Finally worked after about 10 continuous “try agains”!

That’s as far as I have got too.

All good now. You?

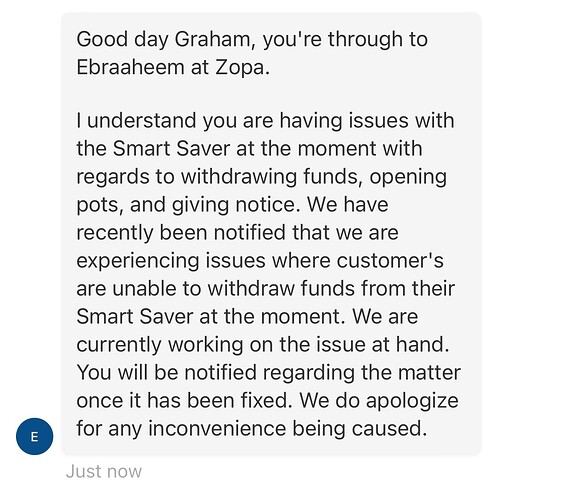

Looks like Zopa have picked up on the “tell the account holders what’s happening” idea.

Very wise.

Well, perhaps start by increasing your current rates, Zopa! ![]()

They have - on their credit cards and loans ![]()

I’ve set up their Borrowing Power thing, just out of interest. I’ve no intention of taking out a loan or credit card with them, but I noticed yesterday that my Borrowing Power had updated and the interest rates were slightly lower.

Well, my Zopa Smart Saver is bleeding money . . . . into higher rate easy access accounts elsewhere.

Lost patience.

3 posts were merged into an existing topic: Savings accounts recommendations

Zopa just increased their rates.

Easy Access: 2.15%

7 Day Notice: 2.20%

31 Day Notice: 2.35%

95 Day Notice: 2.55%

Nice

Will probably render me cba to move for a while

I have a 95 day mature on 1 November, so likely that will move to my EA Santander instead.

Exactly - I’ve got some in a similar pot to liberated later this month.

Happy leaving the notice ones for now - given they’re at a better rate.

My 31-day and 95-day Zopa pots mature this weekend, just in time for transfer to Santander ![]()

Zopa instant access now 2.4pc

What’s everyone’s experience with Zopa? Was thinking of giving them a try.