Because sometimes you’re in the middle of something and trying to pay/query/add something and spending 5-10 minutes updating the app is just irritating.

I have just noticed that Chase has a dedicated PDF file in the statements section for just the interest earned on your accounts in a given year. It lists the accounts and interest for each, with a grand total for all at the bottom.

This is very helpful when doing self assessment

I posted this on another forum but just in case anyone who has chase currently might want to close it, don’t.

I had chase and closed it within the 12 month re-opening ban window. However that has since been changed to a full once you are gone you can’t come back and they won’t honour people who closed it when the rulez were different.

Might be of use to others here

It’s always been 12 months. My partner closed her account in the first week last year and had to wait until this year to reopen it. Lucky for her the cashback runs until October 2023

When did she re-open it though? I closed mine down December last year, went to re-open December this year and was told

“The 12 month policy changed 2 months ago, currently we don’t know when we can welcome previous customers back, we hope this will be next year”

She must have done it before hand. Maybe they are not letting people back at all now. I remember when she did it they had to do it for her because they hadn’t made a process for it yet and a lot of staff didn’t know how to do it.

They had to get their back end to zero off the old profile of her details and then allow her to apply as a brand new customer. Maybe they are building a new process to do it yourself who knows ![]()

The Chase App is a battery hungry app. I accidentally left it open on the background and would you look at that

I think that’s the same for most bank apps left open, Monzo does similar - I think it must be to do with the location services pinging maps for where the device is.

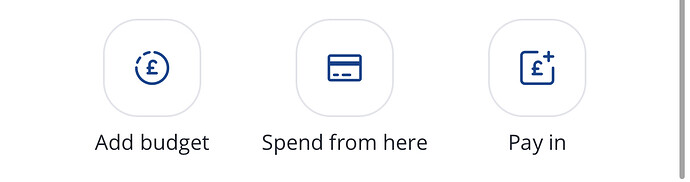

It’s now even easier to pay money into specific chase accounts now by using a dedicated pay in button.

This is much easier than going to payments. Setting the account the money is to be moved from and setting the account it should be moved in to each time! ![]()

Is this ‘pulling’ money over into Chase using open banking?

No it just makes it easier to move money between chase accounts

Planned work: 1am to 5am Friday 16th December

Scheduled

This Friday from 1am to 5am, we’ll be running a planned system upgrade.

From 1am, some features in the app won’t work as usual.

Any card transactions won’t show up with all details in your ‘All activity’ list. Notifications to approve online payments might be delayed but you can still approve them in the app.

Your round-ups won’t be processed until the work is finished.

You’ll see a delay in getting your account closure statements too.

You won’t be able to join us as a new customer either. If you try to change your device, you might have to try again 45 minutes later.

You’ll still be able to use your card as normal, but you may get your transaction notification a few hours later.

Well that’s very much to the point ! ![]()

I like it personally. Zero flim flam, direct, telling folks how it’s going to be.

Not going to lie, still very much enjoying my Chase experience. Wish they’d give us dark mode ![]()

It’d probably be cleaner for all concerned if they simply disabled access for maintenance periods. I think I’d prefer to be bounced with a maintenance message than be able to get in but nothing work as I expect it to (and lets face it most people will ignore or forget about these advance notices of overnight issues).

From email

Good news – we’re increasing the Chase saver account interest rate from 2.1% AER (2.08% gross) variable to 2.7% AER (2.67% gross) variable, effective from 4 January 2023.

We’re also increasing how much you can save

Also from 4 January 2023, you’ll be able to save up to £500,000 in your saver accounts. If your balance across all saver accounts reaches £500,000, you won’t be able to pay in any more, but you’ll still earn interest.

Just so you know

Your Chase saver account terms and conditions will change. To know more and to read your legal documents, log in to the Chase app, tap the profile icon in the top-left corner, then ‘Legal’.

There’s nothing else you need to do – we’ll take care of it for you.

All the best,

The Chase team

Nice touch - gets them back in the game. ![]()

This length of delay feels incredibly old school. Even Coventry BS is managing to raise rates immediately.

Lots of organisations will be inside a change freeze period now.

It’s not archaic, it’s a pragmatic way of minimising risk when there are less hands on deck.

How’s everyone still enjoying chase? Are people still using it as their main bank, day to day spending, savings or leaving it open as a “just in case” account? Mine is actually doing nothing but thinking with the savings rate going up, might actually use it again.