Has it been 2 hours yet?

It was sent at 12:34 today. Chase now says I should wait till next business day.

That’s genuinely bothersome. Anything unusual with the transaction?

FP can take 24h - unfortunately we all sign up to this with account T&Cs

But it’s a pain up the ass

I can not think of any at the moment. My Chase account is funded by my two accounts at Halifax and Lloyds from September last year. My spend is still within usual monthly ranges, no disputes, nothing.

This was another normal transfer like the rest have been.

I am now ending up with money in the cloud. ![]()

![]()

![]()

It is a Chase first.

Don’t know if you did, but how about a phone call?

Seems like more issues with Chase concerning payments. I just logged into my account and there’s a notice about payments being held in a queue, no transactions in activity feed or rewards showing. I’ve not spent anything over the last few days so I’m not that bothered by it personally.

Been going on since 16:30

The Starling app now shows the Verified tick next to my Chase accounts, so I guess they support Confirmation of Payee now?

Edit: The site now says that it’s supported for incoming but not outgoing payments: Confirmation of Payee | Chase UK

Cheers.

All my starling payee accounts are now verified ![]()

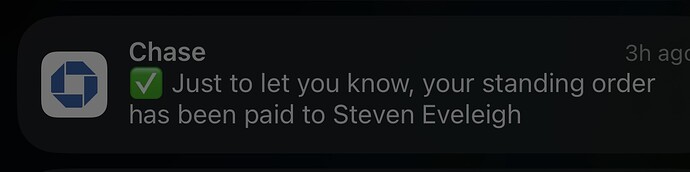

It’s weird how Chase provide notifications for Standing Orders being paid but not for Direct Debits… I’m wondering why this would be the case as both are debits…

Can’t say I have paid any attention. I’ll keep an eye out next time a DD due

It’s a different debit system entirely tho (faster payments vs DD). I imagine those app notifications aren’t triggered simply by a transaction hitting your account’s ledger.

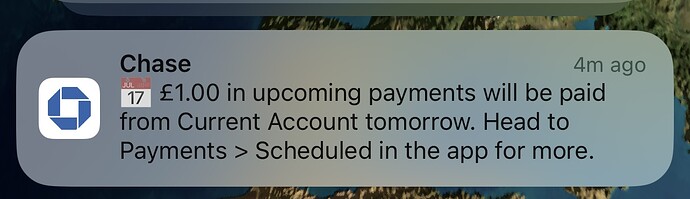

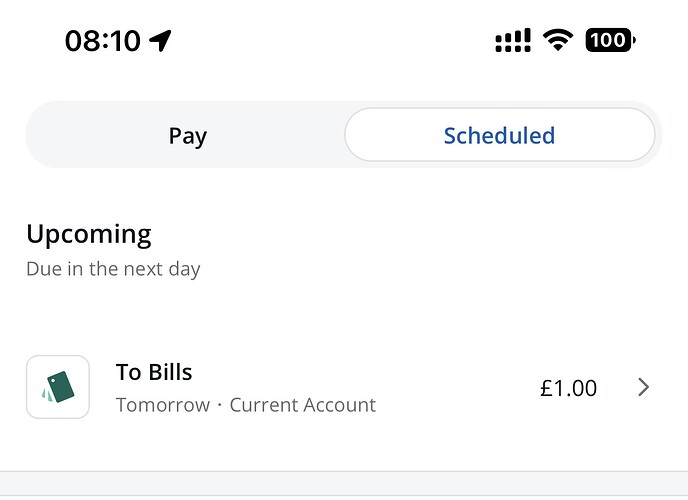

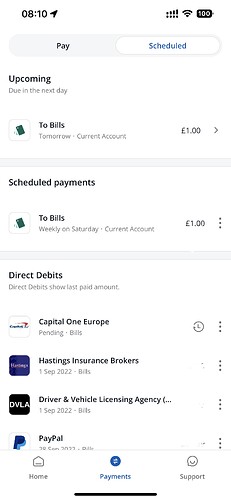

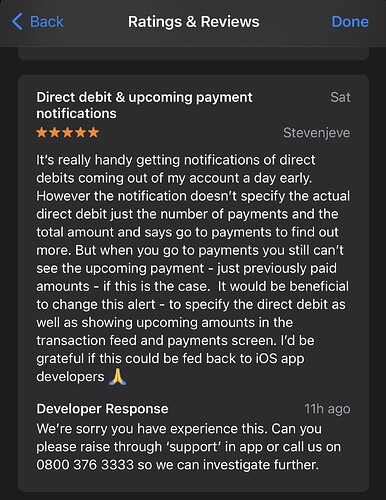

It looks like Chase have improved the notifications and upcoming payments section in the app.

I received this alert this morning

I then went to scheduled payments and there is now an upcoming payments section (I haven’t noticed this section before).

I have a few DD’s due at the beginning of October so I’m hoping they’ll appear in the upcoming section soon. ![]()

To add:

It would be really coincidental that this change happened after I left my review recently on the App Store and I did report it to Support yesterday like the responder advised…..

On another note - it will be really interesting to see what happens next with Chase. Maybe business banking and transferring pensions….

I’ve seen a surprising few Chase cards out in the wild. Granted, mainly from people not from the United Kingdom originally (so probably a lot less attachment to the bank their parents would have signed them up to, should they had lived and grown up here)

I actually had a moment where we went for a meal as friends and when it came time to pay, all 6 of the people there pulled out Chase cards. (I followed suit ![]() ). Sadly I’ve never had that experience with Monzo or Starling though it’s come close a few times.

). Sadly I’ve never had that experience with Monzo or Starling though it’s come close a few times.

I’ve seen lots of individual Monzo cards around, but honestly I’ve seen them decline more often than not ![]() take it as you will

take it as you will

At work I’m seeing more people pay with a Chase card, people of all ages and nothing declines but like you say I see lots of Monzo cards declining or people forgetting they need to move money into that account to pay and annoyingly faffing about to top it up!

I’ve noticed Monzo’s demographic doesn’t seem to be the wealthiest, but I am probably not entitled to make the judgement on their client base.

I don’t see how they can target a relatively poor demographic (students) that they seem to put a lot of effort into appeasing with their “social justice” ethics [that I don’t believe any students who know the sound of a rustling leaf, appreciate + I am 100% sure most above 25-30 doesn’t appreciate it], extensive marketing to students etc all in attempts to catch what is ultimately “spending card” clientele and how this is profitable at all [doubt even students use them as a main account].

Even if they did, how much money do these students have going in per year? 9000ish for maximum student loans (11,000 within The City) and maybe 8,000 [of a part time job]?

I feel like any people that manage their money well in these demographics would go for HSBC, RBS etc.

Edit: honestly all banks should require students and new (first time) account holders (generally, within the UK rather than per-bank basis) to go through a MSE money management course or something. to know how to handle their wallet.