Any guesses?

They surely can’t continue to throw money at it. Maybe a tweak to the savings function?

I agree, but without continuing to offer rewards, they’d just be another typical fintech bank.

I think the 1.5% saver is their current strong suit.

Not with Virgin offering 1.71% now imo

Agreed, no longer a market leader, but still good.

I can’t honestly see what the next benefit might be.

I’ve not been tempted by the Virgin increase tbh.

I find Chase Savings ability for DD and SO outweighs the benefit of the interest difference ![]()

Yep, the overall experience with Chase is strong enough to not make Virgin a real proposition. And in any event, I’ve moved on from signing up for new accounts for only marginal gain.

I still have £1k in their 2.02% current account, and four unused savings accounts, so wouldn’t need to sign up again, I just don’t care for their app ![]()

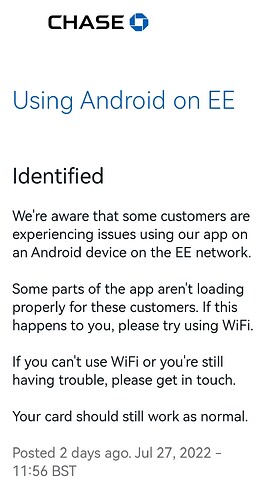

To be fair, if it’s specific to EE I would call this an EE issue rather than a Chase one?

Especially considering I’ve never seen a Chase issue take longer than 6 hours before resolution before

I wonder if it’s to do with adult site settings.

I used EE some time ago and couldn’t access the Santander app. It turned out that EE accounts block adult sites unless the user calls them to ask for them to be unblocked, and for some reason Santander was blocked. ![]()

You can do this in your EE online account - you don’t need to call them.

I think most mobile operators do this in the UK…

I’ve used their app, the only issue is Chase ![]()

Kind of disappointing that Chase doesn’t offer any sort of overdrafts.

Probably not what you’d like to hear, but I’d rather they continue not to offer overdrafts. Too many people out there wanting to rely on an overdraft cushion. I was chuffed to bits when First Direct didn’t offer me an overdraft facility when I CASS’ed my RBS account to them earlier this year. What they did give me though, was a free £150, so no complaints from me.

I’m glad of my FD overdraft. It’s free up to £250 (although my limit is £1500), and it means that if I haven’t transferred enough from my savings account and an unexpected DD comes through, it doesn’t get bounced. I get a text from FD as soon as the overdraft is triggered, and there and then I can transfer money in to cover it. So I never run a balance, it’s just a buffer that means I can keep my current account balance as low as possible to maximise my savings interest. Not all overdrafts are evil.

Doesn’t every FD current account have an automatic £250 overdraft without applying?

Everyone has their own way of running their budgets. Budgeting isn’t a one size fits all scenario. My Wife and I have every single one of our direct debits go out on the first working day of each month, so what we’re left with after, is what we’re left with. I also keep a healthy current account balance so I don’t get caught short. Different folks do different things.