Confirmatory emails regarding the rate increase appear to have been sent by Atom today.

Just got a notification from Atom saying that my annual statement is ready. As always (and I mean always whenever I get a statement notification) it’s not there - the last one is April’s statement. It usually takes another day or maybe two to appear.

Is it just me, or is this a general issue?

Unfortunately quite common. LBG Credit Cards is another where the ‘x statement now available in your account’ means ‘will be there in a day or so’.

Virgin Money credit card and Barclaycard are also guilty of this. It’s bloomin’ annoying.

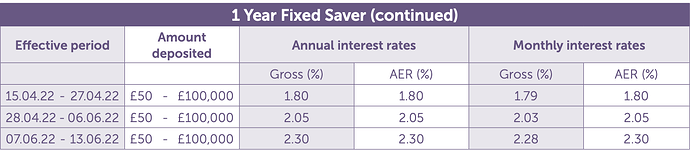

Atom One Year Fixed Saver has hit 2.6% AER

Five weeks ago (08/05/22), it was 2.05%, as I nearly put some money away in one, but instead chose a Shawbrook 6m fix at 2.0%

Looks like the right decision now ![]()

In fact, significant increases in last two months:

Grrr - 2 days after I took out their one-year fix at 2.3% ![]()

Atom Instant Saver increased to 1.35%.

There’ll be a few who’ve used the itchy trigger finger. ![]()

It feels like “Easy access” is best for now.

Do Atom have a dark mode?

Unfortunately they don’t yet.

It being a quiet Thursday, I found myself looking at the FSCS requirements in the Atom Bank app.

Here’s an extract below. Question - is there a typo in item (1) - ie, should “never” be “ever”?

“Exclusions List

A deposit is excluded from protection

if:

(1) The holder and any beneficial owner of the deposit have never been identified in accordance with money laundering requirements. For further information, contact your bank, building society or credit union.

(2) The deposit arises out of transactions in connection with which there has been a criminal conviction for money laundering.

(3) It is a deposit made by a depositor which is one of the following:

• Credit institution

• Financial institution

Etc……”

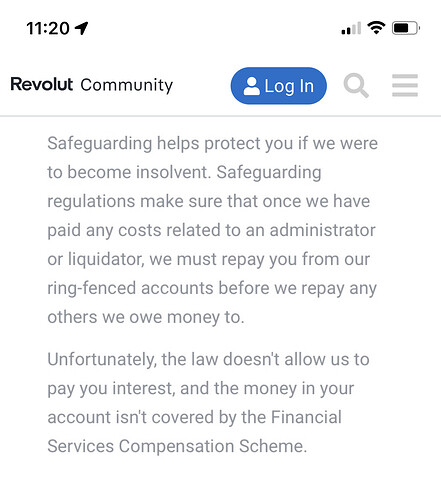

Assuming it’s the same at all banks, it casts some doubt on the financial security of emoney institutions like Revolut. A large part of their guarantee on their clients money is they’re protected if those banks they store deposits go bust.

Interesting find.

Any lawyers here who wouldn’t mind taking a look at this stuff and breaking it down for us laypeople?

I think the promise Revolut et al make is that your money is safe if they go bust, not if the bank they’re holding the money at goes bust. If it’s the latter you’re out of luck. If the former, you may still be out of luck, but it’ll depend.

The banks not offering FSCS protection for money held on behalf of financial institutions’ clients make sense – the money would way exceed £85k

My question is in relation to item (1), though. Am I misreading it?

I can see what you mean. It seems to suggest that you are not covered unless you have been identified as involved in money laundering.

However . . . the phrase is “money laundering requirements”

So . . . . I think what it is actually saying is

“if we cannot identify you as the true owner of the deposit, as required by AML legislation requirements, you’re not getting the dosh”

I miss-typed this morning. This scenario you highlight is actually the one I meant to question on point 3 though:

Is it really still safe with this? Are the deposits with those banks treated as being deposited by me, or by Revolut (a financial institution) and so excluded from protection. Effectively rendering any perceived protection benefit of the e money approach moot and non-existent.

I’m sure I’m overthinking it, and they’ve done their homework on this and wouldn’t lie. But it’s not an issue a layperson can decipher correctly, which causes me concern. I’ve always been wary of trusting Revolut without a banking licence. This just makes that doubly so.

Edit: ignore me! My brain is clearly not wired today to process the eMoney setup, and my concern is still actually for the event the underlying bank goes bankrupt. As I say, I’m overthinking it.

My thoughts have always been the same - unless your parking your life savings in the e-money wallet I’m not too fussed. You can get any funds into an interest beating FSCS vault in a couple of clicks should you wish.

Isn’t Revolut a bare trustee of its customers in this case? Ie it’s depositing on behalf of its customers, not in its own name. If Revolut goes under, surely the funds are owed to Revolut’s customers, not its creditors

Yes that’s right, but the administrators would take the costs of the business failing from customers’ deposits before returning the rest.

…Actually, scrub that. I’m not sure it’s 100% true, but there’s definitely something which can be deducted from deposits.

…I’ve just checked, and that’s essentially correct.

Yeah, so the biggest risk is some fraud or misuse on the ringfenced accounts.