Most cashback I get is from the rewards section. Things like 3.5% at Argos, now there’s 3% at Sainsbury’s petro, 5% at LNER (you can book any national rail ticket here), etc

What of the almost useless LoungeKey access with no free entitlements. The Lloyds credit card that comes at same fee gives you unlimited visits, and discount for your guest. Though the cashback with them is not generous but can be gotten from almost everywhere.

Back then I did, when GBiT was still a thing for me. At the moment, it is Chase and another credit card.

And for me too. Still think it’s awfully clever. Have to admit though I used GBIT often more for the novelty value than for genuine transactional importance.

Sod’s Law applying, of course I went metal just a few months before COVID and what was a quite regular lot of flights dropped to zero ![]()

Never had that one.

Probably have a look there again. I have the same offer in Lloyds and Halifax now. With Curve it appeared on Thursday.

Could they also be targeted? I do much of my shopping and Petrol at Sainsbury’s.

I do most of my food shopping at Sainsbury’s on Curve!

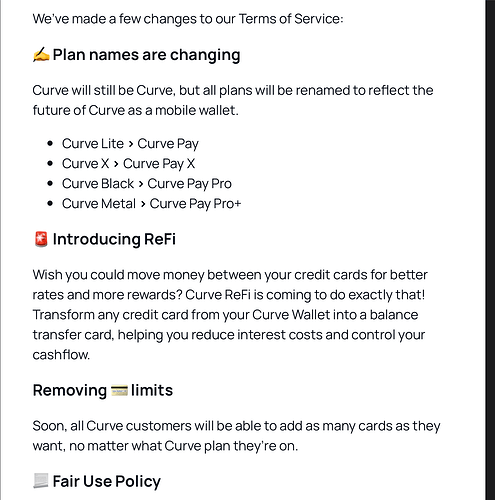

It looks like things didn’t go well with Curve capping number of cards to be added on different tiers.

Wonder what they’re going to add to X when they drop the card limits, as there doesn’t seem to be much difference between free and X with unlimited cards on both?

Fee list here. Looks like you can only spend £250 per month on the free tier, and the ATM costs for the latter are, er, aspirational

The £250 is the limit on free for overseas use. In reality, I always changed the underlying card currency to euro or whatever to avoid their weekend charges i.e. no limit really (so long as the underlying card doesn’t charge you obviously).

The table states

Currency Conversion Fee (AKA “Killer FX”): The Killer FX feature enables you to pay for goods and services in a currency different from the currency of your payment source and remove hidden foreign exchange transaction fees your card issuer would otherwise charge you (we call this type of transaction an “FX Transaction”). Any fee we charge will be in addition to the exchange rate we use to convert the currency you used to pay for the goods and services to the currency your payment source is in. We’ll use the latest available exchange rate from Mastercard (also known as the “Mastercard Wholesale Rate”).

Fee-free currency conversion up to £250 per calendar month.

Which seems to imply that only the first £250 spend is free, after which a fee applies (Then, 2.99% in addition to the Mastercard Wholesale Rate). This did not used to be the case

Of course, as you say, you can get round this using a Euro denominated card as the underlying card (or a card that doesn’t surcharge for euros)

You’d just use the card tho, surely? I struggle to see what value Curve is adding at that point.

I found it handy to keep all the spending in one place rather than spread amongst various cards. That said, having dropped down from metal to free, I’ve been using the underlying cards directly when overseas.

I would, but people who don’t want to carry around a wedge full of cards may not. Or there may be no physical card at all.

Honestly, I find it a little odd that Curve doesn’t have a “passthrough” mode for using cards that don’t have underlying FX fees. Guessing they’re okay with making some pennies from catching people out

After seeing a post on Reddit, I went to check on my Curve card limits.

The jokers have given me a limit of £120 annually.

I am on the free tier from June 2024, and last used their card November 2024 after running into issues they are not bothered to sort.

Are they getting rid of the free tier?

I think that’s a daily limit.

Good question. I hope not.

To be honest, my use for them extends only to the GBIT facility, despite them pushing various other options in my direction from time to time.

Sorry I cropped the image poorly. The limits are £120 for daily, weekly, and annual. ATM £0, not bothered with that.