It is for this reason I don’t leave any bank for good, I just leave the account dormant and watch from a distance.

I can’t understand that either. I’ve been with Barclays for four years and I’ve only had to contact them once. Same with Lloyds. In about 34 years with Nationwide I can’t have needed to contact them more than about a dozen times, and most of those occasions were before internet banking was invented.

I’m afraid I really couldn’t be bothered to have loads of dormant accounts sat in my closet, to me, that’s utterly pointless. I have three fully active accounts, all of which I intend keeping fully operational. The other accounts have all been bribe switching accounts with banks I genuinely couldn’t give a stuff about. If they’re stupid enough to give out free money, I’ll take it.

What I simply don’t get, are the people who publicly whinge moan and fart over a bank, leave it and then some time later whinge moan and fart all over again because the bank won’t let them rejoin.

If any bank operates a policy of permanent barring of former customers who sacked them off because they had a bad hair day, or they weren’t using the account properly or not at all, then good on 'em I say.

I’m surprised that all banks don’t do this. It costs money to set up accounts and send out cards, so of course they’re not going to want customers who keep joining and leaving, especially when they only joined for the free bonus in the first place.

I joined RBS twice just to create dummy accounts to use for a switching bonus elsewhere, but when I tried it a third time, they closed all my RBS and NatWest accounts and effectively told me to do one. Did I complain? Of course not. It was my own fault for chancing my luck too many times and they were perfectly entitled to refuse my custom.

I see there’s an interesting discussion going on on the other forum about banks morals and ethics. Whilst I do fully respect the opinions of the contributors, personally, I couldn’t really give much of a rats arse about a banks morals. If I did, I’d have decades ago looked at where banks invested etc. As it stands, there’s bog all I can do about it and I need a bank account that will function the way I need it to. Chase just happens to function very well for my every day personal spending. Likewise, both my Starling and Nationwide accounts do exactly what I require of them.

I mean, I totally get using a financial institutions services when the product offering is unbeatable elsewhere/is fundamental to achieving a financial objective - but I do think it’s important that we discuss what banks do with their deposits/financing.

The Amazon website has a Money Store where they offer a limited number of financial products.

It was initially. Policy changed and was retroactively applied to those who closed their accounts whilst it still was 12 months.

Discourse over at Monzo seems to suggest it’s related to the extension of the cashback offer, and so you’ll be allowed to sign up after the cashback would have ended for your account. We’ll find out in March if that’s the case.

They are not allowing people because there isn’t a process. It was never built and they have no archiving process for old accounts. If they unlink existing accounts they have no way of linking past 6 years of data to each customer. Nothing to do with hissy fits or business decisions.

After Monzo got a new CEO they got a hold of this for me, too. Before it was just change phone number, go again. Last time I tried a new account w/ my passport though… no dice.

Same with Curve. But I’ve got a rule: if I think I’ll open an account with them (with intentions to use them for more than a cash bribe or something like a student account) in the future I don’t close it.

Sounds like a business decision not to build the functionality? They’ll probably build it in the future, when they’ve enough customers to warrant welcoming people back when they’ve made a good amount of changes

They won’t want to have to do every one manually so they will be holding off until it can be done as a self service feature

I only closed it as I opened it then realised my mortgage was moved forward so didn’t want any new credit accounts on my credit file.

In hindsight, it would’ve never affected it but I was just a little worried and Chase said I could reopen in 12 months. Now they’ve admitted there’s no process, but hopefully they can resolve that.

A new bank account won’t impact this - especially given Chase only soft search & besides that once you’ve opened it you’ve opened it you won’t be erasing its existence

That would tally with my experience. I opened, and closed Chase in Dec 21. The decision was what it was, I didn’t think I’d need it to be honest. Anyway between then and now the answer about re-opening fluctuated between being “not right now” to “after 12 months” to “not currently, try in 2023”

When I last enquired, it was hinted that around Feb this year they might allow people to come back, but who knows. They don’t honour those who closed in the 12 month reopening period either, for reference.

Yup, that was my supposition based on the fact originally I was told after 12 months - i.e. end of cash back and then more recently end Feb/early march. But as with you, I’ll not take any of that as gospel.

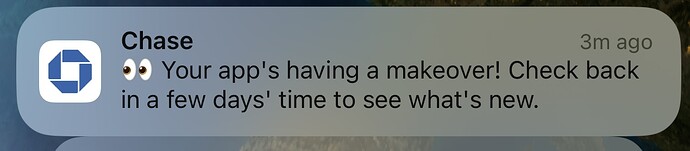

I’ve just had a push notificafion to say my app is having a make over in the next few days

Hopefully at the very least, they’ll give us dark mode, I really can’t stand these retina busting white backgrounds.

The biggest thing for me is better performance. This all is sooooooo slow on android. It took me 2 force restarts to move money from one account to the other earlier