Sorry no - the step only ticked off once I ordered the physical one. It was specifically worded like that too.

I’m only going off what both you and Algbra both told me back in June, when the offer existed.

Honestly I think I thought it did but I had the virtual card from the application flow, it was only when I ordered a physical card to my house that it ticked off that part of it. Didn’t bother to question it, probably should have done.

Whether that’s a bug on my side I don’t know, sorry to speak on everyone’s behalf. I’ve also looked back at the t&c though, it was worded vaguely, so I take that back.

Anyone how I no longer have an account so I will move on…

Where did you hear about this? I never received any communication from algbra about this change and have been waiting since your post, yet still nothing ![]()

Go into app though and tap on rewards and the expiry dates are in there, in the smallest font possible.

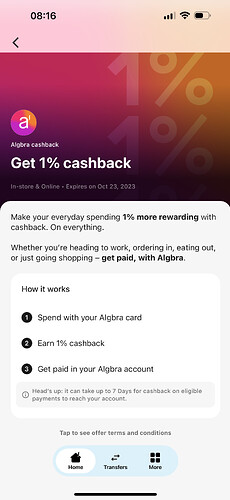

My 1% expires 23 Oct, per your post, with the Super Cashback expiring 14 Feb 2024.

Might help me tidy up my card usage tbf, as currently bounce between Monzo (2% supermarket boost), algbra, Chase, and TSB (20 debit card transactions for £5 for 6 months) and it’s getting ridiculous, for low returns in the main ![]()

![]()

I was in email conversation over non receipt of cashback. That’s when I realised using Curve doesn’t amount to me using Algbra in ApplePay.

The chap went on to say….

“ We’ll be sending out some information on changes to cashback happening later this month, but I thought best just to mention here. Our 1% offer is ending on 23rd of October and we’re extending our 1.5% offer. This does mean that if you use your Curve card for transactions after this date, you won’t receive cashback from Algbra.”

Bearing in mind 23rd is less than two weeks away, you’d think they’d have notified customers by now ![]()

The 1% ending has been displayed in app for quite a while

It is mentioned there. In the smallest font possible, under the word cashback.

Yeah, but …. ![]()

At this point I’d say “My bad” but I really hate that phrase ![]()

Finally had formal email notification from algbra about the changes wef 23 October.

Ditto, just had the notification too.

Sorry for randomly changing the subject of this thread. I completed a DSAR with Cifas (for curiosity as I’d never completed on before) and I received a response saying the following:

“Algbra Group Limited undertook a search on 25 Sep 2023 using your details - please contact

Algbra Group Limited for further information”.

This was the day I opened my Algbra account. I had initiated a switch from First Direct to TSB on the 20th Sep.

Would I be best contacting Algbra to ask about this, or just ignore it as it is only a search?

Would anyone else who may’ve opened a Algbra account and request a DSAR from Cifas possibly have the same search carried out?

Thanks

It’s a search trace, not a marker. Nothing to worry about, only you and CIFAS can see that, and perfectly normal for any organisation to check with CIFAS that you’re not a fraudster or a (potential) victim who has proactively marked their account to prevent (further) fraud.

If you hadn’t applied, then there would be something to be concerned about, but you did.

Thanks for confirming @WillPS. It’s much appreciated. ![]()

REMINDER

Tomorrow (Monday) is the last day where debit card (and debit card details) transactions with algbra will earn you cashback.

From Tuesday 24 October 2023, only transactions using Google Pay (and I assume Apple Pay) will earn you rewards.

Thankyou for that. My ducks are, accordingly, in a row. ![]()

I am currently holding fire on my algbra account, while the cashback catches up, so that I can determine what qualifies under the recent changes.

Super cashback is suppose to be paid if you use Google or Apple’s wallets on a mobile device.

Well, yesterday, I had a lovely meal at The Cambridge (you’ll know that one, Graham) and paid using the Greene King app on my mobile phone and the Google Pay feature within it.

Now, because the amount of the transaction is obviously more significant than my usual ones, the cashback should stand out, or not, as the case may be.

If purchases within app, but using GPay are not covered, then I am ceasing use of algbra altogether and will just focus on my remaining two cashback cards, Chase and Monzo, as bouncing five at the moment, is becoming tiresome already, for the, in reality, meagre returns on the most part.

- Monzo is in supermarkets until 30 November at 2%

- TSB is for the debit card transactions for the rewards (20, for a fiver)

- algbra used to be for most other purchases

- Chase, at 1%, was used for ticket purchases, purely to keep that spend category on one place in case of issues.

- Barclays, at 5%, will return next month, until £200 spent, for a tenner return.

My Starling account (to keep things on topic) remains dormant atm as it does not offer anything for spending on it, and, as my link account to Chip, is currently unused as that savings provider, like Starling, hold exactly £0.00 of my money at the current time.

I was about to say! ![]()

Still, probably more suited for the Algbra thread though.

Yeah I was responding to the “algbra” prompt withion Graham’s email, but have to agree ![]()