I get that at times when the initial charge fails then they immediately charge again.

Only one transaction will clear and the other will be refunded or it will just disappear altogether.

It’s sorted itself out this morning.

Barclaycard app shows two debits and one credit, so correct amount added to what I owe on next statement ![]()

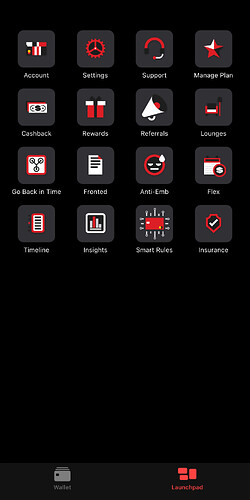

My Curve app has updated to their 2.0 version.

I am still wondering why they had to leave all that space.

Just like many said, the design is awful.

I have had that layout for a while now.

Are you iOS?

Android user here and I think the app must have auto updated as I was trying to avoid the update. I found the old UI quite easy to navigate, the new one much less so.

I am planning on downgrading from Metal to free soon anyway and will probably not use it again so no great issue.

Yes I am on iOS. I think they have been rolling it slowly to users. I have been seeing the notes over several updates.

Biggish news about Curve benefits. They’re discontinuing embedded insurance (‘cos banks do it anyway) and doubling the cashback offering.

That’s a winner for me.

I had come here for this. I didn’t need the insurance honestly since it doesn’t cover my entire family. But paying £150+ for just cashback just doesn’t cut it.

What’s the £150 for?

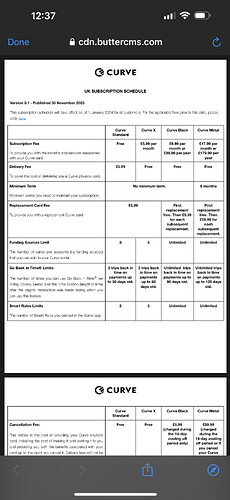

Isn’t metal subscription about that price?

My bad it is now £17.99 a month. That’s £215 a year.

Ah, I thought it might be that. It’s more than that (photo below ![]() ), but why would you have the metal card. I’ve got Black.

), but why would you have the metal card. I’ve got Black.

Using the Curve card just for cashback isn’t necessarily the best option. I use it for GBIT too and find that useful - shifting transactions across cards after the event.

I’ll be going from 3 merchants to 6. It works for me on that basis.

Curve fronted, the last three years have been good to me because of this. I pushed through thousands earning cash back along the way but this is not the case anymore. The limits are now even so low to bother with.

Same here.

I will move to Black on my next renewal in June.

Sounds like a great plan. ![]()

It’s £180 from the next renewal. If they’re dropping the insurance from metal, I’ll be dropping down to free and getting the Nationwide I think.

The insurance saved me over £500 this year, the World Elite about £1000 on car hire.

Definitely don’t see paying upfront for discounts that you might or might not get as being a viable proposition. As for the extra retailers, well I get six already but most other things are Amex for much the same discount. In reality, unless you can change the retailers, three or four covers most of my Curve spending.

I always have issues with these retailers that you can not change until next renewal.

My spending habits are dynamic and that has a great impact on where I spend. Currently there is a retailer I haven’t shopped at in the last 6 months but they are on my list, even do not hope to do so later.

What they really need to do is to retrospectively choose the best retailers for you.

Since that’s not the case, I’m finding that more and more I’m using Amex to get almost 1%.

One thing that’s clear is that my seeing the cashback as making everything else free will no longer be the case. So the cashback will still pay the annual fee but I’ll basically just be paying the fee to get the cashback.

I think that I’ll likely drop down to free at renewal to keep Gbit. That said I’ll need to get another World Elite or Visa Infinite to keep the car hire savings (£1000 last summer).

Asked when I can downgrade free. Reply back that they’ve passed it on to a specialist team who ‘may take some time to reply as they are very busy’.

Sounds like I’m not the only person who has quietly been using the insurance but never needed to claim so didn’t turn up on their stats (same thing with the free Nationwide insurance which ‘few people used’). And who will therefore be downgrading to free as soon after December as they can do for no charge.

I’m glad they’ve dropped the insurance as I do have this elsewhere - I do miss using GBIT - I will look into whether it offers VFM.

I do wonder though, without the insurance, what are black users paying for?

I have benefited from Nationwide offering on a number of occasions including when a workmate’s car that I was in a passenger broke down and their insurer who uses Green flag could not get them a quick recovery person. I just rang AA and we got sorted quickly as they had someone near by.

I have made a few claims on phones for the household and there wasn’t a struggle at all like what I hear from people using AXA through Curve.

The added functionality is great, I used to set it as a Plutus perk so I got part of the subscription back (all but depends on PLU fluctuation). Right now my Plutus Everyday is set to Aldi and Sainsbury which I get £20 in PLU back each month without fail. This costs £4.99 right now but is going to rise soon.

I do love how Curve enable you to keep your money safe earning interest whilst using your credit card and then switch it all back to a cashback card. Extra cashback on top of this process is cool….I guess I’d just have to work out how much extra I’d save at the retailers and take it from there ![]()