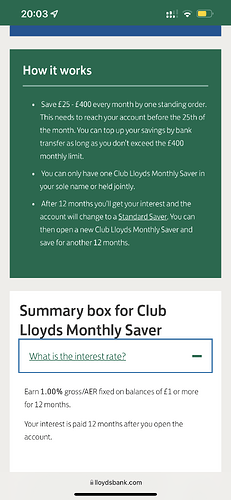

Cllub Lloyds monthly saver gives me 1% capped at £400 pm, and the Lloyds monthly saver at 0.75% capped at 250pm

Very late decision. Some of this forum chatter recently prompted me to do what I haven’t done in ages. Process a switch for £140 or so.

I was ready for a clear out anyway….![]()

Sadly my £400 saver ran its course…

I open a new one each year from 2019. You can have one every 12 months

Aha. I must check what’s available over and above my £250 account.

Edit: and there it is - £400 account @ 1%

Thanks.

Done - account open ![]()

In 2019, I tried to cover all my non-mortgage bills from banking freebies, referrals and matched betting. It took considerable effort at times, but it was doable. Lacking the financial incentive though, I just stick to the low-hanging fruit these days - bank switching incentives, basically. The odd odds boost on an accumulator. Referrals used to tick over nicely, but the Bulb/Octopus carousel died with the gas crisis…

Even at my worst moments though, the hourly rate was still well above minimum wage, so it really does depend on your circumstances…

I explained upthread, in a bit more detail…

- Top up Club Lloyds with pay/easy access savings/whatever so you have £3000 in there (satisfying the £1500 pay in requirement)

- Move £3000 in to Halifax reward 1

- Move all but £500 from there in to Halifax reward 2

- Move all but £500 from there in to Halifax reward 3

- Move all but £500 from there in to RBS (thus satisfying the £1500 pay in requirement on all 3 accounts, leaving 3 accounts with £500 in)

- Move all but the amount needed to cover your 2 DDs in there to Natwest (thus satisfying the £1250 pay in, online login and 2 DD requirement - make sure they’re both at least £2)

- Move all but the amount needed to cover your 2 DDs in there to Santander 1-2-3 Lite (thus satisfying the £1250 pay in, online login and 2 DD requirement - make sure they’re both at least £2)

- Leave enough in Santander 1-2-3 Lite to cover your mobile, broadband, energy, water and council tax direct debits - transfer the rest to Club Lloyds or onwards depending on your saving strategy.

- Pay off credit cards in £500 chunks using Halifax debit cards - if less than £1500, make appropriate payments to NS&I or wherever you like to make up to £500.

Et voila, there’s somewhere between £250 and £300 a year depending how high the bills you’re paying through Santander 1-2-3 Lite are. Even if you exclude that from the mix, it’s £21/month or £252/year.

Typing this has honestly taken way longer than this process will actually take me on Tuesday week.

EDIT: you can part way automate it all with standing orders shifting between accounts too, although you need to pace it out over several days that way (and remember to log in to NatWest/RBS once a month). I prefer to do it all in one shot with a cup of tea.

That’s your water bill taken care of! ![]()

Well today is supposed to be switch day from RBS to FD. As yet, nothing has happened, there’s an awful lot of cash just sat there in my RBS account and my wages went in at midnight too. Best FD and RBS pull their fingers out.

I’d be happy to help with that …

Lol! I’m sure you would, but to be fair with energy prices probably going to top out at between £3/4k annually for most people in the coming 24 months, along with massive rises in Council Tax aka the second mortgage, rises in food costs and petrol/diesel likely to hit £1.80 a litre within 6 months, I suspect it won’t take long for it to disappear ![]()

When I switched from Nat West to HSBC, the balance wasn’t transferred until late afternoon.

The 7 day guarantee is a slight misnomer. I think many people assume you wake up on day 7 and it’s happened overnight, but the switch is actually finalised at the end of day 7 (so overnight into day 8). The balance moves last, then the old account is closed.

And it’s done! Switched in the last half hour, RBS empty and FD now very healthy.

There you go - I did say overnight into day 8!

My RBS account didn’t shut till after 8pm when I switched the other day

I still have both ![]()

![]()